For years, blockchain scaling has been framed as a race. Faster confirmations, higher throughput, cheaper transactions. Each new solution promises to push performance further, often by moving execution away from the base layer. While this approach has unlocked real efficiency gains, it has also introduced a quieter question that is now becoming impossible to ignore. When transactions move offchain, what exactly happens to user control?

This question sits at the heart of Plasma.

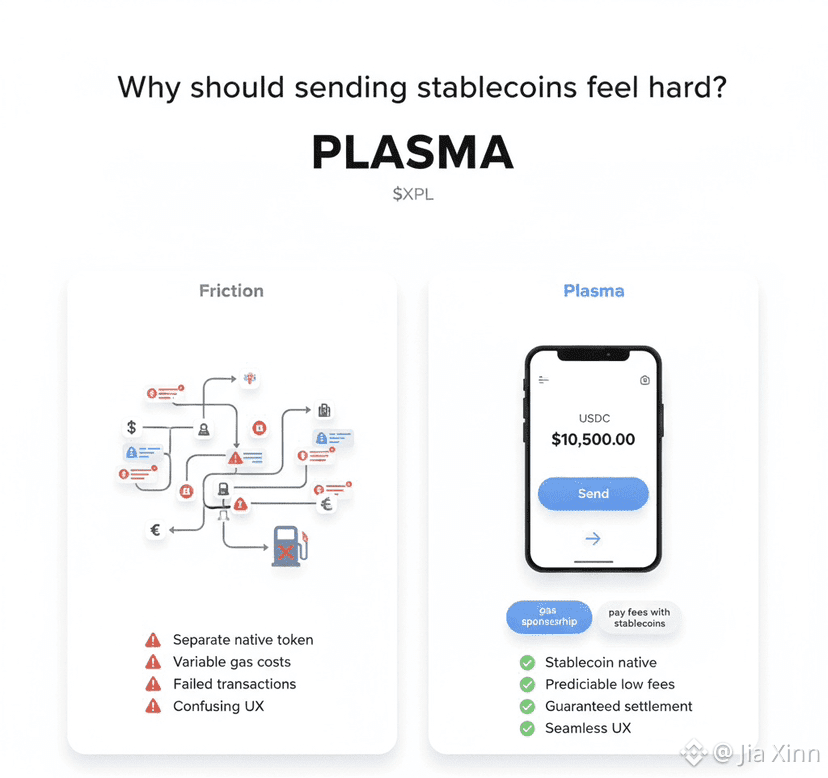

Plasma was never designed to be the fastest or the most convenient solution on the surface. It was designed to solve a deeper trust problem that emerges the moment users are asked to rely on operators outside the base chain. Instead of assuming that offchain systems will always behave correctly, Plasma treats failure as a realistic outcome and builds around it.

The core idea behind Plasma is simple but powerful. Users should always have a way out. Even when transactions are processed elsewhere for efficiency, users retain the ability to exit back to the base layer using cryptographic proofs. This exit mechanism is not an emergency add-on or a marketing feature. It is the foundation of the system.

What makes this approach important is that it shifts how risk is handled. Many scaling solutions implicitly ask users to trust that operators will remain honest, available, and aligned with incentives. Plasma does not rely on that assumption. It enforces accountability by design. Operators know that incorrect behavior can be challenged. Users know they are not locked into systems they cannot escape.

This design choice has trade-offs. Exits take time. There are challenge periods. Disputes must be resolved. Plasma accepts these frictions because they serve a purpose. They allow the system to verify correctness before final settlement. In doing so, Plasma prioritizes safety over instant gratification.

I’m seeing this philosophy become increasingly relevant as more value flows through scaling systems. Early users were often willing to accept hidden risks for the sake of speed and low fees. As adoption grows, expectations change. Users want clarity. They want to know what happens if something goes wrong. They want guarantees, not assumptions.

Plasma offers that clarity.

Another important aspect of Plasma is how it reframes trust. Trust is not placed in operators. It is placed in math and enforceable rules. Operators are incentivized to behave correctly, but the system does not depend on their goodwill. This creates a healthier dynamic where power is balanced rather than concentrated.

Over time, Plasma has also influenced how the broader ecosystem thinks about scaling. Even solutions that do not implement Plasma directly have adopted similar concepts, such as fraud proofs and user exit rights. In that sense, Plasma’s impact goes beyond its own implementations. It helped shape the conversation around what responsible scaling should look like.

What stands out to me is how Plasma treats the base layer. Instead of seeing it as a bottleneck to escape, Plasma treats it as a final court of appeal. When disputes arise, the base layer is where truth is enforced. This reinforces the role of the base chain as a security anchor rather than something to be bypassed entirely.

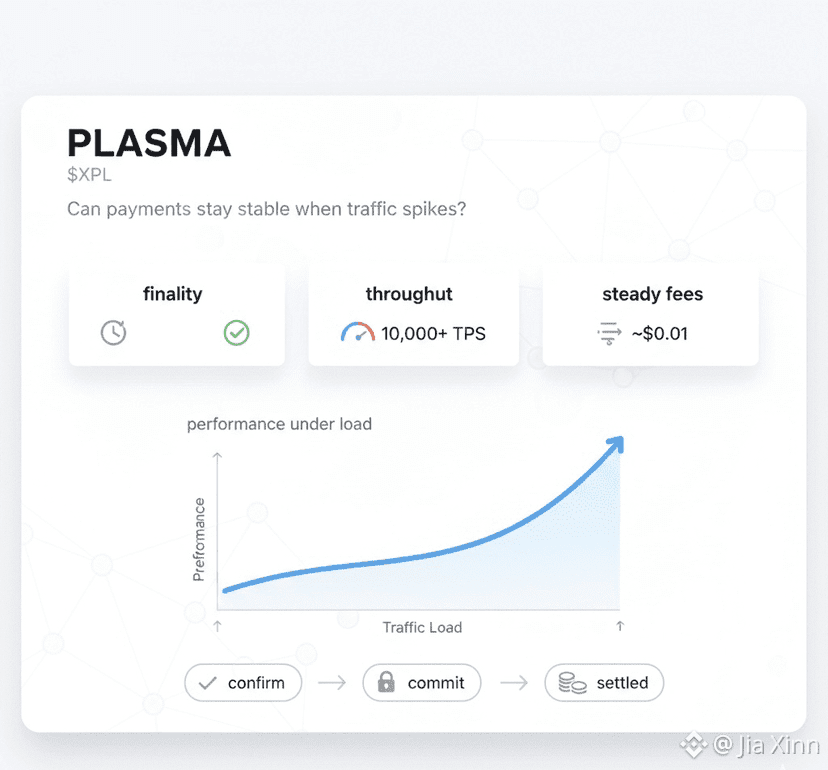

As blockchain moves closer to mainstream use, these design choices matter more. Financial systems are judged not by how they behave in perfect conditions, but by how they behave under stress. Scaling solutions that cannot provide clear recovery paths introduce systemic risk, even if they perform well most of the time.

Plasma was built with this reality in mind.

It does not promise frictionless experiences in every scenario. It promises that users are never powerless. That promise becomes more valuable as stakes increase and as blockchain infrastructure is relied on for more than experimentation.

Looking ahead, Plasma represents a philosophy that scaling should expand access without reducing sovereignty. Efficiency should not come at the cost of control. Convenience should not silently remove protections. These principles may not always produce the most excitement, but they produce systems people can trust when it matters.

In a space that often prioritizes speed, Plasma reminds us that responsibility scales too. As systems grow larger and more valuable, the cost of failure increases. Designs that anticipate failure rather than deny it are the ones that endure.

Plasma is not just about scaling blockchains. It is about scaling them without forgetting who they are supposed to serve.

Sometimes the most important innovation is not making things faster, but making sure people can always step back safely.

That is the role Plasma continues to play.