Closing Profits Is Also a Skill – Not a Weakness

One of the hardest decisions in trading is not entering a trade.

It’s not placing stop loss.

It’s not even handling a losing position.

The hardest decision is closing a winning trade.

When profit is running, emotions become louder than logic. Greed disguises itself as confidence. Hope pretends to be analysis. And suddenly, a good trader starts acting like a gambler.

This is where most accounts bleed — not because the trade was bad, but because the exit was undisciplined.

---

The Moment That Tests a Trader

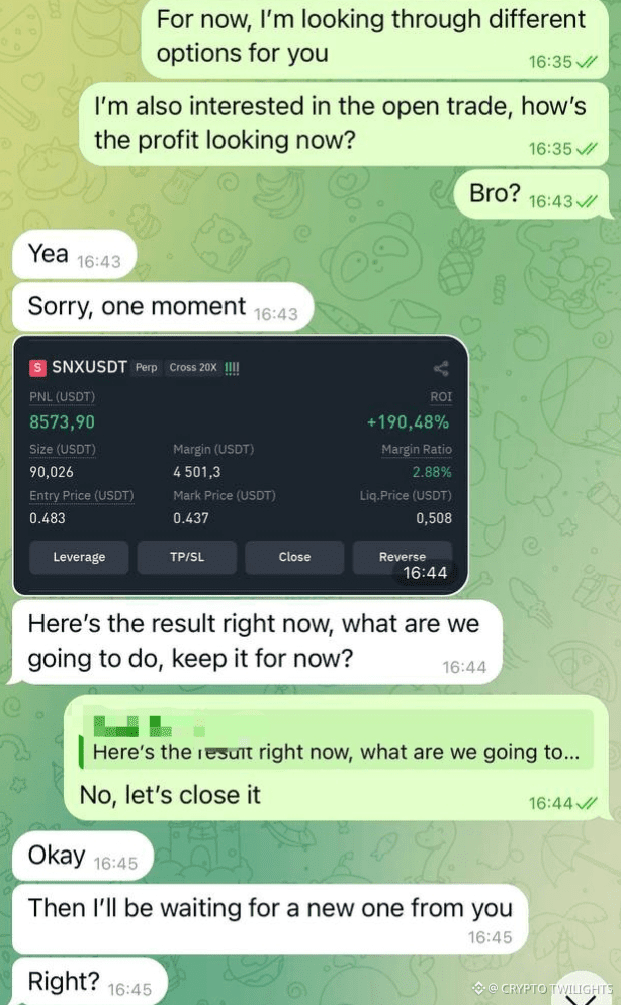

Look at the situation carefully:

The trade is open

Profit is already substantial

ROI looks impressive

The other person asks: “Should we keep it open?”

This single question separates professional thinking from emotional thinking.

A professional does not answer with excitement.

A professional answers with clarity.

> “No, let’s close it.”

That sentence may look simple, but it carries years of experience, losses, lessons, and self-control.

---

Why Closing in Profit Is Difficult

Human psychology is not designed for trading.

When we see green numbers:

We imagine more green

We fear missing out on a bigger move

We forget risk

We rewrite our plan in real time

The market does not reward imagination.

The market rewards execution.

Many traders turn winners into losers because they wanted a little more. That “little more” often costs everything.

---

Profit Is Not Real Until It’s Closed

Unrealized profit is just a number on a screen.

It can disappear:

In one candle

In one news spike

In one emotional mistake

Closing a trade is not fear.

Closing a trade is confirmation.

It means:

The plan was followed

The objective was met

Capital is protected

The trader survives to trade another day

Survival is the first rule of trading.

---

Discipline Over Ego

A disciplined trader asks:

Is my target achieved?

Is risk increasing now?

Is the reward still worth it?

An ego-driven trader asks:

What if it goes higher?

What if this is the big move?

What if I miss the top?

Ego wants perfection.

Discipline wants consistency.

Markets don’t pay for perfection.

They pay for repetition of good behavior.

---

The Power of Saying “Enough”

There is strength in knowing when to stop.

Closing a profitable trade does not mean:

You are scared

You lack confidence

You don’t understand the market

It means:

You respect probability

You respect your system

You respect your capital

One closed profit is better than ten imagined profits.

---

Trading Is a Game of Decisions, Not Emotions

Every trade has three stages:

1. Entry

2. Management

3. Exit

Most traders focus only on entry.

Professionals are defined by exit decisions.

A good exit:

Reduces stress

Builds confidence

Protects mindset

Creates long-term growth

You don’t need to catch the entire move.

You only need your part of the move.

---

Consistency Beats One Big Trade

Accounts don’t grow from one trade. They grow from:

Repeated discipline

Controlled risk

Timely exits

Closing profit today gives you:

Capital for tomorrow

Mental clarity

Emotional balance

Holding for greed gives you:

Stress

Overexposure

Regret

---

Final Thought

The market will always give another opportunity.

There will always be another setup.

Another candle.

Another trade.

But capital and discipline, once lost, are hard to recover.

Closing a profitable trade is not the end of the journey —

It is proof that you are trading with maturity.

Sometimes the best trade you can make

is knowing when to say:

“That’s enough. Close it.”