2025 quietly confirmed something most traders underestimated for far too long.

Bitcoin ETFs didn’t just survive volatility — they redefined demand.

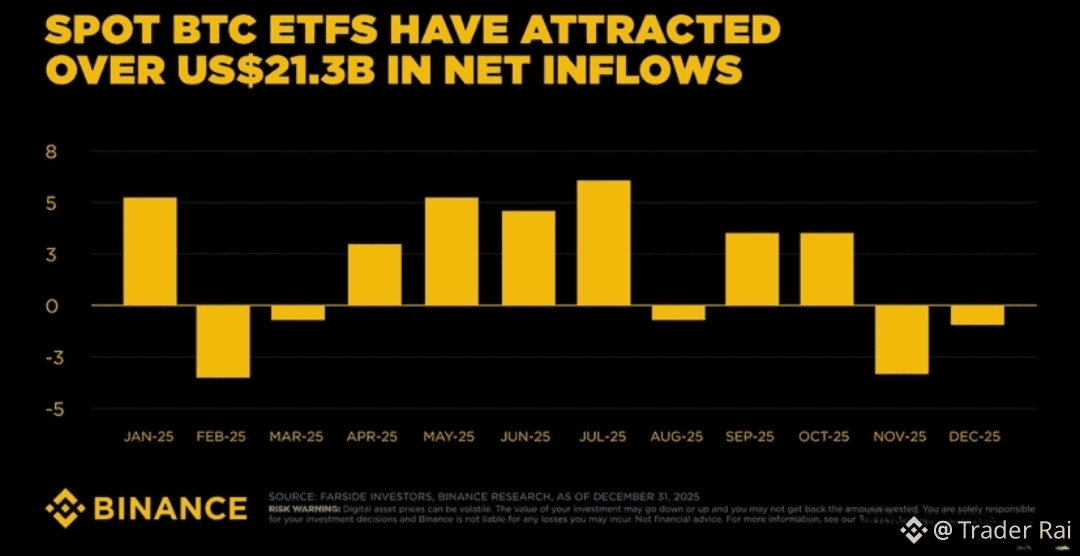

More than $21.3 BILLION in net inflows moved into spot Bitcoin ETFs over the year, and this wasn’t momentum chasing or retail euphoria. This was patient, regulated capital stepping into Bitcoin as a long-term allocation, not a short-term trade.

What matters most is how this money arrived.

These inflows stayed resilient through drawdowns, macro uncertainty, rate debates, and risk-off headlines. No panic exits. No emotional rotations. Pension funds, asset managers, and long-only allocators treated Bitcoin the same way they treat commodities or macro hedges — slow, deliberate, and disciplined.

That’s the structural shift most people still don’t fully grasp.

When capital flows through ETFs, it doesn’t behave like leverage. It doesn’t disappear overnight. It doesn’t chase candles. It accumulates quietly and absorbs supply during weakness.

This is why sell-offs feel different now.

Pullbacks get bought faster. Volatility compresses sooner. Liquidity improves. Price discovery becomes less about liquidations and more about allocation decisions made in boardrooms, not trading groups.

According to Binance Research, Bitcoin ETFs are no longer just a headline metric — they are becoming part of the market’s plumbing.

And plumbing matters more than narratives.

It determines how capital enters.

How stress is absorbed.

And how long-term trends are sustained.

This is also why hype is becoming less relevant.

Bitcoin doesn’t need viral moments when ETFs are consistently bid. It doesn’t need retail FOMO when institutions are building exposure quarter by quarter. Time, not excitement, becomes the main catalyst.

Most traders still watch price.

Professionals watch flows.

Price reacts to what already happened.

Flows tell you what’s still happening — quietly, persistently, and with conviction.

So the real question isn’t whether Bitcoin will move.

It’s who is controlling the pace of that move now.

And in 2025, the answer is clear.

Wall Street isn’t knocking anymore.

It’s already inside.

#Bitcoin #BTC #ETFs #InstitutionalDemand