The on-chain data is speaking, and Binance Square is buzzing with optimism! 🚨 Analysts are pointing to a massive shift in "Whale" behavior that could signal the end of our recent market correction. If you’re hunting for the next big move for #Write2Earn, this is the trend you can't ignore.

📉 The "Selling Exhaustion" Signal

After weeks of heavy distribution, the tides are turning. Key on-chain metrics show that the massive sell-wall from large holders is finally crumbling:

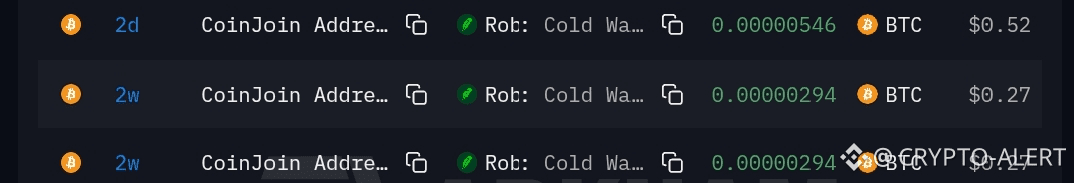

Inflow Drop: Bitcoin whale deposits to exchanges have plummeted. In early 2026, we saw daily inflows drop significantly compared to the December peaks, suggesting whales are moving assets into cold storage instead of preparing to dump. 🧊🔐

Inflow Drop: Bitcoin whale deposits to exchanges have plummeted. In early 2026, we saw daily inflows drop significantly compared to the December peaks, suggesting whales are moving assets into cold storage instead of preparing to dump. 🧊🔐

The "Dolphin" Pivot: While retail ("shrimp") might still be panicking, "Dolphins" (holders of 100–1,000 BTC) have started re-accumulating, absorbing the remaining sell-side liquidity.

Stablecoin Power: Whale-tier stablecoin reserves on Binance are rising again. This "dry powder" suggests big players are waiting for the perfect moment to strike the "buy" button.

🕵️♂️ Market Sentiment: Stability or Trap?Most Square creators are interpreting this as a "Local Bottom." When whale selling pressure declines, it usually leads to a period of consolidation—the "quiet before the storm" that often precedes a bullish breakout.

💡 Pro-Tip for Creators: Focus your content on "Accumulation Phases." Historically, when the Whale-to-Exchange Ratio drops below critical levels (like it is doing now), it’s a high-probability signal for a trend reversal.

#Write2Earn #WhaleAlert #OnChainAnalysis #BinanceSquare #BTCVSGOLD $BTC