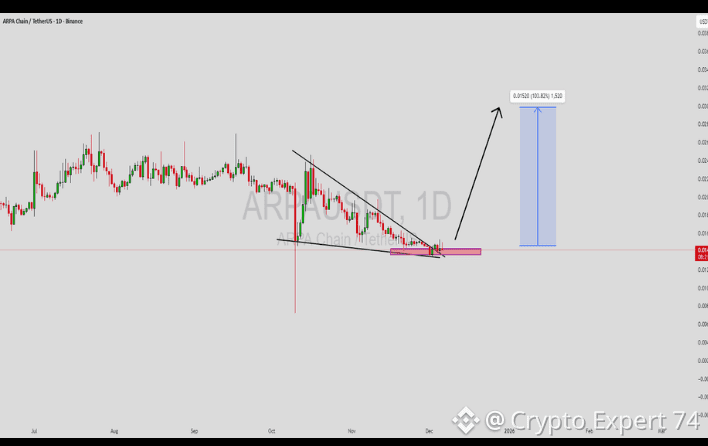

Recent Move: Strong upside impulse (≈ +45–50% seen in momentum phase)

Market Type: Volatility expansion after long consolidation

Current State: Post-pump stabilization

This is not random strength — it’s a breakout from compression.

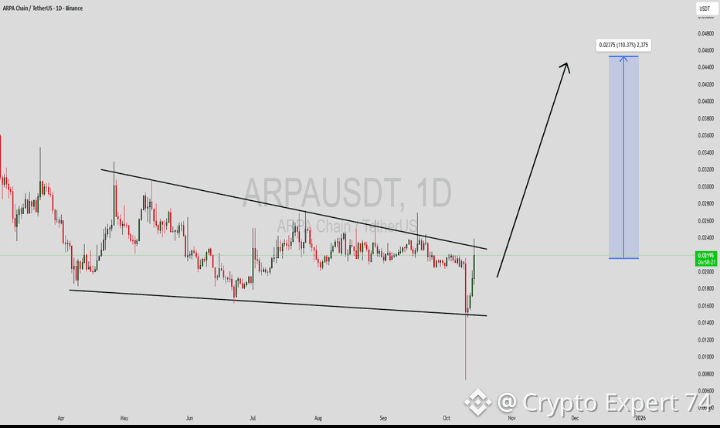

Trend & Candle Structure

Short-term trend: Bullish

Structure: Accumulation → Breakout → Expansion

Large bullish candles followed by smaller bodies → momentum cooling, not reversal

This usually leads to either continuation after pullback or range formation.

Key Support Levels

Immediate Support: 0.0168 – 0.0172

(Breakout retest + prior resistance)

Major Support: 0.0155

(Range base / structure invalidation below)

As long as price holds above 0.0168, bullish structure remains valid.

Key Resistance Levels

Near Resistance: 0.0188 – 0.0192

Major Resistance: 0.0205 (liquidity + psychological zone)

Expect reactions here unless volume expands again.

Bullish Scenario

Price consolidates above 0.0170

Higher low on 15m–1h candles

Break and close above 0.0192

➡️ Upside targets: 0.0205 → 0.0220

Bearish / Pullback Scenario

Rejection from 0.019–0.020

Weak bounce volume

Breakdown below 0.0168

➡️ Pullback toward 0.0155 (still healthy unless broken).

Trading Bias

Bias: Neutral → Bullish

✅ Best entries on pullbacks, not green candles

⚠️ Chasing after expansion reduces risk-reward

ARPA is technically strong, but continuation requires structure holding, not just hype. $ARPA

#ARPA/USDT #BTCVSGOLD #P2PScam