Ever tried paying someone with USDT in the real world? You’ve got the balance, they’re ready to receive it, but then reality kicks in: the gas fees, the right network check, making sure you have enough of the chain’s native token to cover costs, worrying about sudden fee spikes. For crypto traders, that’s just Tuesday. But for everyday folks paying a freelancer, sending cash to family overseas, or settling a quick invoice it’s enough to make you give up and go back to bank transfers or cash apps.

That exact frustration is what Plasma is laser-focused on fixing. Their whole pitch boils down to this: turn USDT payments into something as effortless as firing off a WhatsApp message. No more mental gymnastics around fees or tokens you don’t even care about.

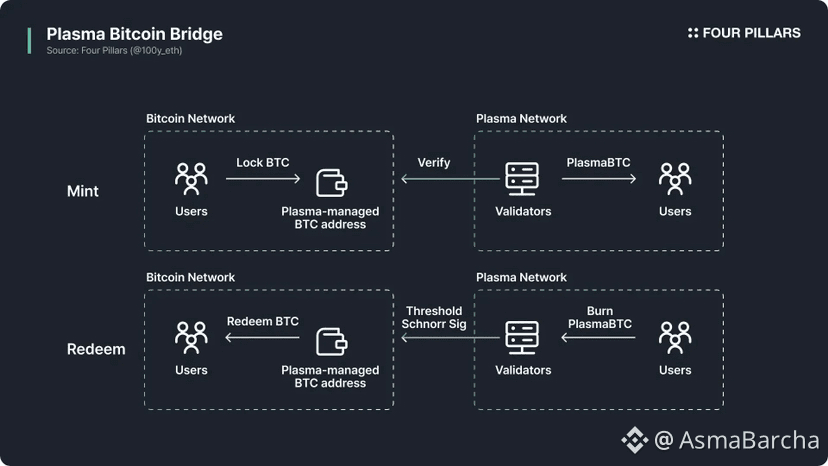

Plasma isn’t trying to be yet another general-purpose blockchain. It’s a high-performance Layer 1 built specifically for stablecoin payments especially USDT at massive global scale. Think near-instant transfers, super-low (or zero) fees for basic sends, and full EVM compatibility so developers can bring over Ethereum-style tools without starting from zero.

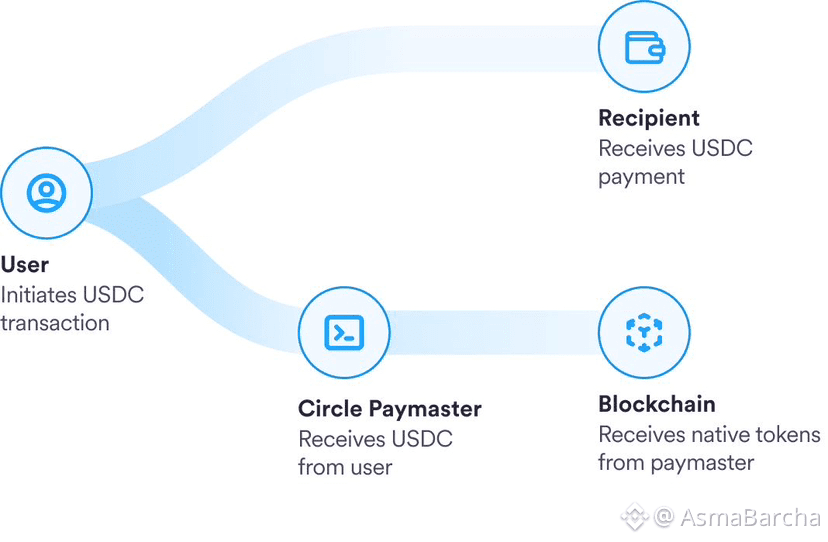

The magic sauce? A built-in system (like a protocol-level paymaster or relayer) that covers the gas costs for straight USDT transfers. The network sponsors those fees under clear rules, so regular users don’t need to hold XPL (Plasma’s native token) or deal with gas at all for simple payments. It’s not unlimited “free forever” magic—there are controls to stop abuse—but for the most common use cases, it removes the biggest roadblock to mainstream adoption: nobody wants to learn about gas to send dollars.

Picture the difference like this:

• Old-school crypto world:

USDT is cash locked in a safe. Every time you want to use it, you need a separate key (the native gas token), and opening the safe costs money that might change any second.

• Plasma world:

USDT acts more like your Venmo or PayPal balance. The chain quietly handles all the backend plumbing, so you just see the money move instantly from point A to point B.

For anyone who’s ever tried onboarding non-crypto friends or family, you know how huge that shift is from “yeah, it technically works but it’s a pain” to “it just works.”

Why go all-in on a whole new chain for this? Because stablecoins are already crypto’s killer app. USDT moves insane daily volume for trading, remittances, merchant payouts, payroll in tough economies you name it. But they’re still stuck on networks built for smart contracts in general, where every move costs gas and forces users to juggle extra tokens.

Plasma flips the script:

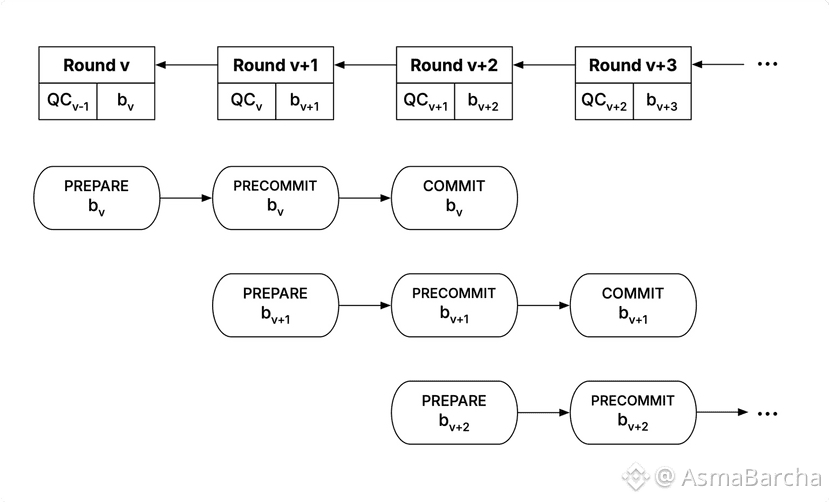

optimize everything around stablecoin flows. Fast throughput sub-second-ish finality in many cases, and features like custom gas tokens or even confidential transactions for privacy.

It’s competing with what already dominates cheap USDT transfers like Tron, which blew up mostly because it was fast and inexpensive. Plasma says: let’s design the perfect USDT highway from the ground up, with deep liquidity baked in from launch (they talk about billions in ready USDT movement) and strong ties to the Tether/Bitfinex world for credibility.

And it’s not just user-friendly it’s builder-friendly too. EVM compatibility means devs can port apps, build payroll tools, merchant checkouts, streaming payments, or even credit layers without massive rewrites.

Even traders win here. Lower friction and near-instant, cheap stablecoin moves mean capital flows faster between exchanges, strategies, or wallets. Better arbitrage, tighter markets, smoother collateral shifts small changes that add up in trading efficiency.

Of course, nothing’s truly free. The sponsored fees come from somewhere—likely protocol treasury, partnerships, or other revenue streams. But the docs suggest it’s carefully scoped to direct USDT transfers with anti-abuse measures, which keeps it realistic and sustainable.

Bottom line:

Plasma is betting big that crypto’s next chapter isn’t flashy new tokens it’s stablecoins becoming boring, reliable money infrastructure that people use without thinking about the blockchain underneath.

If they pull it off, the real win won’t be the fancy tech. It’ll be that nobody notices the tech at all. Just money moving like it should.

Introducing circle paymaster:The official way to pay gas fees in USDC

How plasma works: Technical Deep Dive/DAIC Capital

As of now, XPL trades around that $0.13 mark with solid volume, but the price isn’t the headline. The thesis is: stablecoins are turning into everyday financial plumbing, and Plasma wants to be the invisible rail that powers it.