Allert Allert for crypto world

Recent macro signals from the Federal Reserve point to a level of stress that markets are largely brushing aside. What looks like routine liquidity support is something very different under the surface. This is not stimulus. This is damage control.

Recent macro signals from the Federal Reserve point to a level of stress that markets are largely brushing aside. What looks like routine liquidity support is something very different under the surface. This is not stimulus. This is damage control.

The Fed’s balance sheet has expanded sharply in a short time. Emergency facilities are absorbing large amounts of mortgage backed securities while Treasury intake lags behind. That mix matters. When lower quality collateral moves faster than Treasuries, it usually signals funding pressure inside the banking system 🏦. Institutions are not chasing risk. They are scrambling for cash.

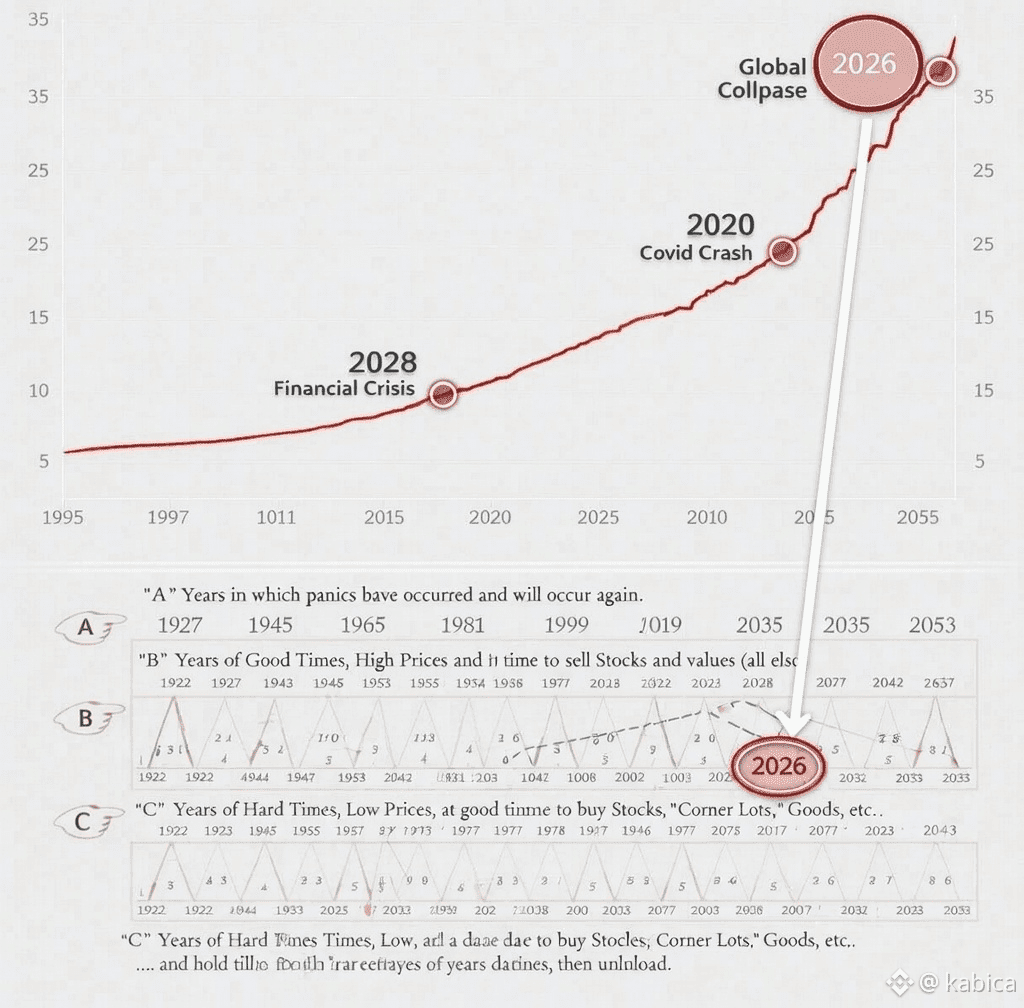

Zooming out makes the picture more concerning. US national debt has crossed historic levels and continues to rise faster than economic growth. Interest costs alone are becoming a dominant budget item. New debt is increasingly issued to service old debt. That is not a growth model. It is a confidence trade, and confidence is starting to thin 📉.

Foreign demand for Treasuries is softening. Domestic buyers are cautious and highly price sensitive. In this environment, the Fed quietly becomes the buyer of last resort. That role works only as long as funding markets stay calm. Once they tighten, the entire structure becomes fragile.

This pressure is not isolated to the US. China is injecting massive liquidity through its own channels at the same time. Different systems, same issue. Too much leverage and too little trust 🌍.

Markets often misread this phase. Liquidity injections look bullish at first glance, but they usually appear when stress is already present. Historically, bonds move first, funding shows cracks next, and risk assets react last. Crypto tends to feel it the hardest.

One signal is already clear. Gold and silver at record highs 🥇. This is not optimism. It is capital seeking safety outside sovereign promises.

This setup has appeared before. Each time, a downturn followed. This is not noise. It is the system quietly warning those willing to listen.