In the fast-paced world of commerce, the moment a customer taps a card or clicks “pay,” a critical clock begins ticking. For merchants, the interval between that initial authorization and the guaranteed settlement of funds—the moment when the money is truly theirs, protected from chargebacks or reversals—is a period of financial risk and operational uncertainty. In traditional digital payments, this settlement process can take days. Even in blockchain networks, many platforms operate with probabilistic finality, where a transaction may appear confirmed but can technically be reversed after several minutes or blocks. For point-of-sale systems, this uncertainty is a major barrier to adoption. Plasma, a blockchain purpose-built for stablecoins, fundamentally changes this paradigm by delivering sub-second deterministic finality, redefining what is possible for digital payments and merchant integration.

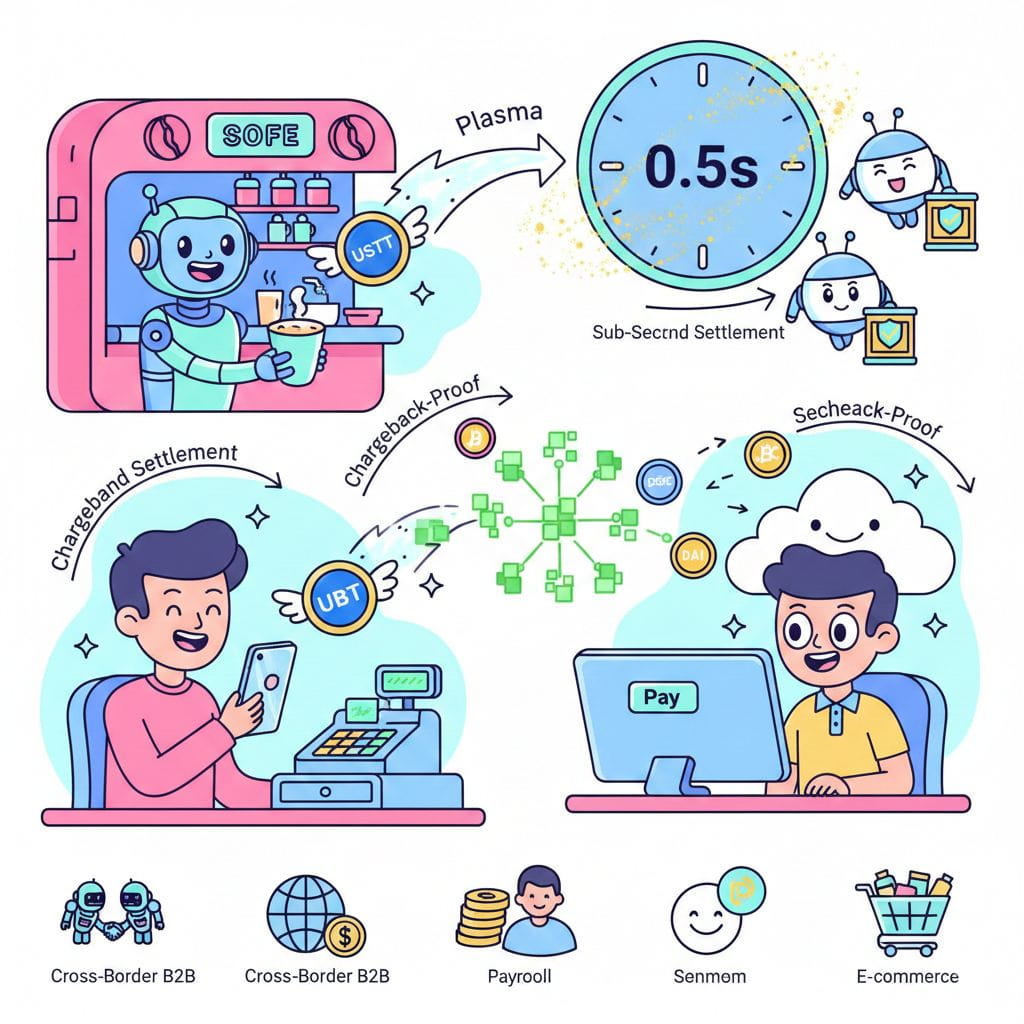

Finality is non-negotiable for merchants. It is the definitive moment when a sale is complete, the product can be handed over, and revenue is securely recorded. In card networks, the illusion of instant payment masks a complex, multi-day settlement process, often fraught with chargebacks, where funds can be pulled back months later. These chargebacks are costly, both financially and operationally: studies show that for every dollar lost, merchants incur an additional $3.75 in related expenses. Stablecoin transactions on a blockchain operate differently. They are push payments—initiated and authorized by the customer—and once settled, they are cryptographically irreversible. This eliminates fraudulent chargebacks entirely, offering merchants a reliable shield. Yet, this benefit is meaningless if finality is slow or uncertain. A coffee buyer cannot wait several minutes for a transaction to “finalize” before receiving their order. For blockchain payments to work at the point of sale, sub-second deterministic finality is not a luxury; it is an operational necessity.

Plasma achieves this breakthrough through its custom consensus engine, PlasmaBFT, a high-performance, Rust-based implementation of the Fast HotStuff protocol. PlasmaBFT is engineered specifically to finalize transactions at the speed of commerce, a design philosophy markedly different from general-purpose blockchains. While Ethereum and similar platforms balance throughput, decentralization, and the execution of arbitrary smart contracts, PlasmaBFT is purpose-built for payment workloads, prioritizing stablecoin throughput and sub-second settlement. Traditional blockchains operate sequentially, requiring each block to finalize before the next is proposed, creating bottlenecks under heavy load. PlasmaBFT, by contrast, uses pipelining and a two-chain commit system, allowing new block proposals to begin while previous ones are still being finalized. This design, coupled with the “fast path” two-quorum-commit approach, means that blocks can be irreversibly settled after just two consecutive validator votes, dramatically reducing latency. The result is a network capable of processing over 1,000 transactions per second, with a block time of roughly one second, where funds are settled faster than a cashier can hand a receipt to a customer.

Beyond speed, Plasma’s architecture is deeply merchant-centric. One of its standout features is zero-fee transfers for stablecoins. A protocol-managed paymaster sponsors gas fees for simple USDT transfers, meaning customers can make payments without understanding gas tokens or dealing with volatile fees. This simplicity transforms microtransactions and low-value sales into economically viable operations for the first time. For more complex transactions, Plasma implements a stablecoin-first gas model, allowing fees to be paid directly in the tokens already held by users, such as USDT or bridged Bitcoin (pBTC), via automated mechanisms. Merchants and customers no longer need to acquire or manage a separate, volatile native token merely to process payments. In addition, Plasma anchors its state periodically to the Bitcoin blockchain, combining the speed of sub-second settlement with institutional-grade trust and security. Merchants and payment processors can be confident that their transaction history and fund security are protected by the most decentralized and battle-tested network in existence.

The practical applications of Plasma’s sub-second finality extend across both retail and global commerce. In point-of-sale scenarios, a coffee shop can accept a USDT payment that settles in under a second. The customer receives their latte, and the merchant’s wallet is instantly credited with irreversible funds. In e-commerce, Plasma-based gateways enable merchants to receive settlement in real time, improving cash flow and eliminating the risk of chargebacks that plague industries like digital goods, travel, and electronics. On a larger scale, businesses can leverage Plasma for cross-border B2B payments or global payroll. Sub-second finality allows real-time reconciliation, while the platform’s programmable architecture supports escrow services and automated compliance through smart contracts, reducing manual overhead and operational risk.

Plasma’s mainnet launch in September 2025 showcased strong market demand, with over $2 billion in stablecoin deposits flowing in on the first day. Infrastructure partners, such as Tenderly, are building tools to simulate, debug, and monitor high-speed payment applications, further strengthening the ecosystem. Yet, the path to becoming the default global payment rail is not without challenges. While Bitcoin-anchored security is a significant advantage, cross-chain bridges must be robustly tested to avoid potential vulnerabilities. Moreover, although regulatory clarity is improving with initiatives like the U.S. GENIUS Act, stablecoin payments remain subject to evolving global regulations, requiring careful integration for wide-scale adoption.

Despite these challenges, Plasma represents a paradigm shift in blockchain design philosophy. It moves away from the “one-chain-fits-all” approach and instead delivers a system specialized for payments. By guaranteeing sub-second deterministic finality, Plasma resolves the core technical issue that has long hindered blockchain adoption in everyday commerce. Combined with fee-less transfers, a user-friendly stablecoin-first gas model, and Bitcoin-backed security, the platform provides a compelling solution for merchants and consumers alike. For businesses tired of fee erosion and chargeback fraud, and for consumers seeking instant, borderless digital cash, Plasma is more than a blockchain; it is a dedicated, high-speed payment rail engineered for the future of money.

In essence, Plasma demonstrates that blockchain technology can achieve the speed, certainty, and usability required for real-world commerce. By blending advanced consensus engineering with a merchant-first design, it sets a new standard for stablecoin payments. Its sub-second finality is not just a technical feature—it is a catalyst for transforming global digital commerce, enabling instantaneous settlement, predictable revenue, and frictionless financial experiences across every point of sale and payment interface. Plasma’s architecture proves that when blockchain is purpose-built for payments, the promise of truly instant, secure, and practical digital money is no longer theoretical—it is here.

Plasma: The Blockchain Built for Global Stablecoin Payments

In the rapidly expanding world of digital finance, over $250 billion in stablecoins now circulate, facilitating trillions of dollars in monthly transaction volume. Yet, despite this explosive growth, most blockchains are designed as general-purpose platforms for smart contracts, decentralized applications, or speculation. They are rarely optimized for the unique demands of high-volume, low-value stablecoin transactions. Enter Plasma, a Layer 1 blockchain engineered from the ground up not to serve every conceivable application, but specifically for the singular purpose of global stablecoin settlement. Plasma represents a fundamental shift in blockchain design philosophy. Rather than attempting to retrofit a general-purpose network for payments, it asks a simple question: what would a blockchain look like if stablecoins were its first-class citizens? The answer is a network that merges the developer-friendly environment of Ethereum with a high-performance, payment-optimized core, creating a purpose-built infrastructure layer designed for the future of money movement.

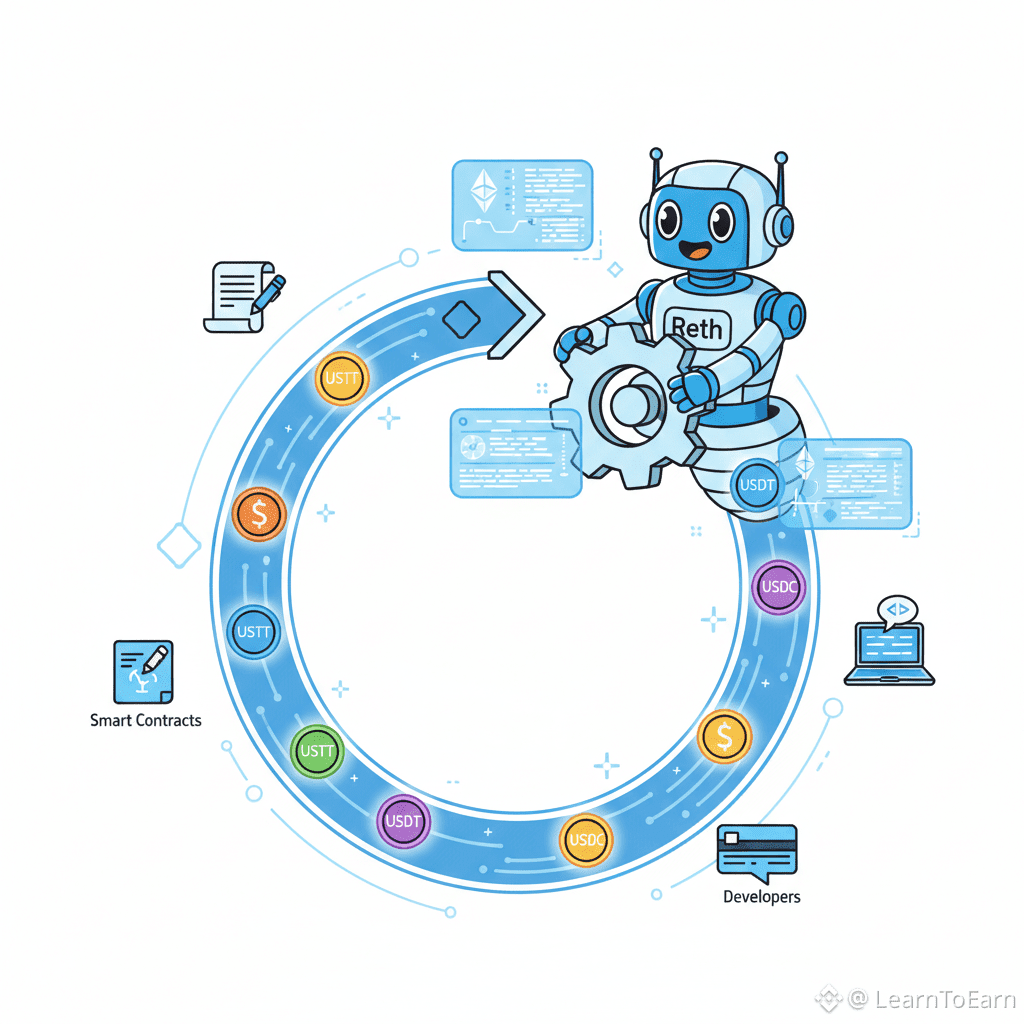

At its core, Plasma’s architecture is modular and intentionally layered, separating consensus, execution, and security responsibilities to maximize both performance and compatibility. The consensus layer, PlasmaBFT, functions as the network’s “brain.” It is a custom, high-performance implementation of the Fast HotStuff Byzantine Fault Tolerant protocol, written in Rust, designed for speed, finality, and reliability rather than general-purpose computation. The execution layer, built on Reth—a high-performance, modular Ethereum execution client—serves as the “muscle,” processing transactions with full EVM compatibility. This ensures that every Ethereum tool, library, and smart contract can run seamlessly on Plasma without modification. Finally, Plasma integrates a Bitcoin-anchored security layer via a trust-minimized bridge, periodically anchoring its state to Bitcoin blocks. This link inherits Bitcoin’s robust security and neutrality, providing censorship resistance and institutional-grade trust.

At the heart of Plasma’s performance is its consensus mechanism, PlasmaBFT. Unlike traditional Proof-of-Work or generic Proof-of-Stake systems adapted for speed, PlasmaBFT is purpose-built for payment-grade workloads. It operates on a leader-based round structure, where a selected validator proposes a block and other validators vote. These votes are aggregated into a Quorum Certificate (QC), serving as cryptographic proof of agreement. PlasmaBFT is designed to tolerate up to one-third of validators acting maliciously while maintaining safety, following classic BFT security assumptions. Its true innovation lies in pipelining. Sequential block processing, common in general-purpose chains, creates latency as each block must be fully finalized before the next is proposed. PlasmaBFT overlaps these stages, allowing a new block proposal to begin even as the previous block is still being finalized. Parallel processing, combined with the “fast path” two-quorum-commit approach, enables sub-second deterministic finality, a critical requirement for point-of-sale payments and real-time settlement.

Plasma’s validator model is optimized for predictability and institutional participation. Misbehaving or offline validators lose only their block rewards, not staked capital, aligning incentives with operational reliability rather than punitive capital risk. Additionally, a committee-based approach selects validators via a stake-weighted random process for each consensus round, avoiding the overhead of involving every validator in every vote and keeping the network scalable and efficient.

Beyond consensus, Plasma’s user-facing innovations systematically remove friction points that have historically hindered blockchain payment adoption. Zero-fee USD₮ transfers, enabled through a protocol-managed paymaster, allow users to send USDT without holding Plasma’s native token, XPL. Lightweight identity checks and per-wallet rate limits prevent abuse, ensuring the system subsidizes genuine transactions. For more complex transactions, Plasma allows gas fees to be paid directly in whitelisted stablecoins, such as USDT or bridged Bitcoin (pBTC), using trusted oracle price feeds to automate conversion without markups or complexity. Plasma is also developing confidential payments, an opt-in privacy module for payroll and B2B settlements, leveraging technologies like stealth addresses to shield transaction amounts and recipients while maintaining auditability for compliance.

Liquidity is another cornerstone of Plasma’s design. The network launched with over $1 billion in USDT liquidity, addressing the “cold start” problem that often plagues new blockchains. Developers and users have immediate access to usable funds, enabling instant adoption of applications from day one.

Plasma’s Bitcoin-anchored security further differentiates it from other EVM chains. By periodically embedding its state roots into Bitcoin blocks, Plasma inherits Bitcoin’s immutability and security, significantly enhancing censorship resistance and providing a neutral, verifiable security base. This setup also enables the movement of real BTC into Plasma’s EVM environment as pBTC, opening new possibilities at the intersection of Bitcoin and stablecoins.

The design of Plasma addresses the needs of two primary user bases: retail users in high-adoption markets, and institutional participants in payments and finance. Retail users benefit from seamless remittances, micropayments, and daily commerce, enjoying zero-fee transfers and the ability to pay fees in the same asset they already hold. Institutions building payment systems, FX platforms, or settlement layers gain access to predictable transaction finality, low costs, high throughput, Bitcoin-backed security, and integrated compliance tools. Key use cases include global remittances, cross-border B2B payments, on-chain payroll and treasury management, high-frequency DeFi settlement, and micropayments for content or services.

Plasma’s roadmap reflects a focused, phased approach. Consensus will roll out in stages, beginning with a trusted validator set at mainnet launch, then expanding to larger committees, and ultimately opening to permissionless participation. Meanwhile, the Bitcoin bridge and confidential payments module are set for progressive deployment, each addressing real-world adoption barriers.

In a blockchain ecosystem often chasing speculative trends, Plasma stands out for its singular vision: to optimize infrastructure for the industry’s most proven use case—stablecoins. By combining Ethereum’s developer ubiquity with a payment-optimized core and Bitcoin-grade security, Plasma is not merely another blockchain; it is a dedicated global payment rail, engineered for the digital age. Its design, from pipelined consensus to stablecoin-native features, positions it to redefine how money moves, making instant, secure, and frictionless digital payments a reality for both consumers and businesses worldwide.

Plasma's Engine: The Reth Execution Layer Powering a Stablecoin Blockchain

When designing a blockchain optimized for a specific function, such as Plasma's focus on stablecoin settlement, architects face a critical challenge at the execution layer. They must decide whether to build a completely custom virtual machine tailored to their niche or to leverage existing, battle-tested infrastructure. Plasma's team chose a pragmatic path that balances innovation with reliability: they adopted Reth (Rust Ethereum), a high-performance execution client that delivers full Ethereum Virtual Machine (EVM) compatibility while providing the speed and efficiency required for payment-grade transactions. This decision goes beyond technical implementation—it reflects a deep understanding of blockchain ecosystem dynamics. By combining Reth with a specialized consensus framework, PlasmaBFT, Plasma creates a “focused compatibility” model, retaining all the developer tools and smart contract capabilities of Ethereum, while optimizing specifically for efficient stablecoin transfers and financial applications.

Reth, short for Rust Ethereum, has gained attention for its modern architecture and performance characteristics. Developed with a modular, library-first approach, Reth represents a shift from the monolithic design of older Ethereum clients like Geth. Its suitability for Plasma’s mission stems from several key features. First, its parallel execution capability allows multiple transactions to be processed simultaneously when there are no dependencies, dramatically improving throughput for payment-heavy scenarios. Second, being written in Rust—a language known for memory safety, performance, and concurrency—Reth avoids many common bugs while maintaining competitive execution speed, a vital feature for financial settlements where correctness is crucial. Third, its modular architecture allows Plasma engineers to customize components specifically for stablecoin operations without sacrificing full EVM compatibility. Finally, Reth’s optimized state management reduces the I/O overhead of reading and writing blockchain state, directly lowering latency and boosting throughput for frequent balance updates typical in stablecoin transfers.

While Reth provides a robust foundation, Plasma adapts it further to specialize in stablecoin settlement. One major adaptation involves stablecoin-optimized state access patterns. By analyzing typical USDT and USDC transaction flows, Plasma engineers have optimized storage layouts and caching strategies, including balance caching for frequently accessed accounts, batch processing for multi-transfer operations, and specialized precompiled contracts for common stablecoin actions like transfers and approvals. Another innovation is the overhaul of the gas mechanism. Traditional Ethereum transactions require ETH for fees, but Plasma allows fees to be paid directly in stablecoins or even offers gasless transactions for simple transfers. This required a gas abstraction layer, integration with price oracles to calculate fee equivalents, and protocol-level sponsorship mechanisms for qualifying transactions. Plasma also extends the EVM with payment-specific precompiles and opcode optimizations, including batch transfer precompiles for reduced gas costs, privacy-enhancing precompiles for confidential transactions, and compliance precompiles for regulatory needs. Deterministic performance guarantees further ensure that even under high load, simple stablecoin transfers complete within predictable time windows, incorporating execution time bounding, priority scheduling, and resource isolation.

The real innovation lies in the symbiosis between Reth and PlasmaBFT. Plasma implements a pipelined architecture where execution overlaps with consensus operations: transactions are speculatively executed as soon as a block proposal is received, validated in parallel while consensus votes are gathered, and immediately committed to state once finality is achieved. Specialized state synchronization protocols allow validators to verify execution correctness using lightweight proofs without running full EVM computations, while a coordinated fee market integrates computational cost and network priority.

Performance benchmarks demonstrate the effectiveness of this architecture. For simple ERC-20 transfers, Plasma can process over 4,000 transactions per second—roughly ten times Ethereum mainnet’s capacity—thanks to parallel execution, optimized state access, and reduced gas costs. The 95th percentile latency for transfers is under 800 milliseconds, with a median of 400 milliseconds, and 99% of simple transfers execute in under 50 milliseconds of computation time, offering predictable performance for point-of-sale systems.

Developer experience benefits significantly from full EVM compatibility. Plasma supports standard Ethereum tooling such as Hardhat, Foundry, Truffle, Ethers.js, and Web3.js, along with standard JSON-RPC APIs and The Graph for indexing. Ethereum smart contracts, especially those for DeFi and token systems, can be deployed on Plasma with minimal modifications. Using the battle-tested EVM also allows Plasma to inherit years of security research while adding financial workload-specific optimizations, including atomic settlement for multi-asset transactions, optional regulatory-compliant execution paths, and MEV protection through fair ordering, private pools, and batch auction mechanisms.

Comparatively, Plasma’s approach—Reth plus PlasmaBFT—strikes a strategic middle ground. While custom VMs can offer maximum performance at the cost of ecosystem isolation, and L2 rollups or zkEVMs provide security with varying speed trade-offs, Plasma achieves both high performance and developer ecosystem benefits tailored to stablecoin payments.

Looking ahead, Plasma’s roadmap includes parallel EVM implementation for even higher throughput, just-in-time compilation of EVM bytecode for faster execution, hardware acceleration for enterprise validators, and cross-chain execution verification for Bitcoin-anchored security.

In conclusion, Plasma’s adoption of Reth represents a carefully balanced architecture, combining the performance characteristics needed for payment-grade settlement—sub-second finality, high throughput, predictable latency—with the developer familiarity and ecosystem advantages of Ethereum. Specialized optimizations for stablecoin operations, from gasless transfers to payment-specific precompiles, transform a general-purpose execution engine into a dedicated financial settlement processor. Plasma offers a compelling model for specialized blockchains: start with proven mainstream technology, then layer targeted optimizations for specific use cases. For stablecoin settlement, where both performance and ecosystem support are essential, Plasma’s Reth-based execution layer provides a solid foundation for real-world adoption, enabling seamless point-of-sale payments, near-instant cross-border settlements, and next-generation financial infrastructure.