XPL is a futures-based crypto asset that represents the true behavior of modern digital markets. It is not designed for slow or passive movement; instead, it reflects momentum, liquidity flow, and trader sentiment in real time. Assets like XPL are often chosen by futures traders because they react quickly to market changes, creating both opportunity and risk within short time frames.

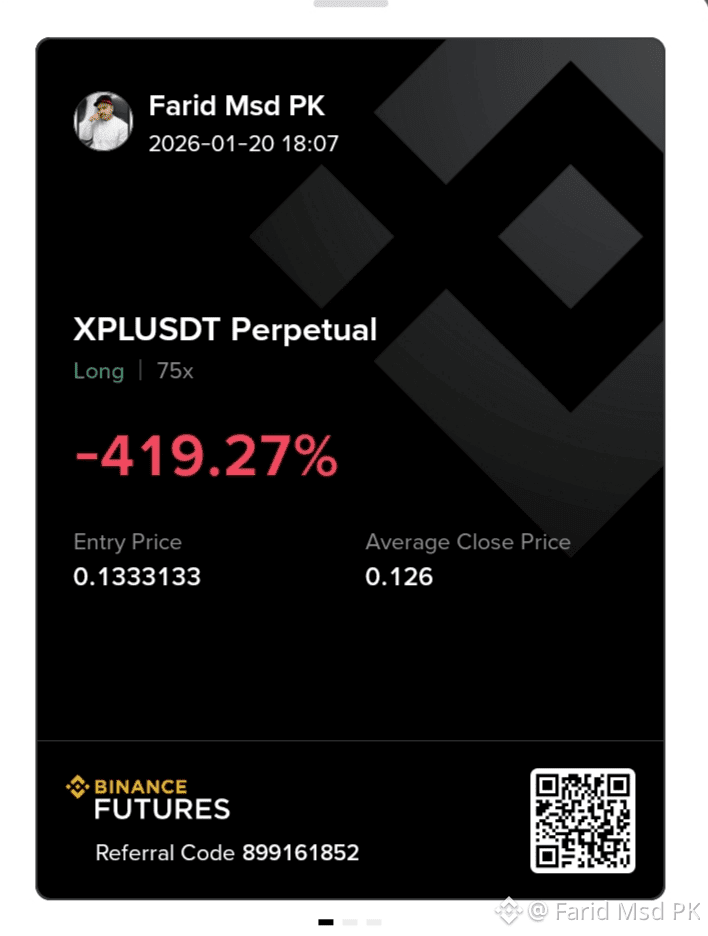

In crypto trading, profit and loss are both normal outcomes. In earlier trades, XPL generated positive returns, while in the most recent position, the result was a loss. This shift does not reduce the value or relevance of the asset. Markets do not reward traders for a single position; they reward discipline over a series of trades. Every experienced trader understands that no strategy delivers profit on every attempt.

The crypto market naturally moves in cycles. After upward momentum, a correction or pullback is expected. These pullbacks are not signs of weakness but part of price discovery. When an asset moves toward its lower zone after a decline, it often attracts attention from traders who focus on risk-to-reward rather than short-term emotions. XPL is currently positioned in such a lower region relative to its recent trading range.

Lower zones are important because they are commonly associated with reduced selling pressure and potential accumulation behavior. While confirmation is always required, many traders consider these levels as areas of interest for buying, provided risk is managed properly. This is not a guarantee of immediate upside, but it represents a phase where the downside may already be partially priced in.

Volatility is a core feature of XPL. This volatility creates rapid price movement, which is why it is favored in futures markets. However, volatility demands responsibility. Proper position sizing, stop-loss planning, and realistic expectations are essential. Without risk control, even strong market ideas can lead to losses.

XPL also highlights an important lesson: one trade does not define performance. A profitable trade in the past and a loss in the present are both part of the same journey. What matters is consistency, learning, and adapting to market conditions as they evolve.

Crypto markets are not linear. There are rises, drops, consolidations, and sudden moves driven by liquidity and sentiment. XPL operates within this reality. Understanding and accepting these dynamics allows traders to stay focused on structure rather than emotions.

In summary, XPL represents market life itself. Sometimes the market rewards, sometimes it corrects. At the current stage, price behavior places XPL in a zone that many traders monitor for potential buying opportunities, while fully respecting the risks involved. Consistent decision-making and patience remain the key factors in navigating assets like XPL@Plasma