Sentient Project In‑Depth Research Report: Opportunities and Risks of AI‑Web3 Collaborative Innovation

TL;DR

Sentient represents a credible attempt to build a Web3-native AI protocol stack combining sophisticated open-source AI research with blockchain-based incentive coordination. With $85M in seed funding from tier-1 crypto VCs, a 110+ partner GRID network, and state-of-the-art reasoning capabilities (ROMA: 45.6% SEAL-0 accuracy), the project demonstrates technical execution capacity. However, the ambitious $1.15B pre-market FDV, 34B token supply, and unproven economic model present material valuation and execution risks. Strategic positioning as a coordination layer for open AGI shows differentiation versus closed labs and pure DePIN plays, but success hinges on post-TGE adoption, GRID scaling, and governance maturation over 24-36 months.

1. Project Overview

Core Identity & Mission

Name: Sentient

Domain: Open AGI Infrastructure / AI Protocol / Web3-native AI Economy

Entity Structure: Sentient Labs (San Francisco, CA) — open-source research organization with protocol-level ambitions rather than single-application focus

Core Mission: Building an Open AGI economy where AI models are community-built, community-owned, and loyal to users rather than platforms. Sentient positions as the world's leading open-source AI reasoning lab, advancing research across model security, post-training, agentic safety, reasoning frameworks, and benchmarking while releasing all breakthroughs openly to demonstrate openness can surpass closed labs.

Organizational Architecture

Sentient operates as Sentient Labs with a hybrid research-engineering structure:

Research Leadership: Director of AI Research from leading universities (Sewoong Oh, Professor @ University of Washington)

Operational Core: Head of Operations (Abhishek Saxena, MBA @ Harvard, ex-Apple), Director of Platform Engineering (Mit Dave, ex-IBM, Goldman Sachs)

Founding Team: Co-Founder Himanshu Tyagi; Core Contributors Pramod Viswanath, Sandeep Nailwal (Polygon co-founder)

Engineering Depth: Principal Software Engineers from Coinbase, Meta; Senior Engineers from IITs, Princeton; blockchain specialists for smart contract development

Governance Structure: Currently steward-led via Sentient Foundation (non-profit empowering open AGI builders with grants/fellowships), with planned progression toward decentralized governance post-TGE through $SENT token utilities.

Development Stage & Maturity

Current Stage (as of January 2026): Pre-TGE Protocol with Active Mainnet Components

Token Status: Pre-Token Generation Event (TGE scheduled January 21, 2026); pre-market trading at ~$0.033 ($1.15B FDV) on OKX

Product Maturity:

GRID network live with 100+ integrated models, agents, data sources, and tools

Sentient Chat operational as user-facing platform

ROMA meta-agent achieved SOTA open-source reasoning (45.6% SEAL-0 benchmark, presented at NeurIPS January 9, 2026)

Builder suite tools (OML, ROMA framework, Sentient Agent API) in active development

Funding: $85M seed round closed July 2, 2024, co-led by Founders Fund, Pantera Capital, Framework Ventures; 20+ additional investors including Delphi Ventures, HashKey Capital, Arrington Capital

Key Milestone: Launched $1M Builder Program for developers to build agents integrating with Sentient Chat ecosystem, signaling imminent mainnet launch phase.

2. Product Suite & Technical Architecture

System-Level Architecture Analysis

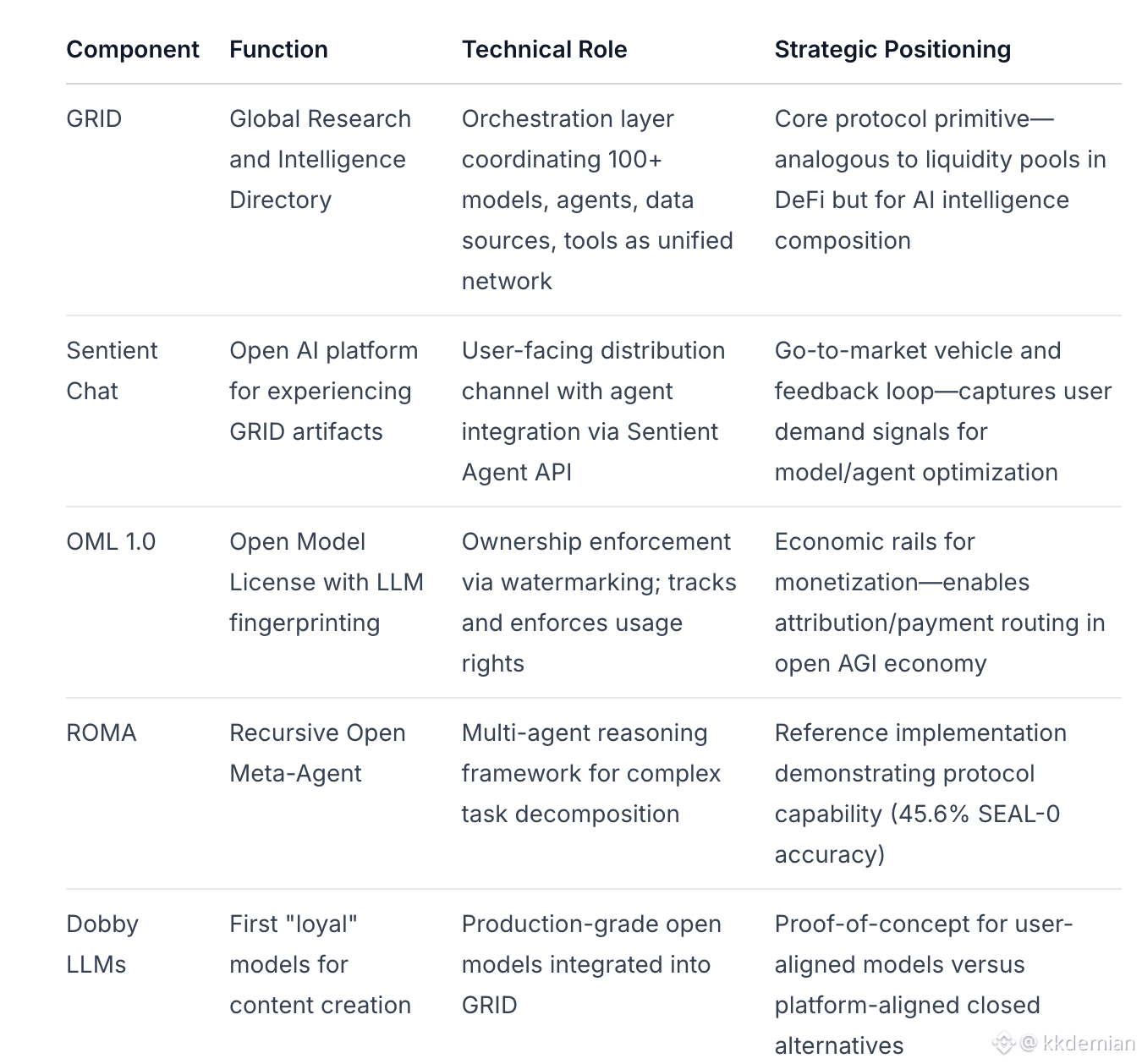

Sentient's product suite functions as a vertically integrated protocol stack combining AI coordination infrastructure (GRID), ownership enforcement (OML), reference models (Dobby LLMs), meta-agent frameworks (ROMA), and user distribution (Sentient Chat). This architecture positions Sentient as a coordination protocol for AGI agents with embedded monetization rails rather than a pure model marketplace or AI operating system.

Protocol Stack Integration Logic

The components interact as a three-layer protocol architecture:

Infrastructure Layer (GRID): Decentralized network composing artifacts (110+ partners); queries routed via Sentient Chat for optimal results based on task requirements

Coordination Layer (OML, Agent API): Standards and interfaces for model/agent integration, ownership verification, payment routing

Application Layer (Chat, ROMA, Dobby): User-facing products and reference implementations demonstrating protocol capabilities

Classification Assessment: What is Sentient?

Based on architecture analysis, Sentient should be understood as:

Primary: Coordination protocol for AGI agents — GRID orchestrates multi-agent systems with blockchain-based incentive alignment

Secondary: New asset layer for AI labor and intelligence — OML enables ownership, attribution, and monetization of AI outputs

Tertiary: AI operating system — Provides runtime environment (GRID) and developer tooling for building/deploying agents

Not: Pure model marketplace (no spot market for individual model access) or monolithic AI OS (emphasizes composability over integration).

3. Economic Design & Incentive Alignment

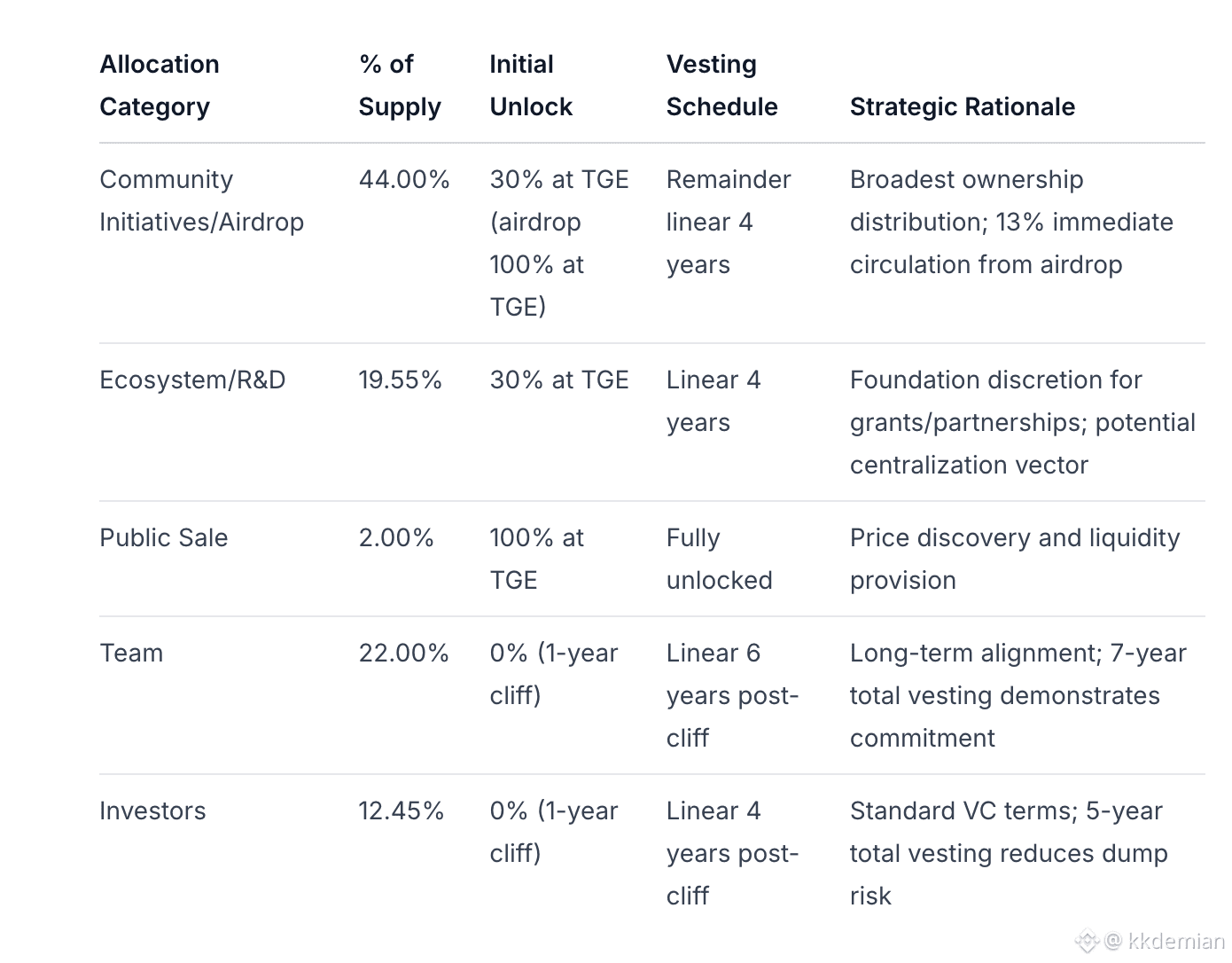

Token Mechanics & Issuance Logic

Token: $SENT

Total Supply: 34,359,738,368 (exactly 2³⁵ tokens)

TGE Date: January 21, 2026 (scheduled)

Value Accrual Mechanisms

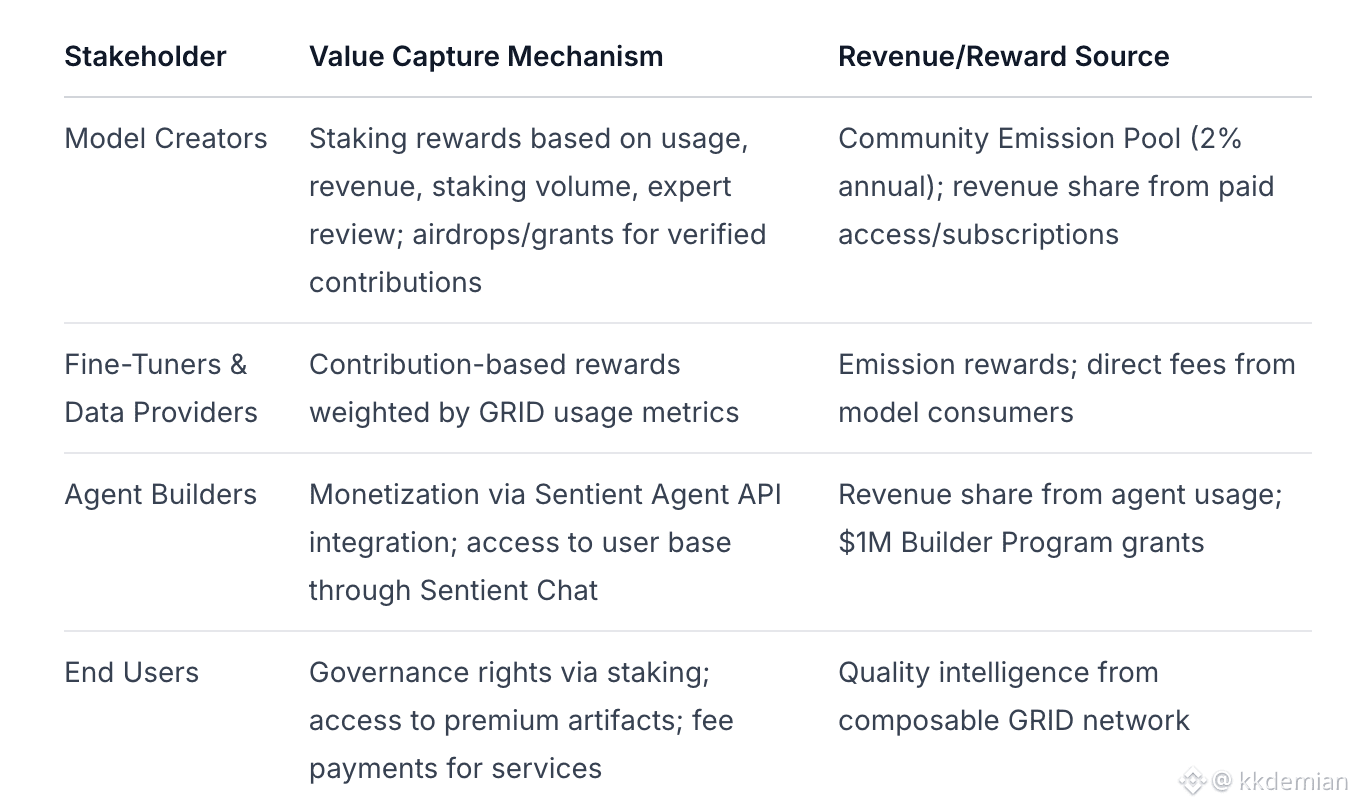

Multi-Sided Incentive Model:

Key Economic Primitive: Staking on artifacts (models, agents, data) directs emissions based on verifiable usage, creating reputation-weighted allocation versus pure mining/compute-based systems.

Comparative Value Capture Analysis

Key Differentiation: Sentient combines OpenAI-caliber performance (ROMA SOTA reasoning) with Bittensor-style decentralization while adding Web2 usability (Sentient Chat) as distribution layer—addressing both technical quality and economic alignment gaps in existing models.

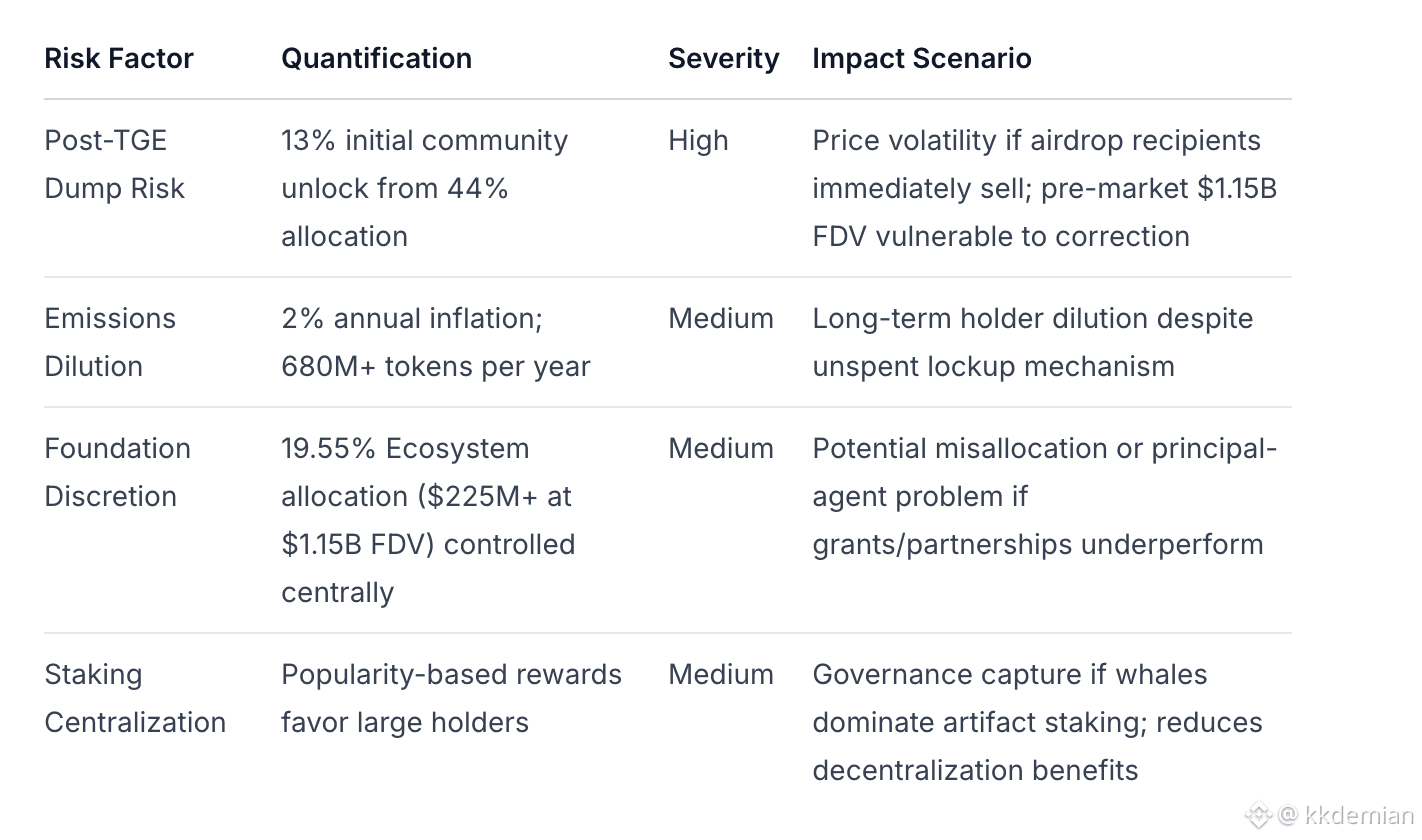

Economic Risks & Misalignment Vectors

Identified Risk Factors:

Dilution Risk: 2% annual emissions compound over time despite unspent lockup mechanism

Governance Capture: Staking-based rewards favor popularity over merit; potential centralization if large holders dominate artifact staking

Foundation Discretion: 19.55% Ecosystem allocation controlled by non-profit creates execution dependency and potential principal-agent problem

Valuation Risk: Pre-market FDV ~$1.15B with 34B token supply; high dilution from initial 13% community unlock may trigger post-TGE volatility

Coordination Overhead: Tragedy of the commons if contributors free-ride on open research without quality contributions

Malicious Artifacts: Economic incentives could drive low-quality or adversarial agents/models to GRID if verification mechanisms are weak

Mitigation Factors: Long insider vesting (6-year team, 4-year investor cliff structures), verifiable work requirements for emissions, expert review layer in staking algorithm.

4. User, Developer, and Ecosystem Adoption

Developer Adoption Indicators

GitHub Activity (as of January 2026):

11 public repositories under sentient-agi organization focused on AI frameworks and blockchain integration

Recent updates: January 2026 commits to chain-dev-stack (Ethereum-compatible chains) and Sentient Enclaves (confidential AI applications)

Core Framework: Recursive-Open-Meta-Agent repository updated January 13, 2026, supports multi-agent systems development in Python

Technical Stack: Rust and Python projects with Apache 2.0 licensing fostering open-source collaboration

Research Output: 4 papers at NeurIPS 2026; ROMA framework achieved #1 GitHub trending; arXiv paper on agent vulnerabilities (#1 trending March 2025)

Builder Program Traction:

$1M allocated for agent developers integrating with Sentient Chat ecosystem

Sentient Sparks: 10 projects selected from 2,000+ applicants (January 14, 2026) for grants/fellowships—0.5% selection rate indicates high competitive interest

110+ partners integrated into GRID network (models, agents, data sources, tools)

Community Growth & Discourse Quality

Social Media Presence:

Twitter (@SentientAGI): 585,686 followers as of January 2026

Engagement Quality: Detailed tokenomics breakdowns, technical achievements (ROMA benchmarks), partnership announcements (Polygon for agentic commerce)

Geographic Expansion: East Asia campus tours for workshops; regional Discord channels launched May 2025 for Vietnam, Russia, India supporting local events/meetups

Discord Community Structure:

Role system categorizing members as artists, builders, educators, helpers to encourage specialized contributions

Role progression tracks activity via reactions with manual reviews for senior levels ensuring quality control

Trial phase as of late 2025 with community feedback integration

Narrative Themes:

Community-owned AGI countering centralization (65% token allocation to community emphasized repeatedly)

Global open-source shift positioning Sentient alongside regional movements (e.g., DeepSeek from East Asia)

Long-term alignment versus ad-driven closed models through blockchain incentives

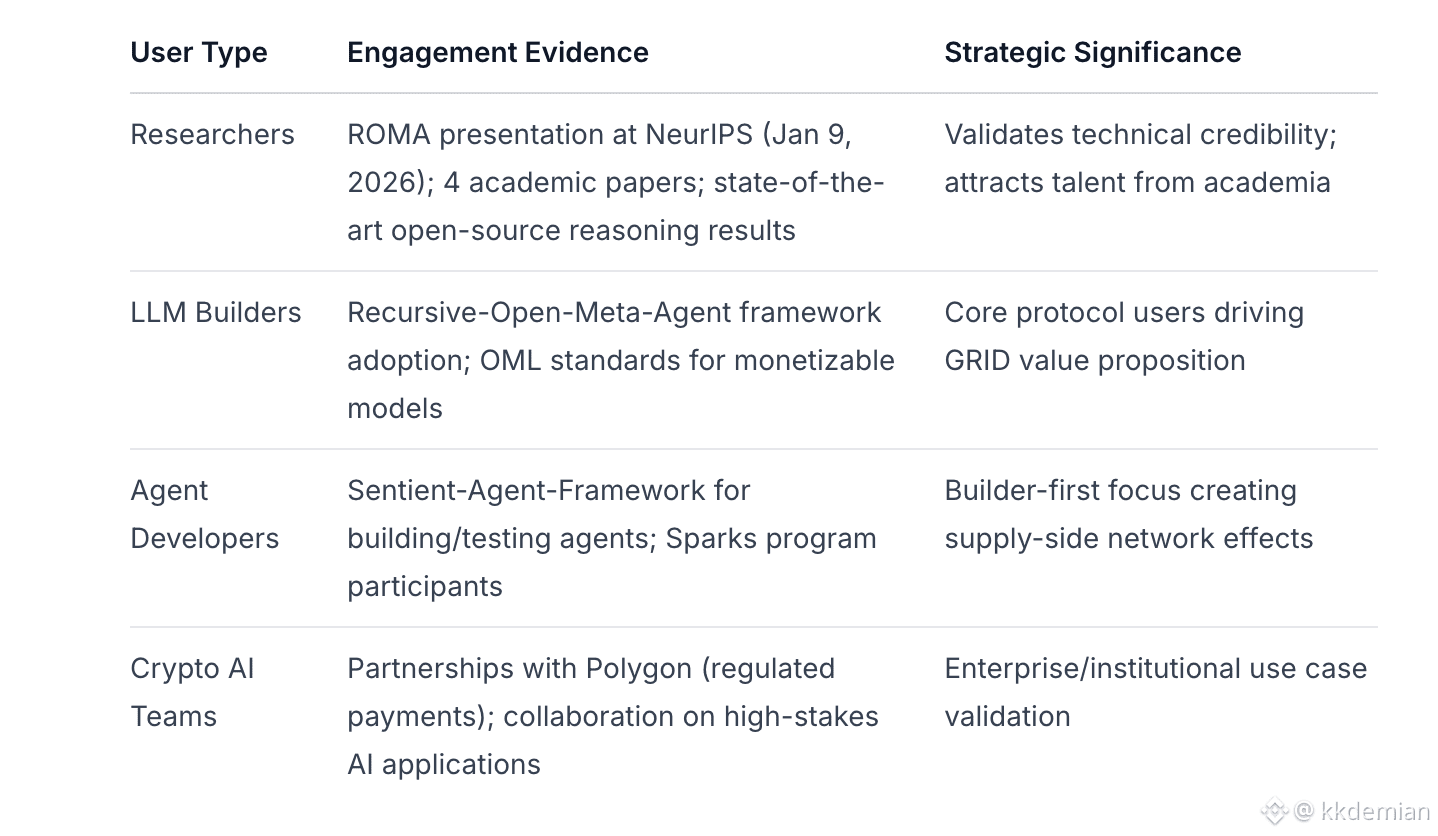

Early User Segments

Ecosystem Orientation Assessment

Classification: Hybrid Research-First + Builder-First Protocol

Research-First Elements: Academic outputs (NeurIPS papers), open meta-agent architectures, benchmarking focus (SEAL-0 accuracy)

Builder-First Infrastructure: GitHub frameworks for agents/enclaves/chains, $1M grants, Agent API, GRID coordination layer

User-Facing Distribution: Sentient Chat for accessible intelligence, community programs for model coordination

Strategic Implication: Balances scientific credibility (research outputs) with practical adoption (builder tools) while using consumer interface (Chat) for feedback loops—mitigates risks of pure research projects (no GTM) or pure infrastructure plays (no demand validation).

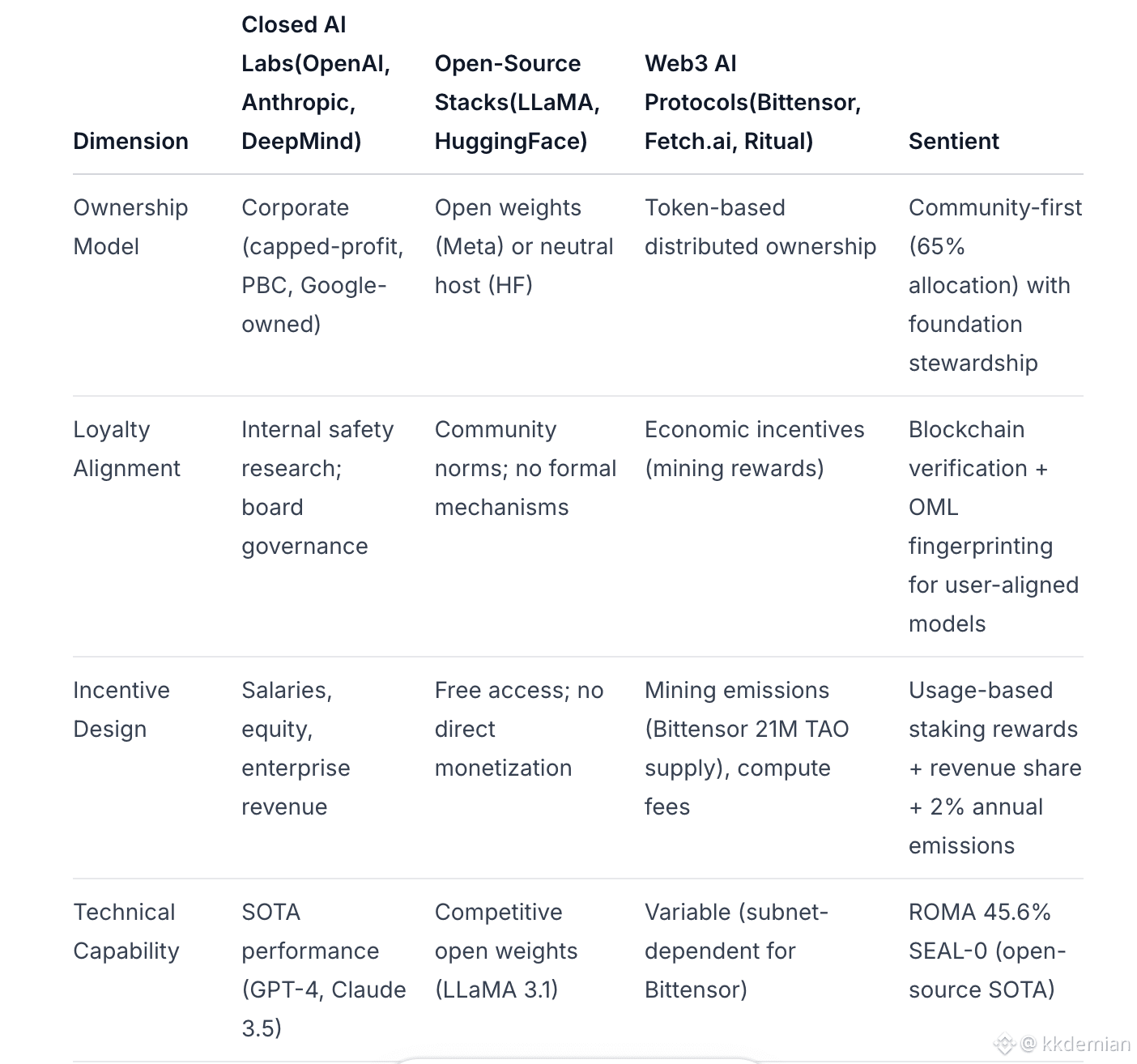

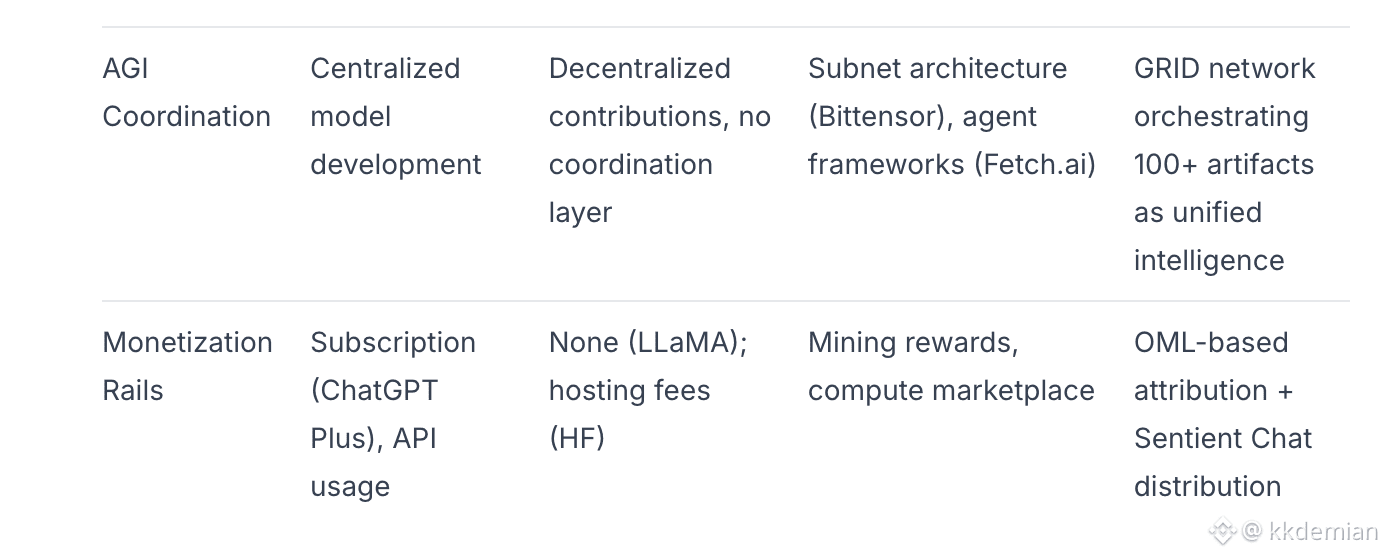

5. Competitive Landscape

Multi-Dimensional Competitive Analysis

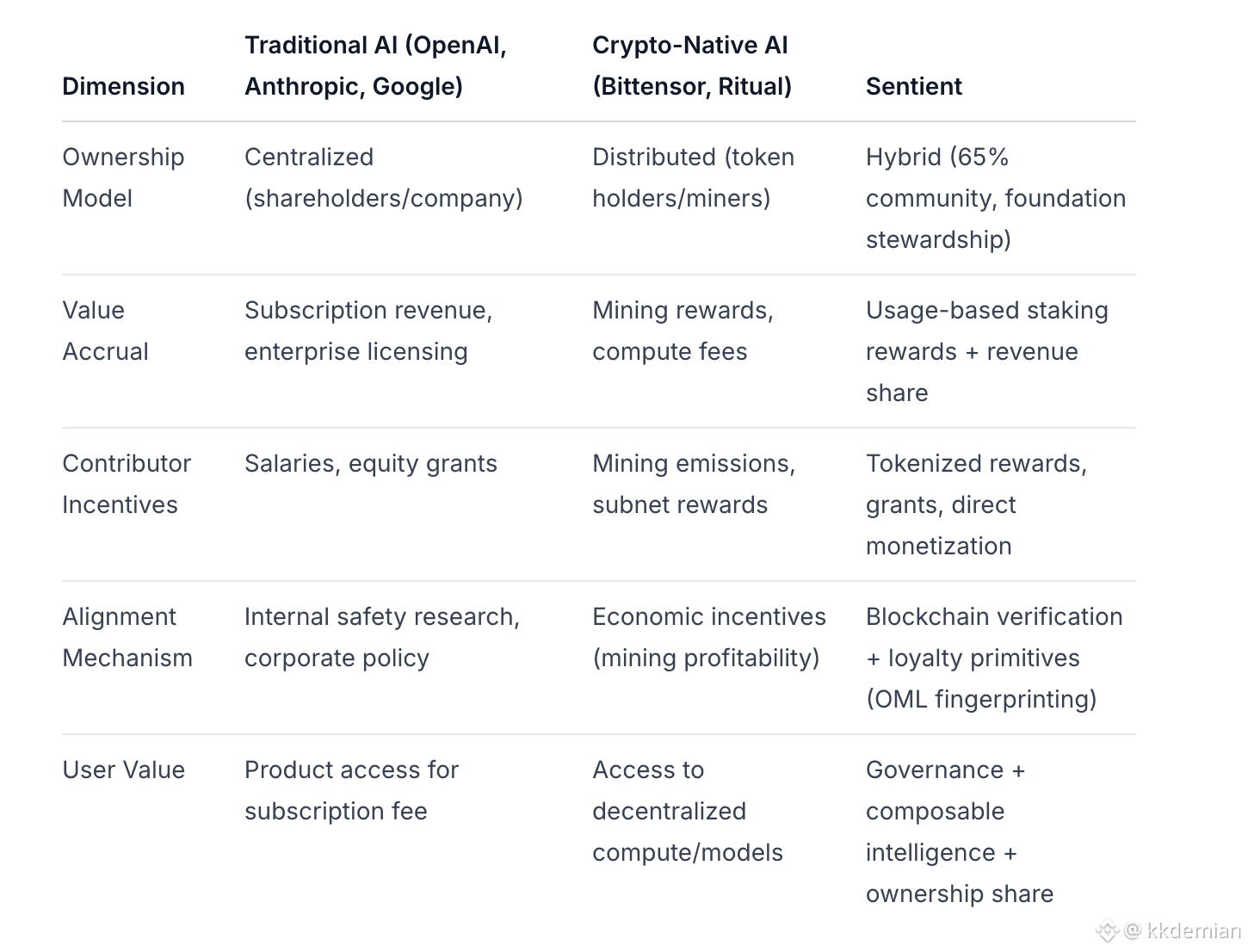

Differentiation Analysis

Versus Closed Labs:

Ownership: Sentient's 65% community allocation versus OpenAI's capped-profit structure (board control) or Anthropic's Public Benefit Corp (safety trust oversight)

Openness: All research released openly (ROMA, OML, Dobby) versus proprietary model development

Alignment: Blockchain-verified loyalty primitives versus internal governance mechanisms

Versus Open-Source Stacks:

Beyond Access: Sentient adds Web3 incentives/protocols (GRID coordination) beyond LLaMA's open weights or HuggingFace's neutral hosting

Monetization: OML fingerprinting and revenue routing versus pure open-access model

Coordination: GRID orchestrates 100+ components versus fragmented ecosystem of independent models

Versus Web3 AI Protocols:

Community Allocation: 65% (Sentient) vs. 100% mining rewards (Bittensor TAO) but with foundation stewardship providing strategic direction

Performance: ROMA SOTA open-source reasoning versus variable subnet quality (Bittensor) or pre-launch status (Ritual)

Verifiable Work: Staking on artifacts based on usage/revenue/expert review versus pure compute-based mining (potential quality advantage)

Enterprise Positioning: Polygon partnership for regulated payments versus consumer/developer focus of competitors

Unique Positioning: High-performance open AI with blockchain incentives and Web2 usability—bridges technical quality gap of pure DePIN plays while maintaining decentralization benefits versus closed labs.

Competitive Threat Assessment

Primary Threats:

Closed Labs' Scale: OpenAI revenue/model advantages; potential for "pseudo-open" strategies capturing Sentient's narrative

Established Web3 Projects: Bittensor's $2.4B market cap and mature ecosystem; Fetch.ai's ASI Alliance with broader scope

Execution Risk: Pre-TGE status means Sentient must prove GRID adoption and economic model post-launch while competitors have operational track records

6. Governance, Trust, and Risk Surface

Governance Trajectory

Current State: Steward-Led Foundation Model

Sentient Foundation (non-profit) manages 19.55% Ecosystem/R&D allocation with discretion over grants, fellowships, partnerships

Community initiatives (44% allocation) programmatically distributed via staking and emissions

No explicit DAO structure announced, but $$SENT nables governance, staking, and voting on protocol decisions

Implied Progression: Foundation stewardship provides strategic coordination during launch phase, with potential transition to decentralized governance as ecosystem matures and token distribution broadens post-vesting.

Protocol Upgrades & Decision-Making:

Technical upgrades driven by open-source research team (ROMA framework, OML standards, SERA-Crypto risk analysis)

Economic parameters (emissions, staking algorithms) likely governed by foundation initially, then token holder votes

Model/agent standards set via OML specifications and expert review processes

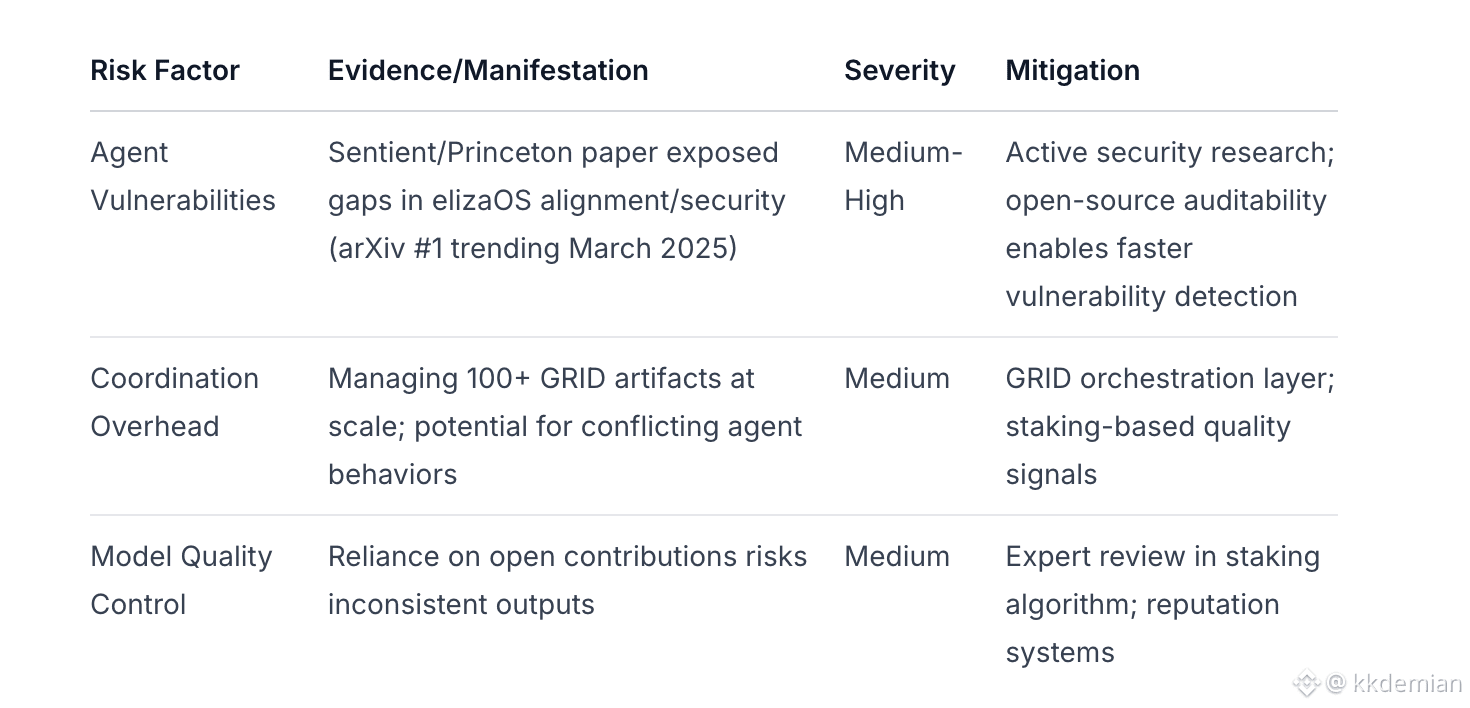

Multi-Dimensional Risk Analysis

Technical Risks:

Economic Risks:

Strategic Risks:

Competition: Closed labs' capital/talent advantages (OpenAI, Anthropic funding scales); Bittensor's established network effects ($2.4B mcap, mature subnets)

Adoption Timing: Pre-TGE execution critical—must demonstrate GRID utility and economic model viability before competitors adopt similar strategies

Narrative Capture: Risk of competitors (e.g., OpenAI) adopting "open" language without blockchain commitments, diluting Sentient's differentiation

Regulatory Risks:

AI Governance: Increasing scrutiny of AI safety/alignment (labs like Anthropic prioritize); Sentient's open model may face criticism for reduced control

Securities Classification: Token incentives could trigger securities regulations depending on jurisdiction and usage patterns

Data Ownership: IP ambiguity in community-contributed models/data; regulatory uncertainty around AI-generated content ownership

Risk Surface Assessment: Medium-High Overall—Technical risks manageable via open-source model; economic risks material due to high FDV and emissions; strategic risks depend on execution velocity post-TGE.

7. Strategic Trajectory Assessment

Probability-Weighted Scenario Analysis

Scenario 1: Foundational Protocol for Open AGI (30% probability)

Requirements:

GRID scales to 1,000+ high-quality artifacts with sustained usage

Economic model achieves product-market fit—staking rewards attract top model creators, revenue routing functions efficiently

Governance transition to decentralized structure maintains coordination quality

Enterprise adoption validates high-stakes use cases (e.g., Polygon payments integration expands)

Inflection Points:

Successful TGE with stable post-unlock price action (Q1 2026)

10x growth in GRID partners and Chat MAUs by Q4 2026

First major enterprise deployment generating material revenue (2026-2027)

Transition to token-based governance with community proposals (2027)

Outcome: Sentient becomes coordination layer for multi-agent AGI systems, analogous to Ethereum for DeFi—billions in TVL (Total Value Locked in staked artifacts), ecosystem of specialized agents/models, meaningful market share of AI compute spend.

Scenario 2: Coordination Layer for AI Agents (50% probability)

Requirements:

GRID achieves niche adoption among crypto-native AI builders and Web3 projects

Economic incentives sufficient to sustain developer community but insufficient for mainstream enterprise

Maintains technical credibility via research outputs and open-source contributions

Competes effectively in decentralized AI segment versus Bittensor/Ritual but doesn't displace closed labs

Inflection Points:

Moderate TGE success with $500M-$1.5B sustained market cap (2026)

100-300 active GRID contributors and steady growth in agent integrations

Partnerships with 3-5 major Web3 ecosystems (Polygon-type deals) by 2027

Research outputs maintain quality but don't achieve breakthrough commercial impact

Outcome: Sentient establishes as credible Web3 AI infrastructure provider serving decentralized applications, DAOs, and crypto projects—mid-tier market cap ($500M-$2B), sustainable community, but limited mainstream penetration. Comparable to current positioning of Bittensor or Fetch.ai.

Scenario 3: Niche Research Collective (20% probability)

Requirements:

Economic model fails to achieve network effects—emissions insufficient to attract top talent, staking centralization reduces decentralization benefits

GRID adoption stalls due to coordination overhead or quality control issues

Closed labs (OpenAI, Anthropic) capture "open AI" narrative via pseudo-open strategies

Regulatory headwinds or token volatility damage community trust

Inflection Points:

Post-TGE dump drives sustained price decline below $300M market cap (2026)

GRID partner growth plateaus or reverses; Chat MAUs stagnate

Foundation allocation controversies or governance disputes fragment community

Technical vulnerabilities (e.g., agent security issues) undermine trust

Outcome: Sentient maintains small community of ideologically committed open-source AI researchers but fails to achieve economic gravity—becomes academic project with minimal market relevance, similar to many early blockchain protocols that didn't achieve product-market fit.

Key Inflection Points (24-36 Month Horizon)

Critical Success Factors:

TGE Execution (January 21, 2026): Price stability post-airdrop unlock; listings execution (Binance, OKX confirmed); liquidity depth achievement

Metric: Sustained market cap >$800M with <50% volatility in first 30 days

GRID Scaling (2026 Q2-Q4): Partner growth from 110 to 300+; sustained SOTA benchmarks beyond ROMA; diverse artifact types (models, agents, data, tools)

Metric: 10k+ active agents/models integrated; 100k+ MAUs on Sentient Chat

Economic Model Validation (2026-2027): Staking rewards attract material value; revenue routing generates meaningful income for creators; emissions utilization exceeds 50%

Metric: $10M+ annual revenue distributed to ecosystem; 1M+ SENT staked on artifacts

Governance Transition (2027): Community proposals activated; foundation allocation decisions transparent; no major controversies

Metric: 10+ successful governance votes; >30% token holder participation

Enterprise Adoption (2027-2028): High-stakes applications deployed (payments, identity, compliance); partnerships with Fortune 500 or major crypto projects

Metric: 3+ enterprise contracts with $1M+ annual value

Failure Modes to Monitor:

Token price collapse below $200M market cap signaling loss of confidence

GRID partner churn exceeding new additions indicating quality/incentive issues

Foundation allocation controversies fragmenting community

Security incidents (agent exploits, data breaches) damaging trust

Regulatory enforcement actions targeting token mechanics

8. Final Investment & Partnership Assessment

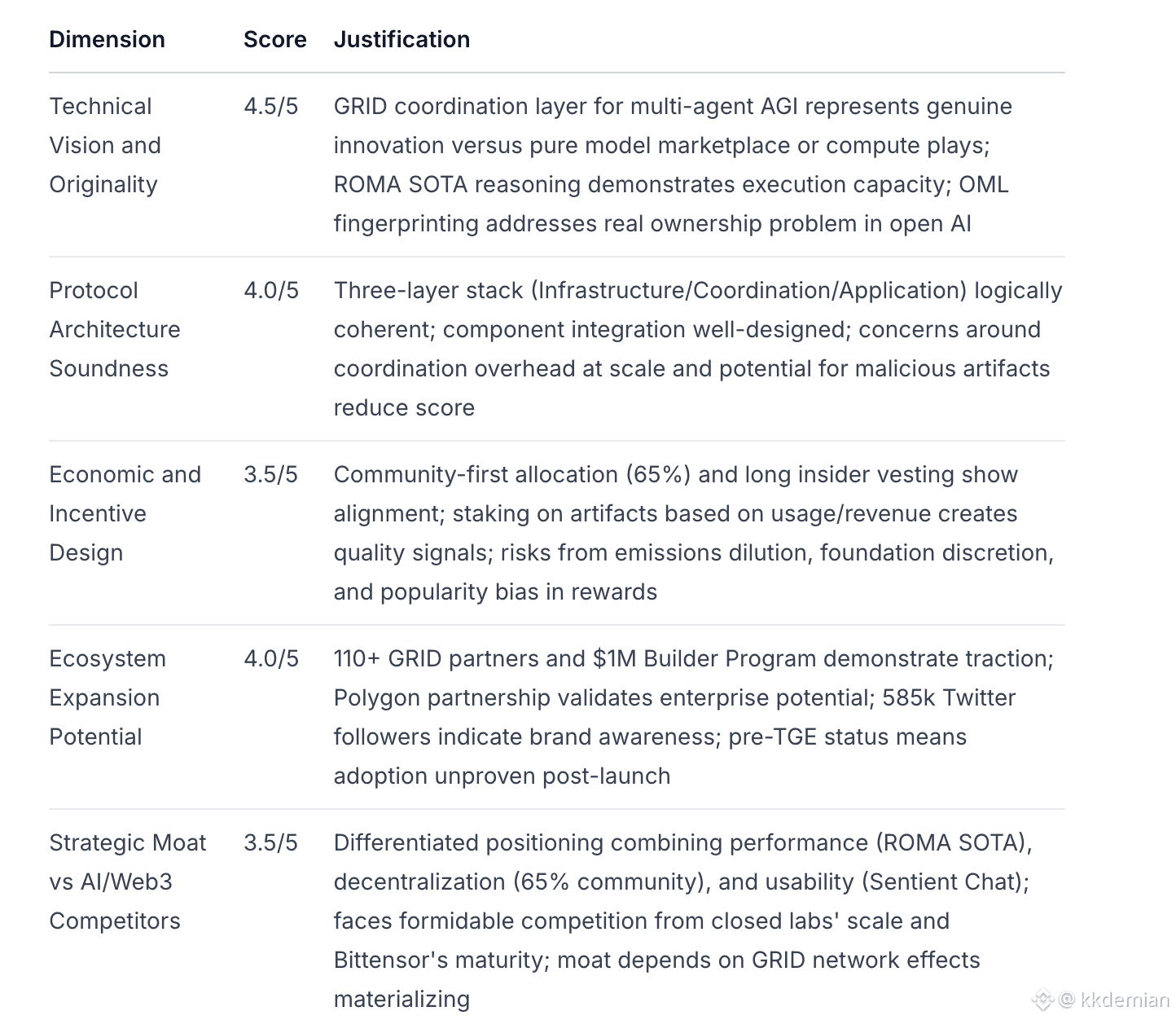

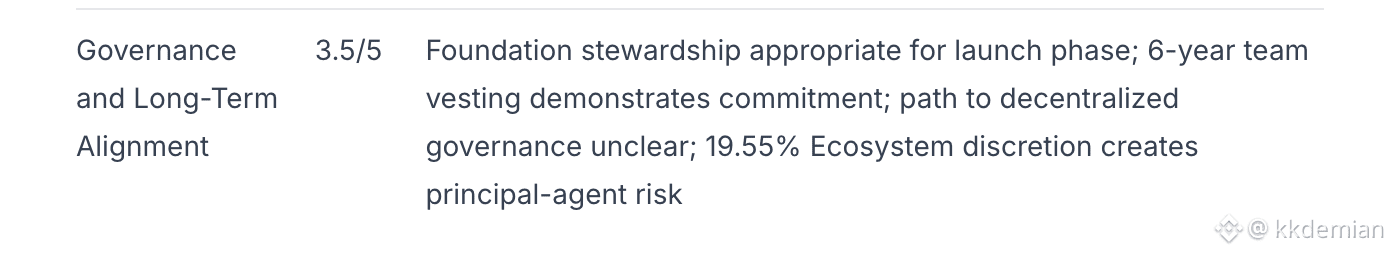

Dimensional Scoring (1-5 Scale)

Overall Assessment Score: 3.8/5 (Weighted average emphasizing technical vision and economic design)

Summary Verdict: Strategic Partnership with Cautious Investment Posture

Investment Recommendation: CONDITIONAL BUY for strategic investors with 24-36 month horizon and risk tolerance for pre-revenue protocols

Rationale for Strategic Engagement

Affirmative Factors:

Technical Credibility: ROMA's 45.6% SEAL-0 accuracy (open-source SOTA) and 4 NeurIPS papers demonstrate genuine research capability, not vaporware

Differentiated Positioning: GRID coordination layer addresses real gap in open AI ecosystem—no competitor combines performance + decentralization + monetization rails at this sophistication level

Community-First Economics: 65% allocation to community with 6-year team vesting shows authentic commitment to decentralization versus typical VC-heavy structures

Ecosystem Traction: 110+ GRID partners, $1M Builder Program, 585k social following indicate organic interest versus purely manufactured hype

Team Quality: Sandeep Nailwal (Polygon co-founder), academic leadership (UW professor), engineering depth (ex-Coinbase/Meta) provide execution capacity

Strategic Optionality: Open AGI economy represents massive TAM if thesis proves correct; protocol layer positioning enables value capture across multiple AI verticals

Disqualifying/Cautionary Factors:

Valuation Risk: $1.15B pre-market FDV with 34B token supply and 13% immediate unlock creates material downside risk post-TGE

Execution Uncertainty: Pre-TGE status means economic model and GRID adoption unproven under real market conditions

Competition: Closed labs' capital advantages and Bittensor's $2.4B mcap create formidable competitive pressure

Economic Model Risks: Emissions dilution, staking centralization, and foundation discretion over 19.55% allocation present misalignment vectors

Regulatory Uncertainty: AI governance and token securities classification create tail risks

Actionable Investment Strategy

For Tier-1 Crypto Funds:

Phase 1: Pre-TGE Strategic Positioning (Now - January 21, 2026)

Action: Negotiate strategic investment allocation if possible (likely closed given January 21 TGE); alternatively, prepare for secondary market entry

Rationale: Early positioning at valuation discount versus post-TGE hype; strategic influence via governance participation

Risk Management: Limit exposure to 1-2% of fund AUM given pre-revenue status; structure with liquidity preferences if primary allocation available

Phase 2: Post-TGE Observation (Q1 2026)

Action: Monitor TGE execution, price stability, initial GRID adoption metrics, airdrop recipient behavior

Key Metrics: Sustained market cap >$800M; <50% price volatility first 30 days; GRID partner retention >90%; Chat MAU growth trajectory

Decision Point: If metrics positive and price corrects to $0.02-0.025 range ($700M-$850M FDV), initiate 2-3% fund position

Phase 3: Growth Validation (Q2-Q4 2026)

Action: Scale position to 5-7% fund allocation if GRID scales to 300+ partners and economic model shows traction ($5M+ annual revenue distributed)

Partnership Approach: Propose strategic collaboration—fund portfolio companies integrate with Sentient GRID; co-marketing; technical advisory

Exit Optionality: Maintain liquidity discipline with 25-50% position size available for exits if key metrics deteriorate

Phase 4: Long-Term Hold (2027+)

Condition: If governance transition succeeds and enterprise adoption validates model, maintain core position as foundational Web3 AI infrastructure bet

Target Outcome: 10x return over 3-5 years if foundational protocol scenario materializes (30% base case probability)

Partnership Recommendation

Strategic Partnership Thesis: HIGH PRIORITY for ecosystem integration and co-development

Partnership Structure:

Technical Collaboration: Integrate fund portfolio companies with GRID for agent/model access; co-develop use cases in DeFi, gaming, identity

Ecosystem Support: Provide introductions to enterprise clients; facilitate partnerships with complementary protocols

Governance Participation: Actively vote on protocol decisions; propose improvements to economic model and security standards

Research Collaboration: Co-publish research on decentralized AI coordination, token incentive design, agent security

Value Proposition:

For Fund: Early positioning in open AGI infrastructure with potential 10x+ upside; portfolio company access to cutting-edge AI capabilities; governance influence over strategic protocol

For Sentient: Tier-1 validation signal to market; enterprise/ecosystem connections accelerating adoption; strategic guidance on token economics and go-to-market

Final Conclusion

Sentient represents a high-risk, high-reward bet on open AGI coordination infrastructure with genuine technical merit and differentiated positioning. The protocol's three-layer architecture (GRID orchestration + OML ownership + Chat distribution), community-first economics (65% allocation), and demonstrated research capability (ROMA SOTA) justify strategic partnership and selective investment for funds with risk tolerance and 24-36 month horizons.

However, the $1.15B pre-market FDV, unproven economic model, and formidable competition necessitate cautious position sizing and rigorous post-TGE monitoring. Success requires GRID network effects materializing, economic incentives achieving product-market fit, and governance transition maintaining coordination quality—probabilities estimated at 30% for foundational protocol scenario, 50% for niche coordination layer, 20% for research collective.

Verdict: Invest strategically at 2-5% fund allocation post-TGE validation; pursue partnership immediately for ecosystem integration and governance participation. Sentient's combination of technical sophistication, credible team, and genuine attempt to solve open AI coordination problems merits serious consideration, but execution risk and valuation concerns prevent full conviction absent post-launch performance data.