Dusk Network isn’t just another Layer-1 blockchain—it's quietly building the privacy backbone for the next wave of tokenized finance. Right now, trillions of dollars in assets are getting tokenized. Major players like the NYSE are rolling out platforms for nonstop trading and instant settlement. But honestly, without real privacy baked in, all those assets and the strategies behind them are just sitting out in the open, waiting for trouble from regulators or bad actors.

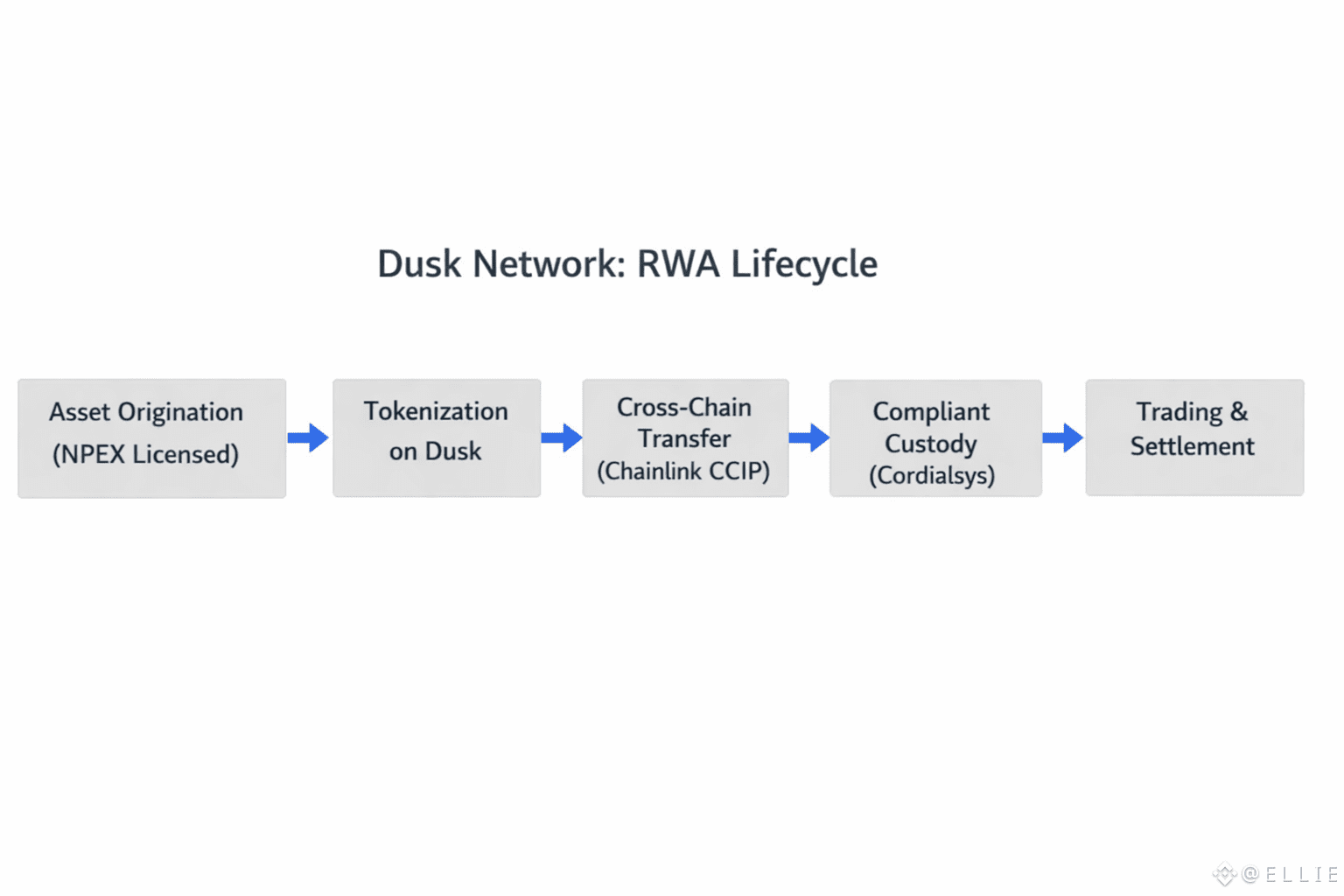

That’s where Dusk comes in. This team’s been at it for over seven years, pushing to make on-chain finance not just secure and private, but actually usable for institutions. They’re not just promising, either—they’re already working with big names. Look at NPEX, an established Dutch exchange managing €300 million. They aren’t some newcomer; their licenses cover everything from trading facilities to crowdfunding. With Dusk, NPEX is moving regulated securities—bonds, equities, private placements—fully on-chain. These assets come with full EU financial licensing, so you don’t get clunky workarounds or legal grey areas. It’s all natively on-chain and fully legit.

But Dusk isn’t stopping there. They’ve teamed up with Chainlink to make sure these real-world assets can move smoothly across other chains like Ethereum and Solana. It’s not just buzzwords—Chainlink’s tech brings fast, reliable data and verified market feeds. Dusk and NPEX act as official sources for this regulated info, pushing out trustworthy data to institutional DeFi apps. Quantoz joins the crew with EURQ, a digital euro stablecoin that’s already MiCA-approved, lining up compliant payments for euro-denominated assets. The result? You get stability, privacy, and compliance in one shot.

Custody is covered too. Cordialsys handles secure, compliant storage without giving up on auditability. And 21X, an early leader in DLT trading venues, builds out advanced trading options. These aren’t just one-off partnerships—they’re pieces of a complete system for real-world assets: from creation to custody to cross-border transfers. Privacy is built-in. Institutions can hide sensitive stuff like order books or trading volumes, but still meet compliance rules when needed, thanks to frameworks like MiCA and GDPR.

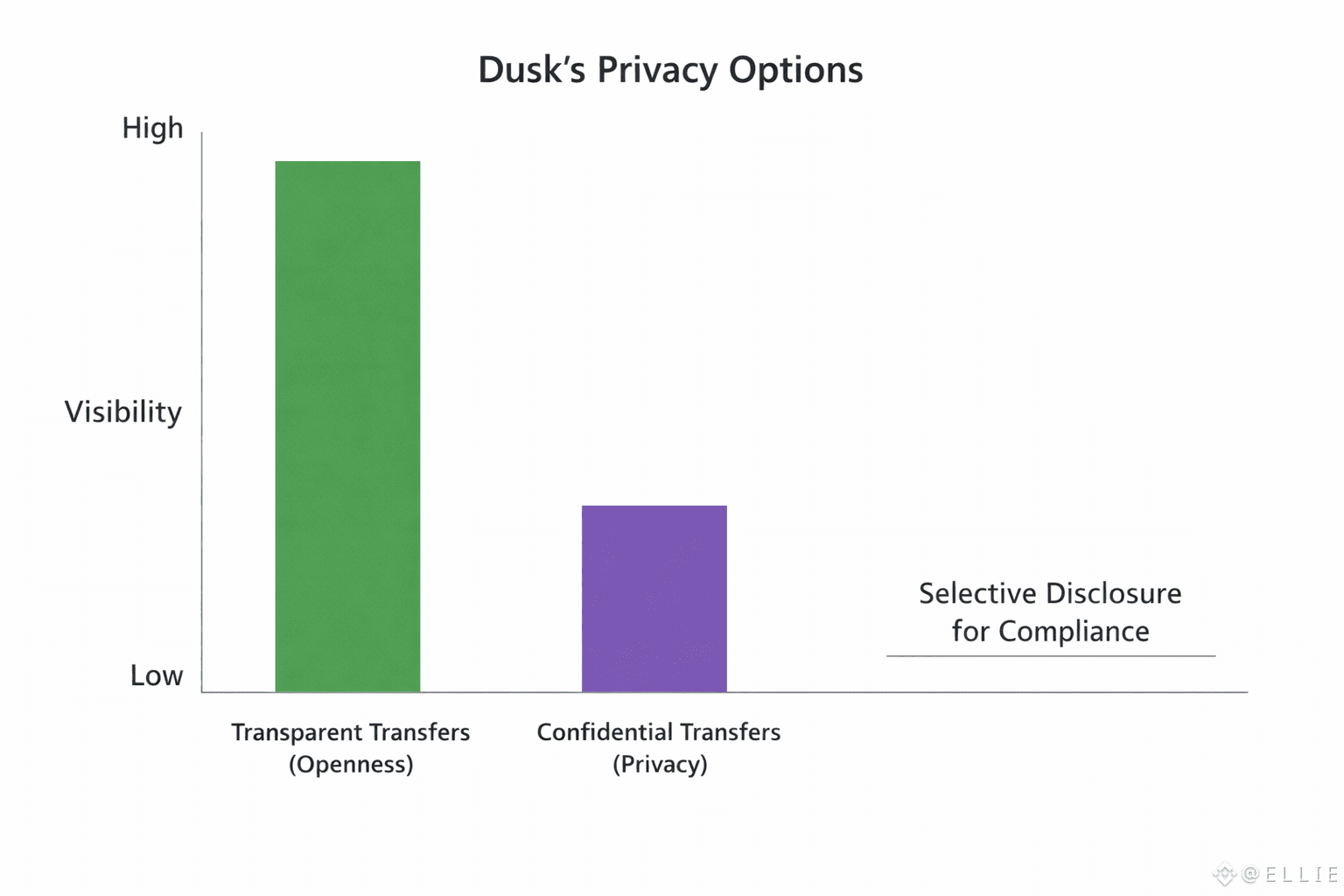

Dusk’s privacy tech isn’t just a buzzword. For over seven years, they’ve been perfecting ways for users to pick between transparent and private transfers. Zero-knowledge proofs, selective disclosure, homomorphic encryption—techy, sure, but the point is, you get auditability without putting everything on display. No more front-running or data leaks that could wreck a deal. You can see this in action with tools like the Dusk Explorer, which sorts private transfers by block height and shows the network running strong since mainnet launch.

On the community side, Dusk stays active. They’re hosting an X Space with HTX on January 21, where leaders like Autholykos and Hein Dauven are set to break down the future of compliant, on-chain markets—pretty timely, with tokenization gaining serious steam. Earlier, CTO Hein Dauven spoke at TechTalk2030, talking shop with FinTech heavyweights. These aren’t just marketing stunts—they’re real conversations about why Dusk’s approach to licensed integrations sets it apart from other layer-1s.

The team doesn’t just hide behind announcements either. CEO Emanuele Francioni and the rest are on Discord and YouTube every week, answering questions, talking about audits, grants, hackathons, and more. They’re building trust the old-fashioned way—by showing up. They’re also clearing up the usual myths: on-chain finance isn’t just “regular finance but worse.” It’s actually better, with instant settlements cutting out T+2 delays and shrinking risk.

As tokenized markets take off—whether it’s green bonds for climate projects or luxury assets wrapped into SPVs—Dusk’s focus on real ownership stands out. You’re not just getting synthetic price exposure; you actually own the asset. With all these partners, Dusk is piecing together the infrastructure that makes tokenized finance real: compliant, cross-chain, private, and scalable. If this is the future of finance, Dusk is the quietly powerful force making it happen.