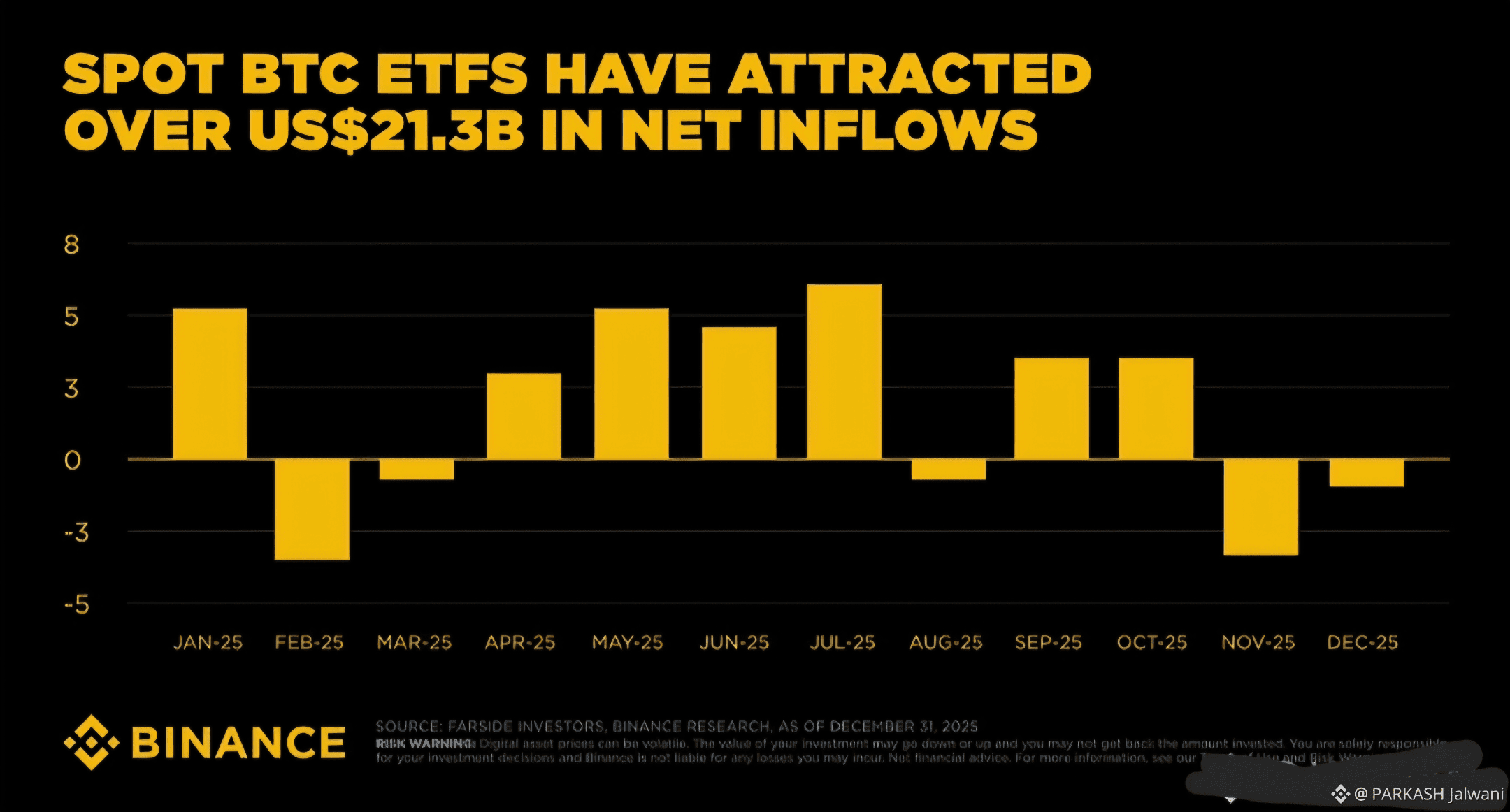

$BTC WALL STREET CAN’T STOP BUYING: $21.3B FLOODED INTO BITCOIN ETFs 🚨

2025 quietly confirmed what most traders underestimated: Bitcoin ETFs became a dominant market force. Over the year, spot BTC ETFs吸 pulled in more than $21.3 BILLION in net inflows, cementing them as a core signal of institutional demand — not a short-lived trend.

These weren’t emotional buys. Flows stayed resilient across volatility, drawdowns, and macro shocks. Pension funds, asset managers, and long-only allocators treated Bitcoin like a strategic exposure, not a speculative trade. That’s a structural shift.

When this much capital moves through regulated vehicles, it changes market behavior. Liquidity deepens. Sell-offs get absorbed faster. And price discovery becomes increasingly driven by institutions, not leverage tourists.

As highlighted by Binance Research, ETFs are no longer just a headline — they’re the plumbing.

If ETFs stay bid, Bitcoin doesn’t need hype.

It just needs time.

Are you watching price… or watching flows?

Follow Wendy for more latest updates

#Bitcoin #ETFs #InstitutionalDemand