Forget the news. Ignore the influencers. The most valuable alpha in crypto isn't broadcast—it’s written in silence on the blockchain, in a metric 99% of traders don't know how to read.

We all watch “Funding Rates” and “Exchange Flows.” But there's one elite, institutional-level signal that has flashed green before every major BNB rally in the last 18 months. It's not a perfect timing tool, but it is an unwavering conviction indicator from the smartest money in the room.

It's called the "Token Circulation Velocity Squeeze."

Here’s what it means and how you can track it for free, right now.

The Concept: Activity vs. Price

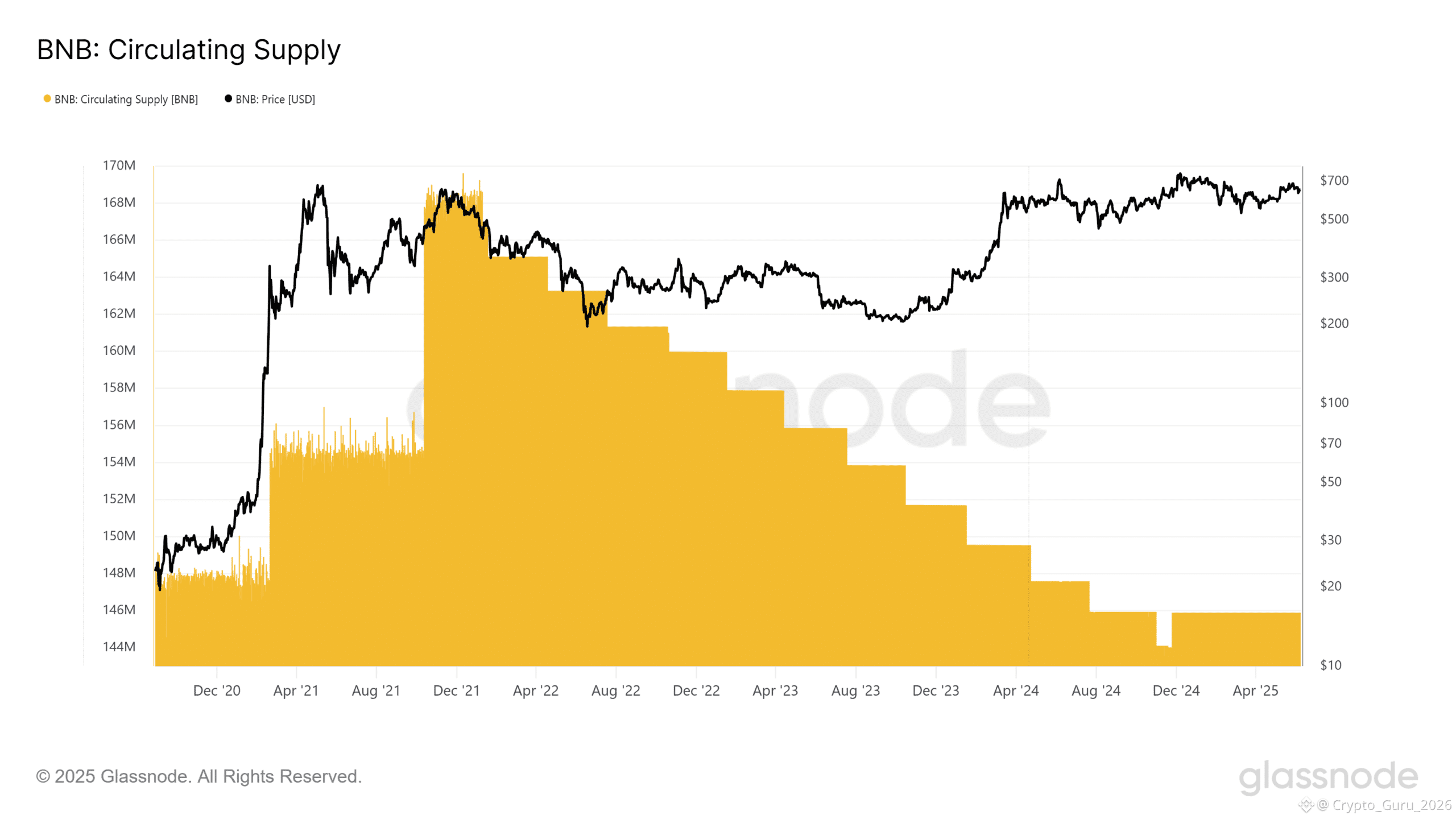

Circulation Velocity measures how frequently tokens are changing hands on-chain. A high velocity during a price pump suggests retail FOMO—coins are being rapidly flipped. A low velocity during a price pump is far more bullish. It suggests the coins moving are not being sold—they're being moved between wallets in preparation for something bigger.

But the "Squeeze" is the key.

The Setup: How to Spot the Squeeze

1. Go to Santiment or Glassnode (both have free tiers for BNB metrics).

2. Chart the 90-day Circulation Velocity for BNB against its price.

3. Look for this sequence:

· Phase 1 - Accumulation: Price is flat or dipping. Velocity is moderate to low. This is quiet accumulation.

· Phase 2 - The Squeeze: Price begins a slight uptrend or consolidates firmly. However, Velocity drops sharply to multi-week lows. This is the magic. It means the tokens being bought are immediately going into cold storage or staking contracts. They are being taken off the market. The available supply is shrinking just as demand subtly increases.

· Phase 3 - The Launch: Velocity remains suppressed as price starts its parabolic move. Why? Because the smart money that accumulated isn't selling. They're holding, forcing the price higher on lower available supply. High velocity only returns near a local top, as those same holders begin to distribute to latecomers.

Why This Works for BNB Right Now:

BNB isn't just a trading token. It's a utility engine for the entire BNB Chain ecosystem. When velocity drops during consolidation, it often means whales are moving BNB into:

· Staking (for Launchpool allocations).

· Liquid Staking Tokens (like stkBNB).

· Collateral positions on Venus or Alpaca, to borrow stablecoins for further deployment.

They aren't selling. They're gearing up.

The 1 BNB Winner's Edge:

While the crowd watches the price chart react, you learn to watch the behavioral chart underneath it. The Velocity Squeeze tells you the foundation is being fortified before the castle is built. It's the difference between seeing a wave and understanding the tide.

Your action item this week isn't to buy something. It's to open a new tab, pull up this metric, and study the last three BNB rallies. See the pattern for yourself. The next time the squeeze happens—and you'll see it—you won't need an article to tell you what it means. You'll have the quiet confidence of someone who reads the whale's whisper.

#CryptoAlpha #OnChainAnalysis #BNB #TradingStrategy #WhaleWatching #BlockchainData #DeFi #CryptoResearch