Let's have a real talk about safety. For generations, holding cash, especially U.S. dollars, felt like the ultimate security blanket. But what if that blanket has a slow, steady leak? A profound shift is happening right under our noses, driven not by retail hype, but by the world's most conservative financial institutions: central banks.

The numbers tell a clear story. In November 2025 alone, central banks were net buyers of 45 tonnes of gold, continuing a multi-year trend of moving reserves away from traditional government bonds. Why? They are less concerned with short-term interest and more with a fundamental principle: preserving wealth against the silent killer of purchasing power.

The Dollar Dilemma: A "Safe" Asset That Can't Hold Its Value

The core risk of holding dollars isn't a headline-grabbing crash—it's erosion. When inflation outpaces interest earned, your money loses real value. The U.S. inflation rate for 2026 stands at 6.18%.

Morgan Stanley Research forecasts further strain on the dollar, expecting it to depreciate through mid-2026 before a potential rebound.

This loss of purchasing power is a global concern. Experts point to a "loss of credibility" in the dollar due to geopolitical tensions and the "weaponization" of financial systems, pushing nations to seek alternatives. The dollar's share of global central bank reserves has slipped from about 66% a decade ago to around 57% today.

The Institutional Pivot: Why Gold is Shining Again

With the dollar's dominance under question, institutions are turning to the ultimate historical safe haven. In a volatile world, gold is seen as "nobody's debt"—an asset whose value isn't tied to any single government's promise.

The data is undeniable:

Active Accumulation: Central banks reported buying 297 tonnes of gold in just the first eleven months of 2025.

A Strategic Shift: Gold has even overtaken the euro to become the world's second-most important reserve asset after the dollar.

Repatriation Trend: Countries like Poland, India, and Hungary are physically moving their gold reserves back to domestic vaults for perceived safety and sovereignty.

Bitcoin: The Digital Contender in the Hard Money Race

This brings us to the trillion-dollar question: where does $BTC fit in? While fundamentally different, Bitcoin shares gold's core appeal: absolute scarcity. Its supply is capped at 21 million, making it immune to the "printing presses" that devalue fiat currencies.

Academic research confirms that Bitcoin appreciates in response to inflation shocks, validating its role as a potential hedge. It's crucial to understand, however, that this differs from being a "safe haven." During periods of broad financial panic, Bitcoin's price has tended to fall, unlike gold which often rises. Its value proposition is long-term scarcity, not short-term stability.

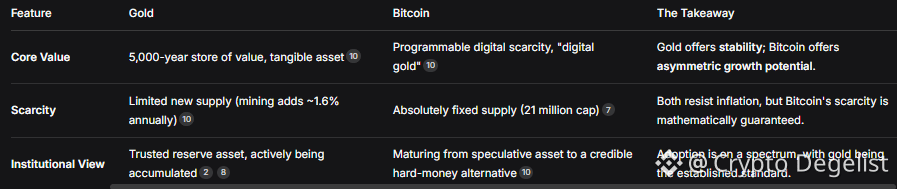

Think of them as a complementary duo for a modern portfolio:

Looking Ahead: A Framework for the Future

Predicting exact prices is speculative, but we can use disciplined models. WisdomTree, for instance, creates scenarios based on global money supply growth and hard-asset adoption. In their base case, where Bitcoin captures a growing share of the "hard money" market, its long-term growth trajectory is substantial. This isn't about a random "moon shot," but a fundamental reallocation of global capital towards verifiably scarce assets.

The bottom line: The definition of "safe" is evolving. Safety is no longer just about avoiding volatility—it's about preserving purchasing power over decades. While gold remains the bedrock of this strategy, Bitcoin is emerging as a powerful, digital-age complement. The smart money isn't just watching; it's already moving.

I hope this detailed breakdown provides a solid, research-backed perspective for your audience. Would you like to explore a specific aspect of this analysis, like a deeper dive into the economic models for $BTC long-term valuation?