Hello Square Family #MavisEvan

I’ve spent time reading, researching, and thinking carefully about this project, and I want to share what I understand in a clear, grounded way. What I’m writing here is not excitement-driven and not marketing. It’s how I see the system after looking at its design choices and asking why they exist.

At its core, Plasma exists because stablecoins quietly became one of the most heavily used parts of crypto, but the infrastructure underneath them never really caught up. We often talk about blockchains as general-purpose machines, yet most real activity today is simply moving dollars from one place to another. In my view, Plasma starts by admitting this reality instead of fighting it.

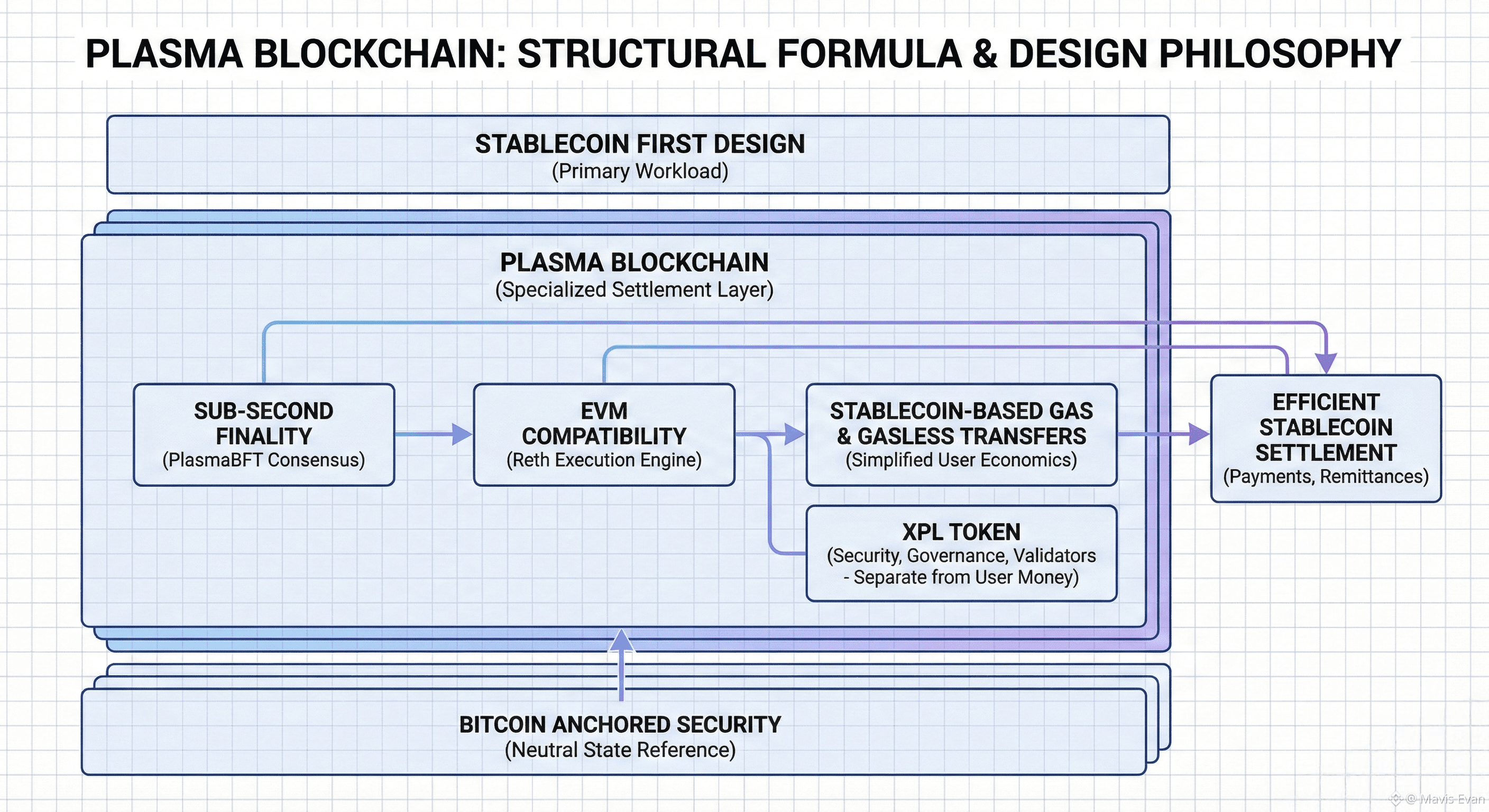

When I look at Plasma, I don’t see a chain trying to be everything at once. I see a system that says, let’s treat stablecoin settlement as the main job, not a side feature. We read a lot about scaling, but scaling means different things depending on the workload. For payments, speed and certainty matter more than expressiveness. Plasma’s entire structure reflects that assumption.

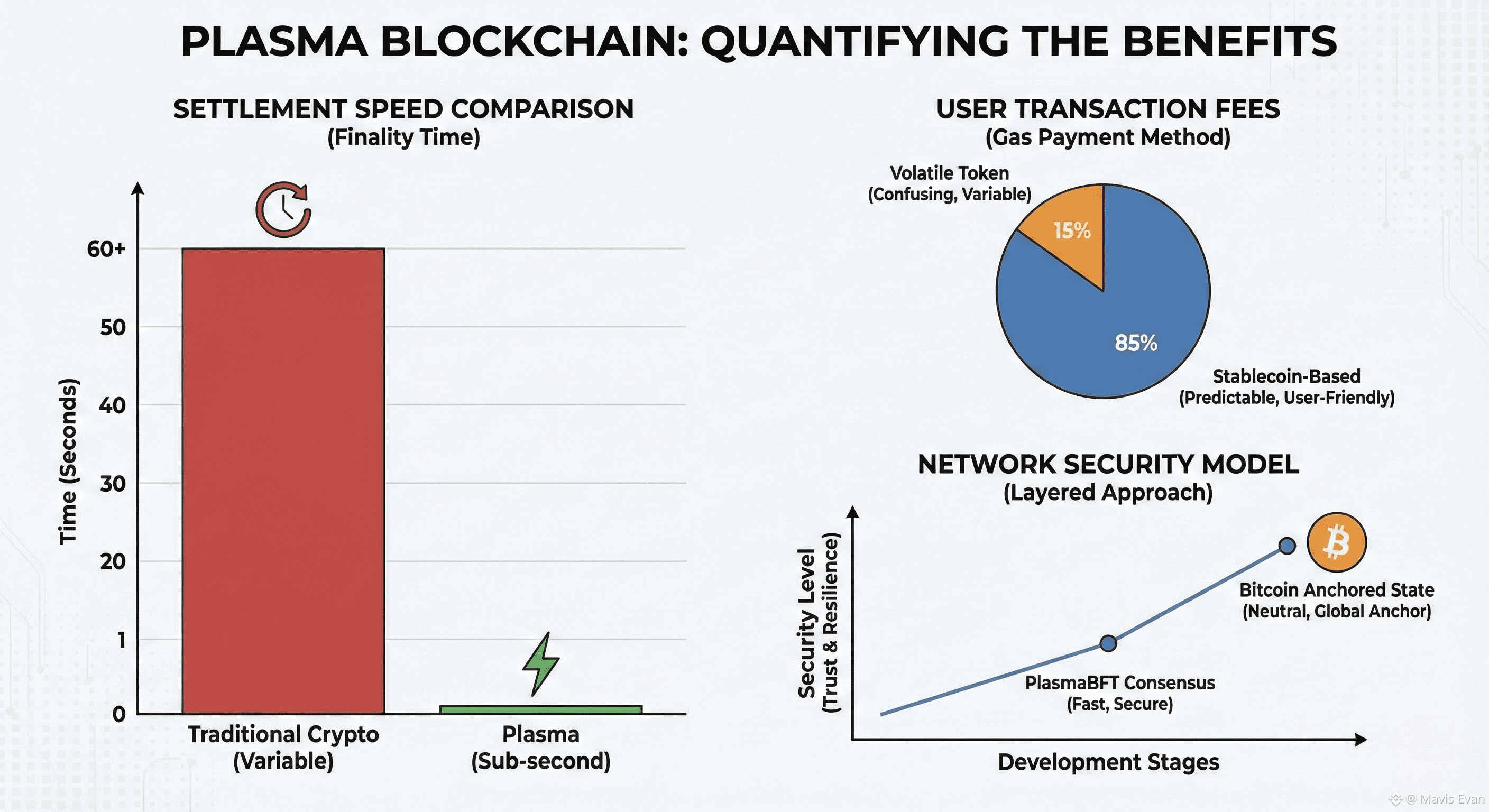

I want to talk first about how Plasma thinks about finality. In my research, one thing stood out clearly: sub-second finality is not a vanity metric here. If you’re moving money, you don’t want “probably final.” You want to know it’s done. PlasmaBFT is built to answer that human question quickly. From my understanding, this is closer to how traditional payment rails think about settlement, even though the technology underneath is very different.

Now let’s look at execution. Plasma stays fully EVM compatible using Reth, and this tells me a lot about the mindset behind the project. They are not trying to force developers to relearn everything. We’ve seen many technically interesting chains fail simply because builders didn’t want to move. In my knowledge, compatibility is not laziness. It’s respect for how software ecosystems actually grow.

Something I find particularly important is the stablecoin-first gas design. I’ll be honest. For years, we accepted that users must hold volatile assets just to send dollars. When I step back, that never really made sense. Plasma’s gasless USDT transfers and stablecoin-based gas feel less like innovation and more like overdue cleanup. They remove friction that users shouldn’t have had to manage in the first place.

From what I understand, this design also changes developer behavior. If fees are paid in the same unit users already think in, applications become easier to price and reason about. I tell you this as someone who has watched many products struggle not because of technology, but because of confusing user economics. Plasma seems designed to reduce that confusion at the base layer.

Another part I spent time thinking about is Bitcoin-anchored security. We often talk about security in abstract terms, but institutions think differently. They ask who controls the system and what happens under stress. Anchoring Plasma’s state to Bitcoin is not about speed. It’s about neutrality. In my view, it’s like periodically stamping the ledger with a globally recognized timestamp that no single actor controls.

I also want to be realistic here. Anchoring to Bitcoin adds complexity. It’s not free. Its value depends on people continuing to trust Bitcoin as a neutral reference layer. If that assumption ever weakens, the benefit weakens too. I think Plasma is making a long-term bet that Bitcoin’s role as a neutral anchor will remain relevant.

Let’s talk briefly about the XPL token. From what I see, it’s not designed to be something users think about every day. That’s intentional. Its role is to secure the network, align validators, and support governance. In my opinion, this separation between infrastructure token and user money is healthy. Users moving stablecoins shouldn’t be forced into token exposure they didn’t ask for.

I want to ground this in a simple real-world picture. Imagine a business paying international contractors in USDT. Today, they juggle confirmations, fee spikes, and delays. On Plasma, the idea is that payments settle almost immediately, fees are predictable, and accounting can treat transfers as final. When I picture this scenario, the blockchain fades into the background, which is exactly what good infrastructure should do.

That said, I don’t want to ignore the risks. Plasma is highly specialized. It’s betting that stablecoin settlement will keep growing as a primary blockchain use case. If regulation or issuer dynamics change sharply, that focus could become a constraint. Also, abstracting fees away from users shifts responsibility to applications, which can introduce centralization if not carefully designed.

In my research, I don’t see Plasma trying to win by being louder or flashier. I see a project trying to be narrower and more honest about what blockchains are actually being used for today. That approach won’t appeal to everyone. But infrastructure rarely succeeds by being exciting. It succeeds by being boring, reliable, and invisible when it works.

To close, I’ll say this in my own words. Plasma makes sense if you believe the future of crypto infrastructure looks more like financial plumbing than experimental labs. It succeeds if stablecoins continue to behave like real money and if builders value predictability over novelty. It fails if the world decides it doesn’t need specialized settlement rails. That’s the real question Plasma is answering, whether explicitly or not.