@Plasma is emerging as one of the most talked-about Layer-1 blockchains in 2025, built specifically for zero-fee stablecoin payments and high-throughput DeFi activity. Unlike many chains, @Plasma combines EVM compatibility with Bitcoin-anchored security and is optimized for USDT transfers, making it ideal for everyday cross-border payments and DeFi liquidity.

The native token $XPL L plays a central role: it secures the network through staking, pays for gas, and enables governance participation. Early adoption has been strong — Plasma launched with multibillion-dollar stablecoin liquidity and integrations across major protocols like Aave and Curve.

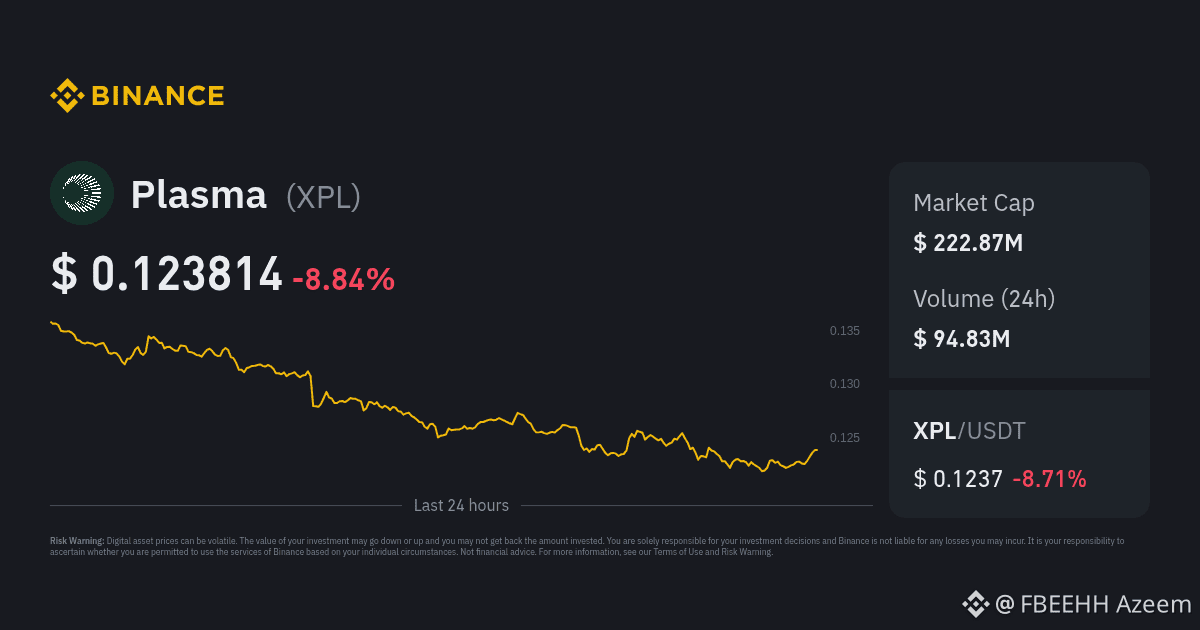

From a market perspective, XPL carries both bullish potential — driven by exchange integrations, airdrops, and innovative use cases — and risk from supply unlocks and broader crypto volatility.

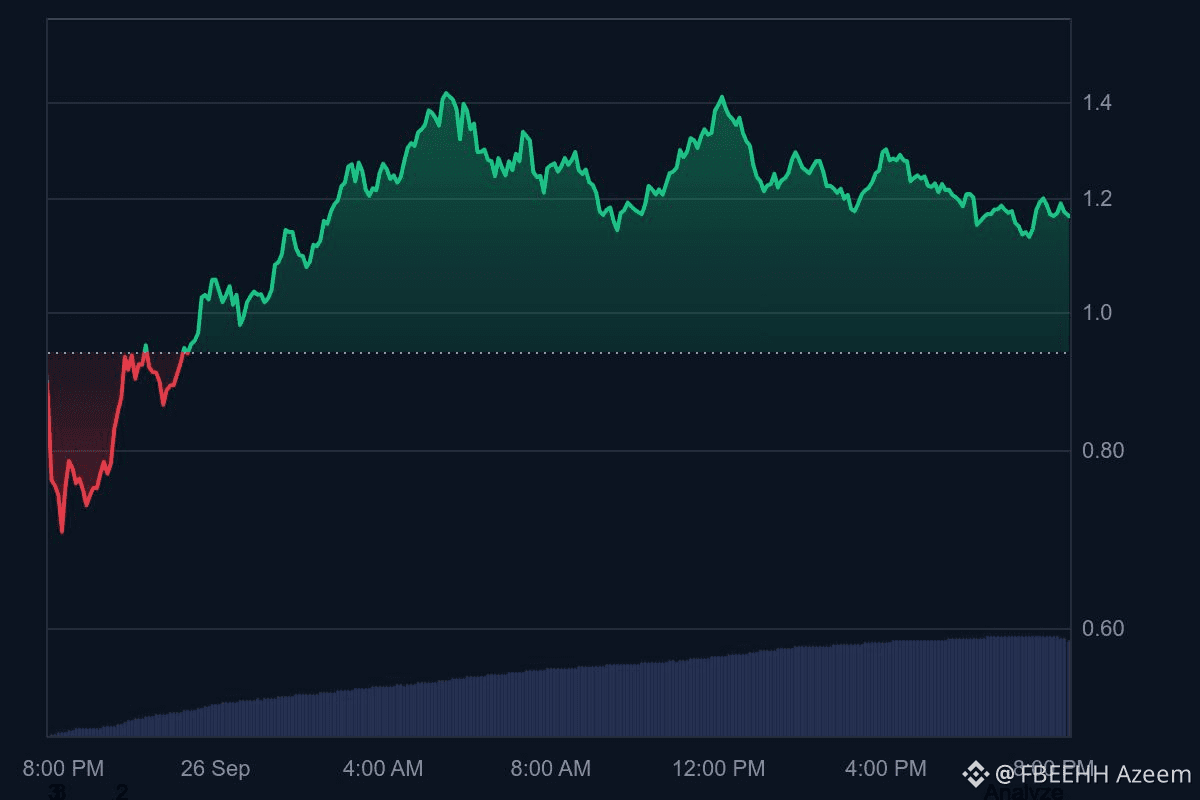

This graph reflects real-time pricing trends and historical movements for XPL. According to live sources, XPL is trading around $0.14-$0.15, down from highs and showing recent volatility. It’s trading significantly below its all-time high (~$1.68), indicating current bearish sentiment with possible support zones forming

In the long term, Plasma’s focus on frictionless stablecoin rails, expanding ecosystem, and neobank plans positions it as a core infrastructure for digital dollar adoption, with $XPL benefiting from network growth and real-world usage

Overall, Plasma targets a clear niche—stablecoin infrastructure at scale. If execution stays strong, XPL could evolve into a valuable utility token backed by genuine network usage, not just speculation.

Trade here $XPL

Plase support I'll help you with my most recent analysis in future too