🚨 THIS IS BAD

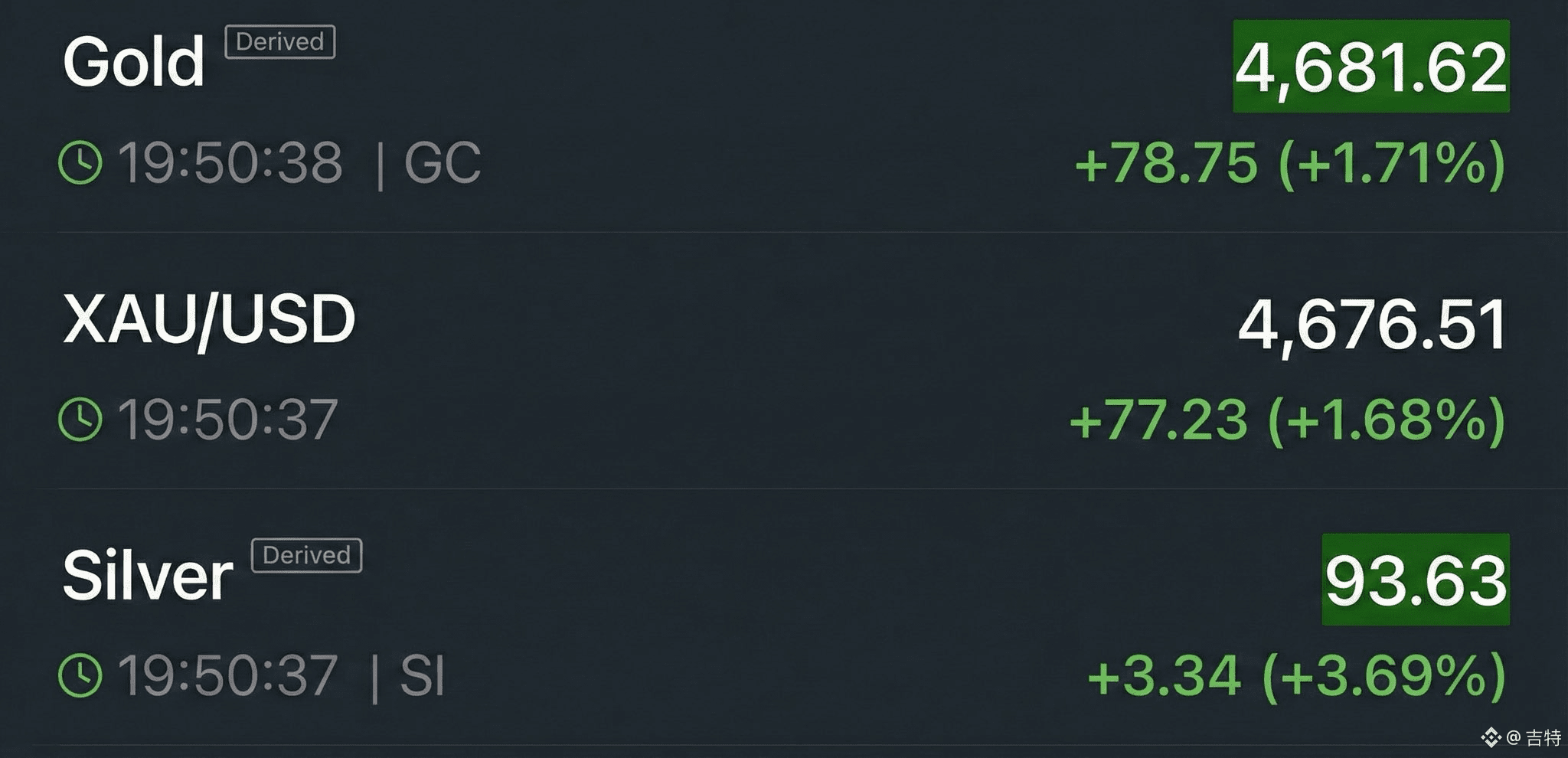

Gold = NEW HIGHS

Silver = NEW HIGHS

Gold isn’t just going up…

It just went above a multi-decade resistance level that capped EVERY inflation cycle.

There’s one setup I really hate…

Here’s what’s going on & why I’m worried:

I’ve been analyzing these charts for years, and trust me…

WE HAVEN’T EVEN SEEN ANYTHING YET.

This is a systemic warning.

Historically, moves like this signal the start of a recession.

Capital is fleeing risk assets at a pace we haven't seen in decades.

But why?

Because the market is finally pricing in the truth:

THE CENTRAL BANKS ARE ALREADY F*CKED

Watch the inventories at the Shanghai Gold Exchange (SGE). They’ve been going down rapidly. The East is draining the West of physical bullion.

I called two of my friends in China, and they can’t buy physical silver for less than $120/oz.

And Japan? $128 minimum.

This is a classic 'Gresham’s Law' event in action:

Good money (Gold/Silver) is being accumulated like NEVER before, while bad money (Fiat) is being spent.

They can either crash the economy or print the dollar into oblivion.

This screen tells you they’ve chosen the printer.

LOOK AT THE SPREAD.

The Gold-to-Silver Ratio has crashed through 70 and is hitting 50.

Silver isn't just outperforming; it's overlapping Gold's gains by a factor of 2.2x.

Industry needs it (Solar, EV, Tech).

Investors need it (Wealth preservation).

There is NOT enough physical metal to cover the paper claims.

Gold at $4,700 isn't gold becoming expensive.

It’s the dollar becoming WORTHLESS.

The smart money is front-running the inflation crisis and trust me, it’s coming sooner than y’all think.

They’re securing their purchasing power before it’s too late.

The flight to safety has begun.

DO NOT BE LEFT HOLDING WORTHLESS TOILET PAPER.

I’m about to make the biggest investment of my life , and when I do, I’ll share it here publicly for everyone to see.

If you want to WIN in 2026, all you have to do is follow me.

If you’re not following me, you will regret it…