The Fed just released fresh macro data and it’s far worse than markets expected.

We’re moving closer to a global market breakdown, yet most investors don’t even realize it’s underway.

This is deeply bearish

If you’re holding risk assets right now, what comes next won’t be comfortable.

What’s happening beneath the surface is not normal.

A systemic funding problem is quietly building, and almost no one is positioned for it.

The Fed already knows this and they’re scrambling.

Here’s what just happened:

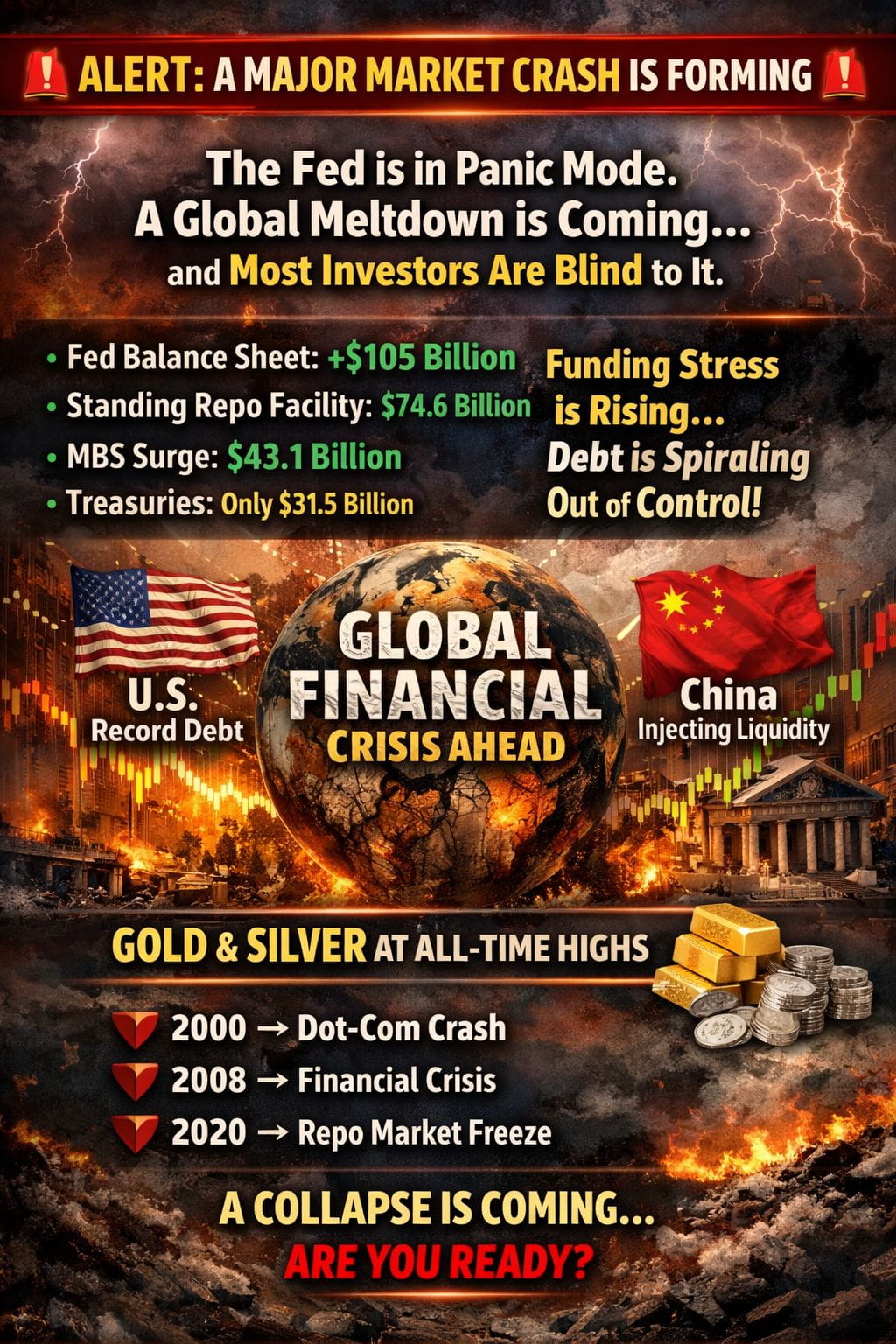

The Fed’s balance sheet expanded by ~$105B

$74.6B injected via the Standing Repo Facility

$43.1B surge in mortgage-backed securities

Only $31.5B in Treasuries

This is not bullish QE.

This is emergency liquidity.

Funding tightened. Banks needed cash fast.

And when the Fed absorbs more MBS than Treasuries, that’s a serious warning sign.

It signals deteriorating collateral quality something that only shows up during financial stress.

Now zoom out.

The real issue most people are ignoring:

🇺🇸 U.S. national debt is at record levels — structurally.

Over $34 trillion, growing faster than GDP.

Interest expenses are exploding and becoming one of the largest line items in the federal budget.

The U.S. is now issuing new debt just to pay interest on existing debt.

That’s not sustainability.

That’s a debt spiral.

At this stage, Treasuries aren’t truly “riskfree.”

They’re a confidence trade.

And that confidence is cracking:

Foreign demand is weakening

Domestic buyers are extremely price sensitive

Which quietly forces the Fed into the role of buyer of last resort, whether they admit it or not.

That’s why funding stress matters so much right now.

You cannot:

Sustain record debt when funding tightens

Run trillion-dollar deficits as collateral quality declines

Keep pretending this is normal

And this isn’t just a U.S. problem.

🇨🇳 China is doing the same thing at the same time.

The PBoC injected 1.02 trillion yuan in a single week through reverse repos.

Different country.

Same issue.

Too much debt.

Too little trust.

A global system built on rolling liabilities that fewer people actually want to hold.

When both the U.S. and China are forced to inject liquidity simultaneously, that’s not stimulus.

That’s the global financial plumbing starting to clog.

Markets always misread this phase.

People see liquidity injections and think: “bullish.”

They’re wrong.

This isn’t about pumping asset prices.

It’s about keeping funding alive.

And when funding breaks everything else becomes a trap.

The sequence never changes

Bonds move first

Funding markets show stress

Equities ignore it until they can’t

Crypto gets hit the hardest

Now look at the signal that actually matters:

$Gold at all-time highs

$Silver at all-time highs

This isn’t growth.

This isn’t inflation.

This is capital rejecting sovereign debt.

Money is leaving paper promises and moving into hard collateral.

That does not happen in healthy systems.

We’ve seen this setup before:

2000 → Dot-com crash

2008 → Global Financial Crisis

2020 → Repo market freeze

Each time, recession followed shortly after.

The Fed is trapped.

Print aggressively → metals explode, signaling loss of control

Don’t print → funding markets seize and debt becomes unserviceable

Risk assets can ignore reality but never forever.

This is not a normal cycle.

This is a quiet balance-sheet, collateral, and sovereign debt crisis forming in real time.

By the time it becomes obvious, most investors will already be positioned wrong.

Position yourself wisely if you want to survive 2026.

I’ve been calling major market tops and bottoms for over a decade.

When I make my next move, I’ll post it here first.

If you’re not following yet you probably should.

Time is not on most people’s side.