Bitcoin is showing renewed downside risk after failing to hold its recent breakout, with technical indicators pointing toward a possible move back into the $58,000–$62,000 range.

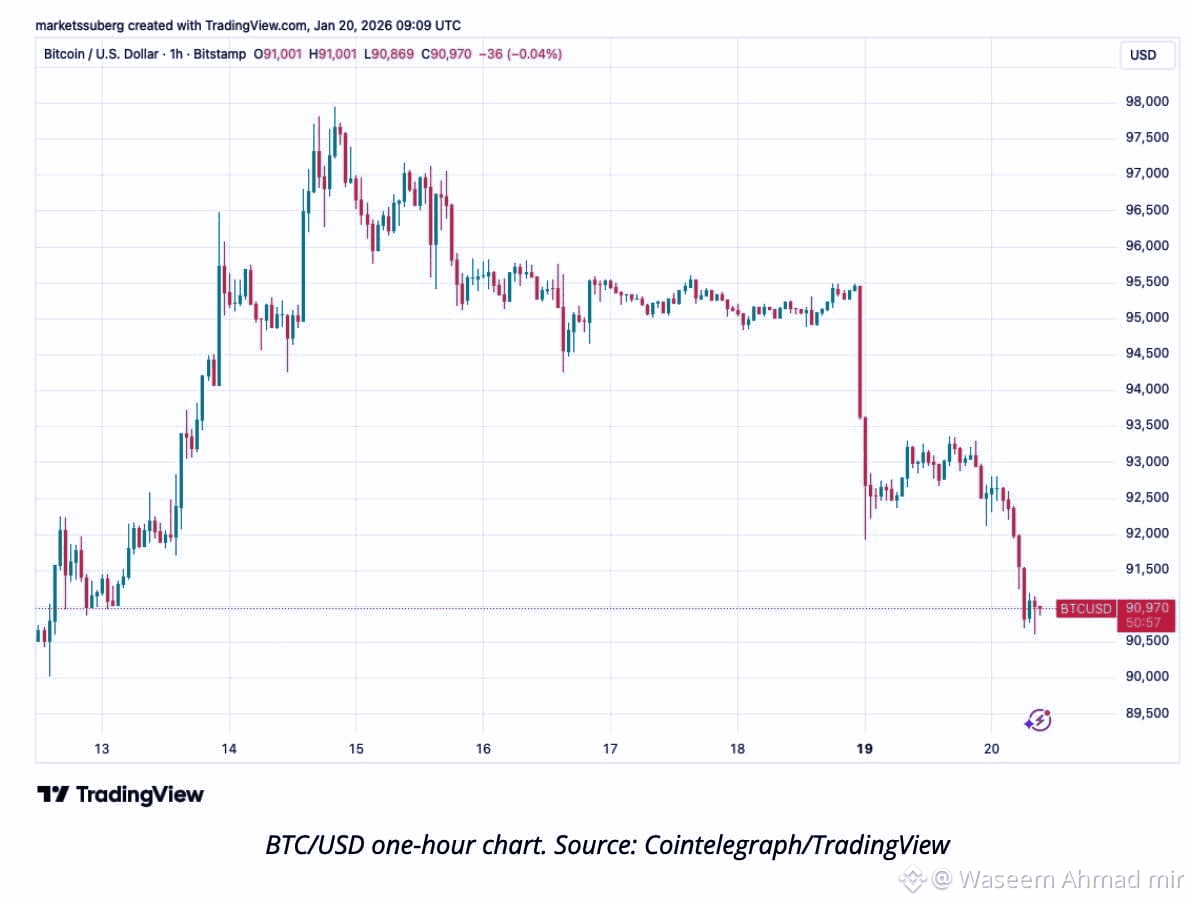

BTC fell to multi-day lows near $90,000 as global risk sentiment weakened and price slipped back into its long-standing consolidation zone. Analysts say the rejection confirms that bullish momentum has faded for now.

Failed Breakout Returns BTC to Range

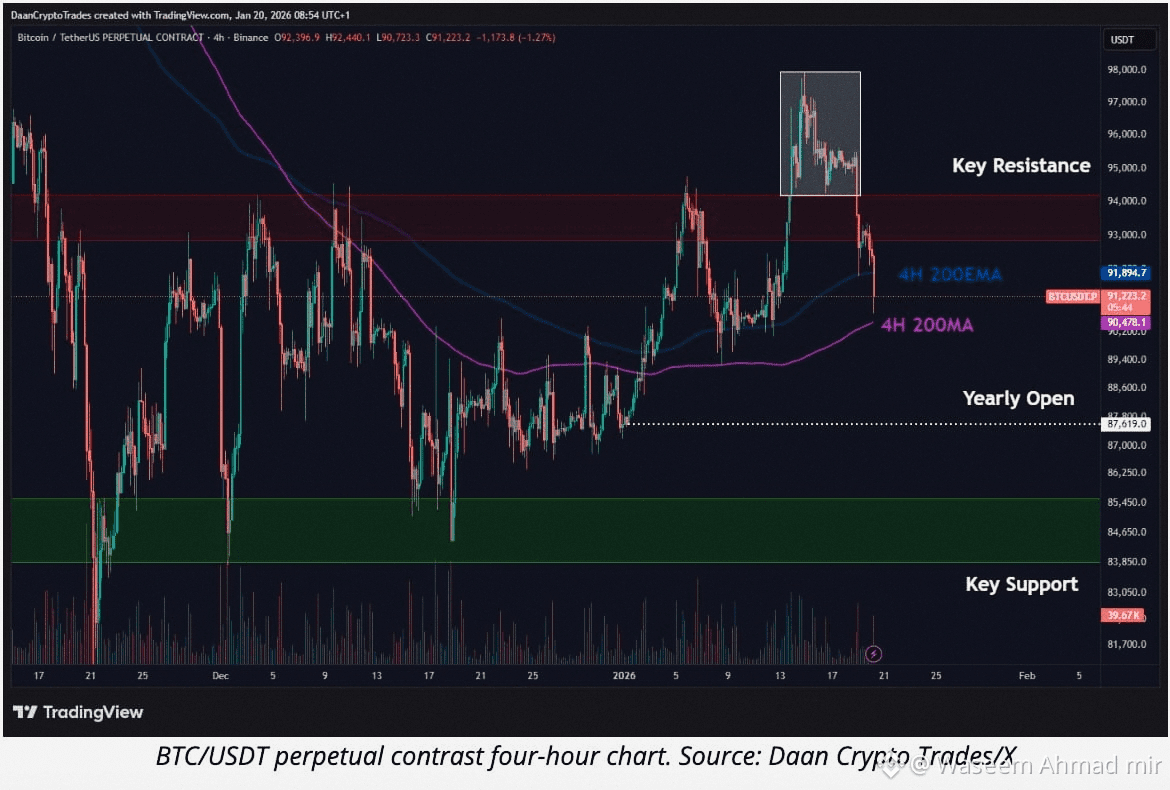

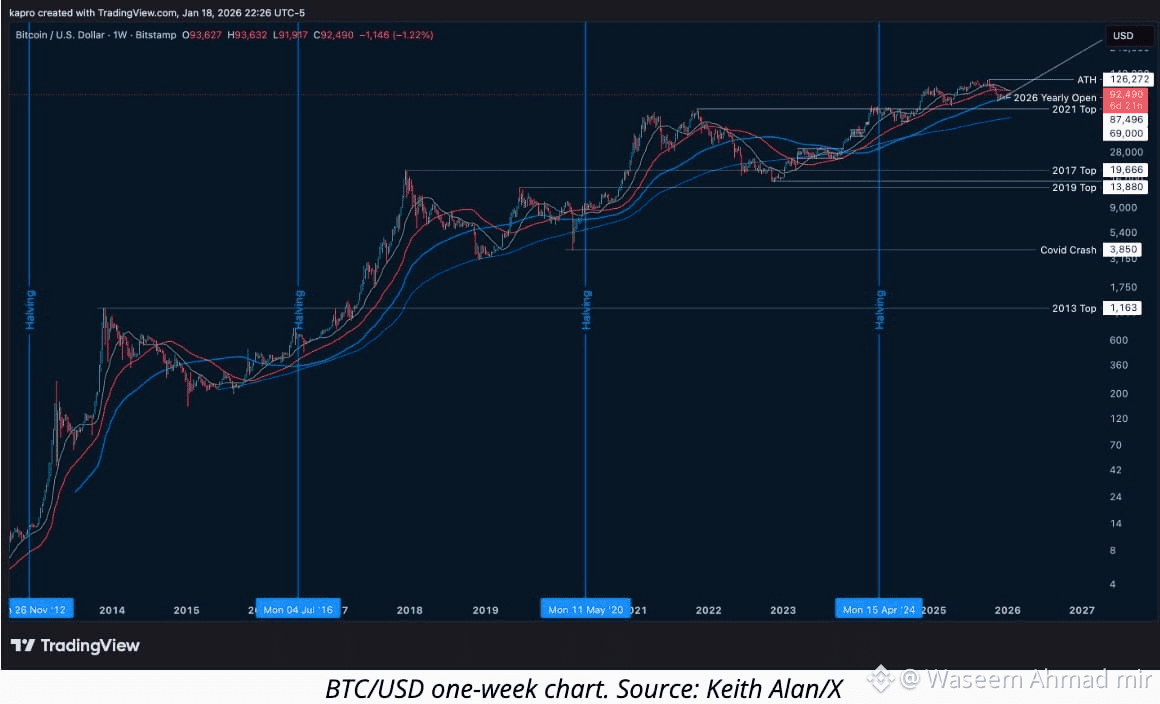

TradingView data shows Bitcoin back inside the $84,000–$94,000 range it has traded within for the past two months. Trader Daan Crypto Trades noted that price has clearly re-entered the range, turning the failed breakout into a technical negative.

The loss of the 4-hour 200-period SMA and EMA has further weakened short-term structure.

Yearly Opens Become Key Support Levels

Attention has now shifted to major yearly reference points:

2025 yearly open: ~$93,500

2026 yearly open: ~$87,000

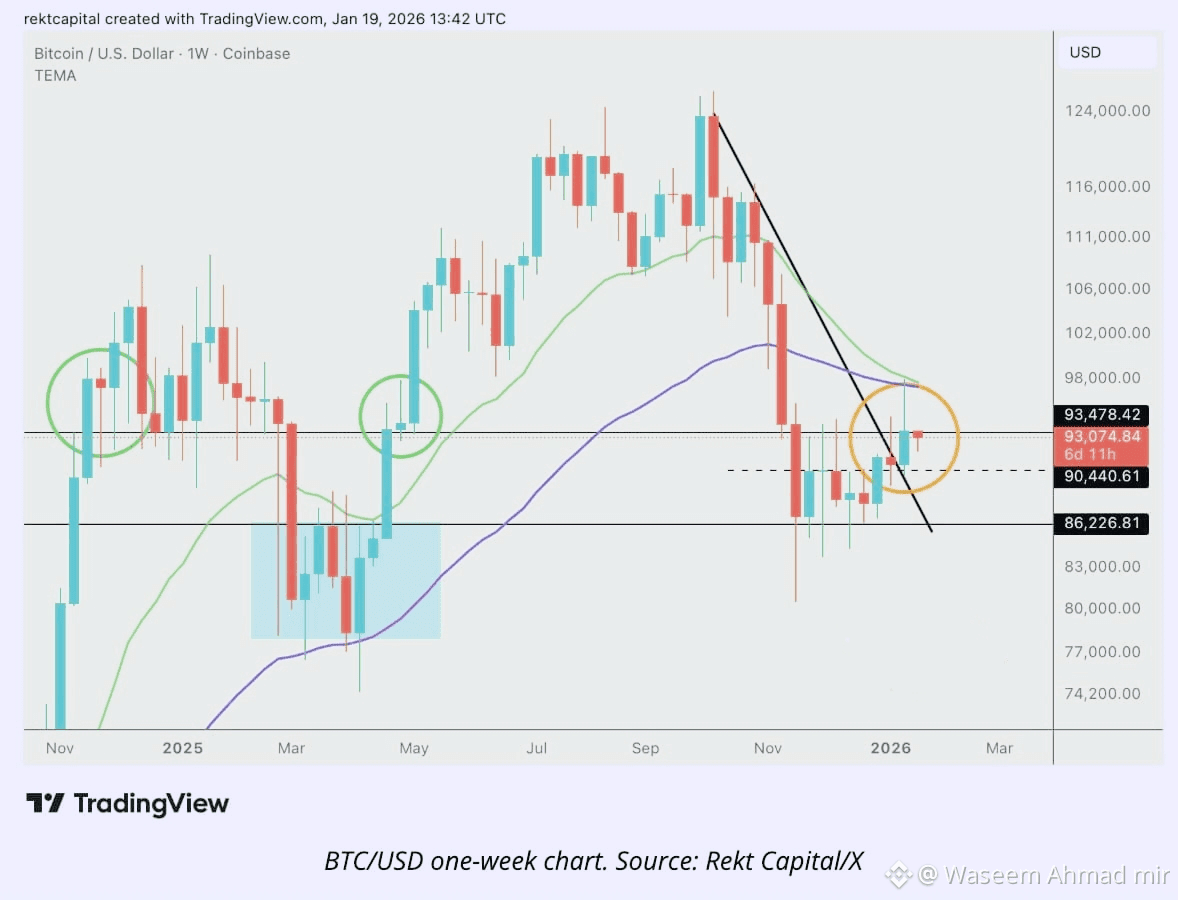

Analyst Rekt Capital warned that Bitcoin must reclaim $93,500 to keep the weekly breakout intact. Failure could expose the 2026 yearly open, a level traders believe is likely to be tested.

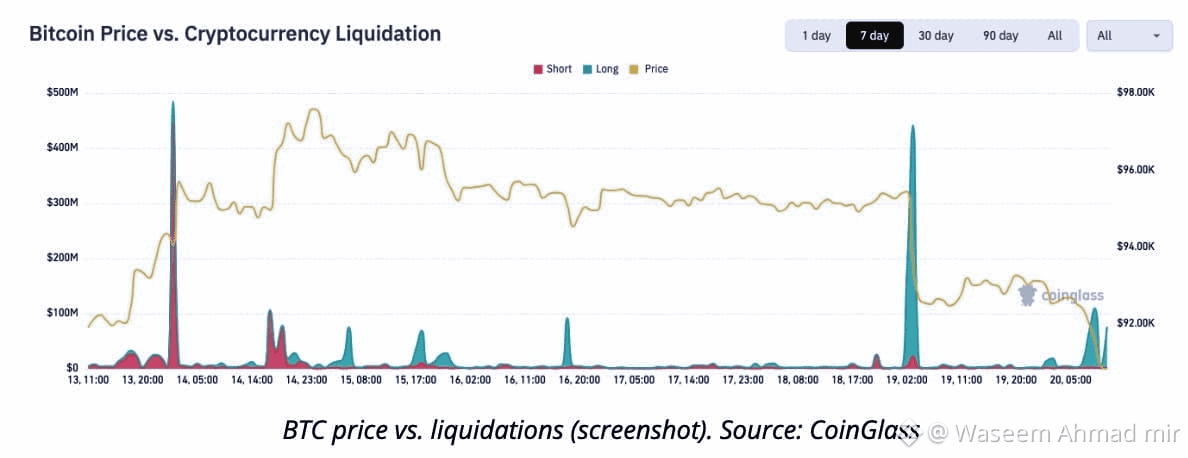

Liquidations Increase as Volatility Returns

According to CoinGlass, more than $360 million in liquidations were recorded in the past 24 hours, signaling renewed market stress. While macro headlines added pressure, analysts say the move aligns with a broader technical breakdown.

Weekly Bearish Cross Signals Caution

Material Indicators cofounder Keith Alan highlighted the formation of a weekly death cross, with the 21-week moving average crossing below the 50-week average. Historically, this signal has often appeared during late-stage corrections rather than at cycle highs.

Bitcoin may attempt a reaction near the 100-week SMA around $86,900, but downside risk remains unless key levels are reclaimed.

$58K–$62K Back on Watch

Veteran trader Peter Brandt suggested Bitcoin could revisit the $58,000–$62,000 region if current support fails, a zone last seen in late 2024.

Market Outlook

While short-term pressure persists, leverage has largely been flushed and open interest remains below previous peaks. This leaves room for further downside to act as a structural reset rather than a full trend reversal.

Bitcoin now needs to reclaim the $93,500–$98,000 area to shift momentum back in favor of bulls.