I’ve spent the last 24 hours analyzing this, and honestly… I’ve never seen anything like it.

Here’s the situation:

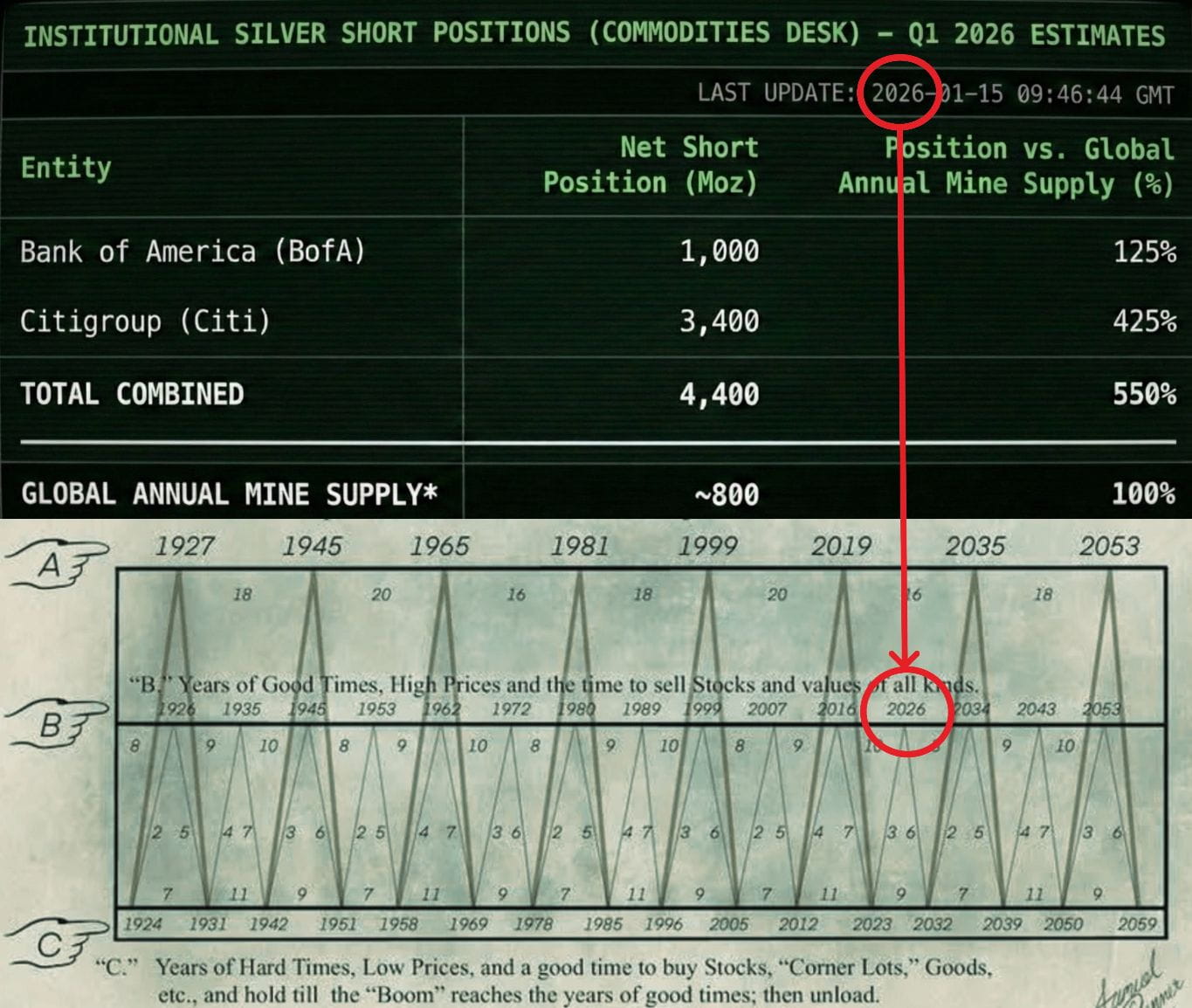

World silver production: ~800M ounces/year

Combined short positions (BofA & Citi): 4.4 BILLION ounces

I’ve been deep in macro for 20 years, and I thought I’d seen it all. I was wrong.

At current levels, if silver keeps climbing, some of the biggest banks in the U.S. could face serious trouble.

What’s happening:

Yesterday, silver touched $92, dropped over 6% in minutes, bounced to ~$91, and now it’s slipping again. Most traders see this as a “normal correction.” I see a trap.

At ~$90/oz, the banks’ combined short positions are now roughly $390 BILLION — bigger than the market cap of many global banks. Survival mode is ON.

Why the overnight dip to $86?

They had to force it. If silver had broken $100 yesterday, margin calls would have wiped out banks holding these shorts. So they dumped paper contracts during thin overnight liquidity to push the price down.

But the physical market tells a completely different story:

Lease rates for borrowing silver have skyrocketed

We’re in backwardation — spot prices are higher than futures

People want the metal now, not promises for later

The math is brutal:

Shorts: 4.4B ounces

Annual mined supply: 800M ounces

Recycling dries up at $90+, and industrial demand (AI chips, solar panels, EVs) has to be filled

BofA and Citi aren’t just shorting silver — they’re effectively shorting the industrial revolution itself.

Force majeure is coming:

Wholesale markets are already showing delays, and physical delivery is becoming nearly impossible. Once the price snaps back above $92 (and it will), it won’t stop at $100 — the first major short declaring force majeure could push it to $150 overnight.

Two markets now exist:

Screen price ($88) — just algorithms

Street price — metal you can’t get

They’re shaking the tree one last time to grab your physical silver… but do not sell.

We are witnessing the death of the paper silver market and the start of a commodities supercycle.

I’ve studied macro for over a decade and called almost every major market top, including the last $BTC $ATH .

If you want early warnings before the headlines, follow and turn notifications on. This one will move fast.