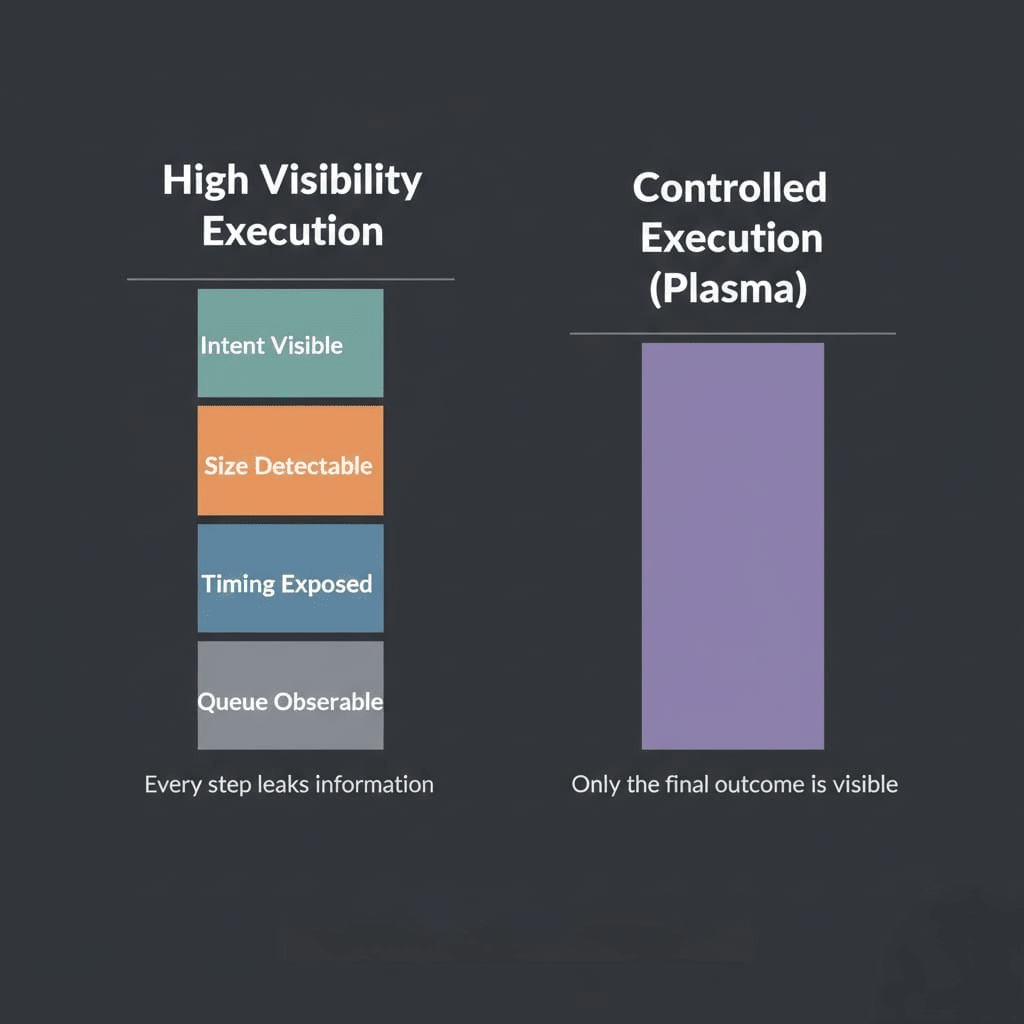

When you move small amounts of money, being visible doesn't matter much. If someone notices, the damage is limited. But when you move large value, visibility becomes risky. Timing matters. Intent matters. And showing your hand too early gives others a chance to react.

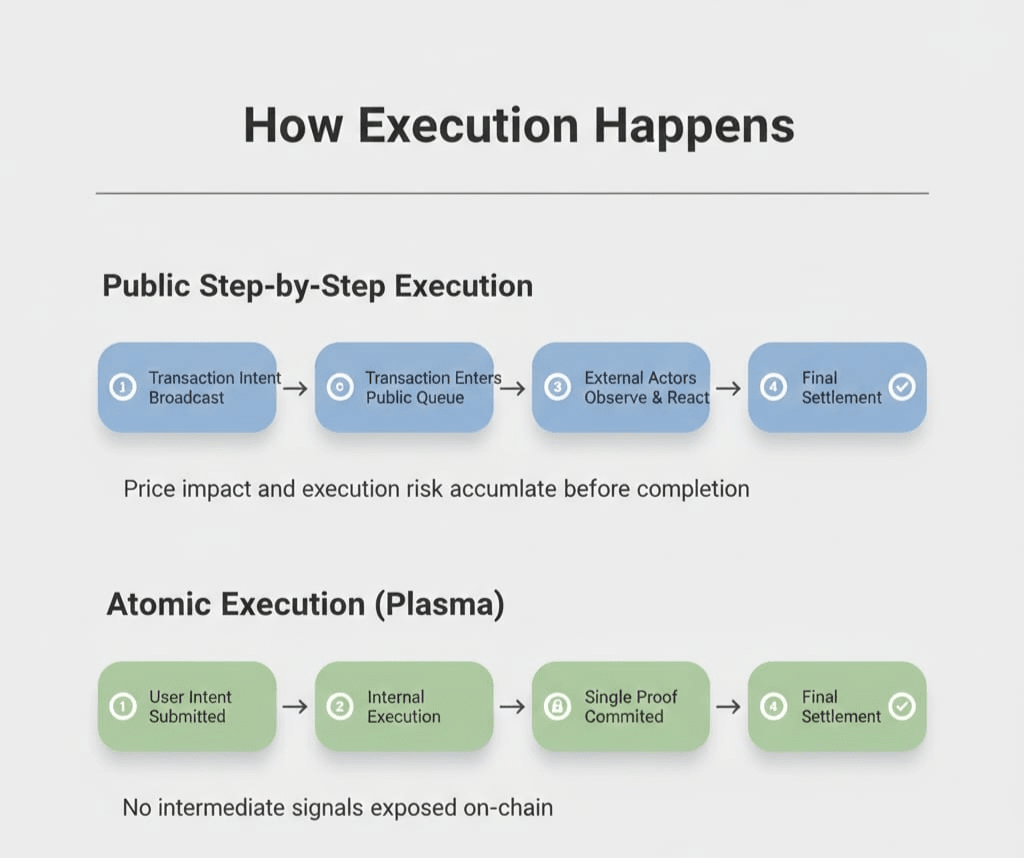

Most public blockchains treat small and large transactions similarly: every step is visible in the network. This openness supports transparency, but it can introduce real risks when significant value is involved.

Why Visibility Can Be Costly Imagine holding a sign in a store line that says exactly what you’re about to buy and how urgently. That's essentially what happens on many public chains.

When a large transaction enters the network:

Others can see it before it’s finalized

They can estimate its size and direction

They can act ahead of it or around it

Nothing illegal happens, and nothing is broken. But the result is often worse prices, slower execution, or higher costs–especially when this repeats over time. That accumulated impact is the real cost of being too visible.

Plasma’s Approach: Finish Before Anyone Can Interfere

Plasma’s Approach: Finish Before Anyone Can Interfere

Plasma and modern layer-2 solutions like rollups take a different approach. Instead of revealing every intermediate step, transactions are executed internally first, and only a final proof or batch result is submitted on-chain. There are no early signals, no partial states, and no visible execution trail—only a final, verifiable outcome.

It's similar to closing a deal privately and announcing it only after everything is settled.

Why This Feels Safer for Institutions This mirrors how traditional financial systems operate. Banks don't announce trades before settlement, and companies don’t disclose internal steps while moving treasury funds. What matters is that the result is correct, auditable, and final.

Plasma-style systems bring that same confidence on-chain. Institutions can move large value knowing the rules are enforced automatically, results can be verified, and strategic intent isn't exposed mid-execution.

Paymasters: A Supporting Layer, Not the Core

Paymasters: A Supporting Layer, Not the Core

Plasma is the core architecture that protects high-value execution by keeping intermediate steps off-chain and publishing only a final, verifiable outcome. That design is what removes most visibility risk.

Paymasters don’t replace this model or redefine it. They simply prevent small, secondary signals like gas pre-funding or temporary balances—from leaking intent around Plasma-based execution. Think of them as infrastructure polish, not the engine itself.

The security advantage still comes from Plasma's execution-first, disclosure-later approach. Paymasters only ensure that no side detail quietly undermines that core design.

In systems moving serious value, architecture matters most. Everything else exists to support it.