Right now, institutions can’t get enough of blockchain and tokenization. But here’s what no one likes to admit: traditional KYC locks you into centralized systems, puts your data at risk, and strips away real ownership. Dusk Network’s Citadel protocol turns that on its head. It gives you the power to manage your own compliance credentials and prove you’re eligible—right on-chain—without oversharing your info. After seven years of R&D in Amsterdam, Dusk isn’t selling buzzwords. They’re actually delivering infrastructure where privacy and regulation can work together, letting people access tokenized assets without losing control.

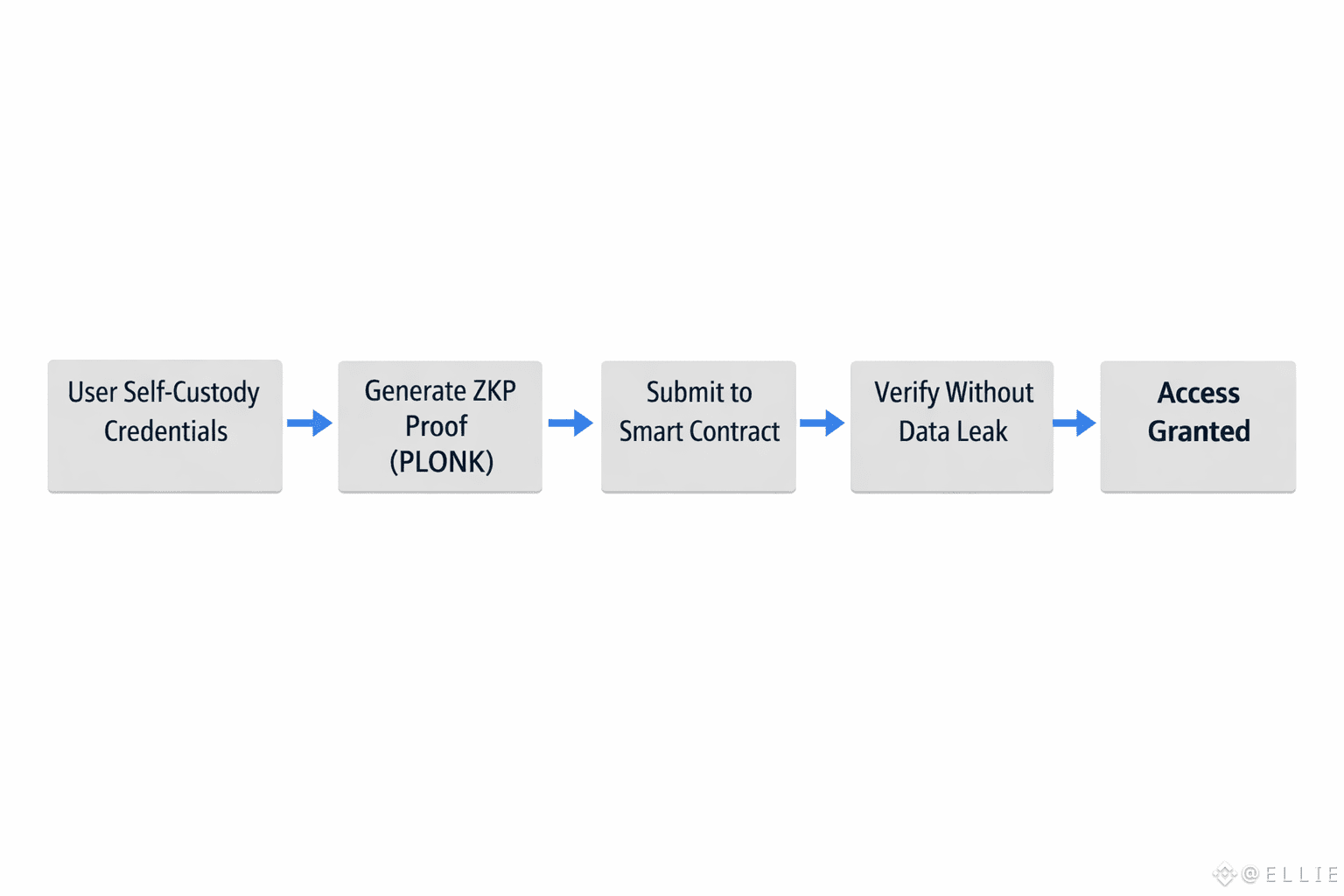

Citadel works like a one-way mirror. You keep your identity proofs in your own wallet and show only what’s needed for audits or access. It uses zero-knowledge proofs—PLONK, to be exact—so you can prove things like KYC status or investor accreditation without giving up your name or address. Picture this: you want to use a regulated DeFi app. You prove you’re an eligible investor, but the smart contract never sees your personal details. This isn’t some wishful idea—it’s already live on Dusk’s mainnet, since January 7, 2026, and ready for apps dealing with securities under EU rules like MiCA.

What really sets Citadel apart is how well it fits real-world finance. Traditional systems force you to verify again and again, wasting time and money, raising risks—data breaches, intermediaries failing, all that. Dusk flips the script. You hold your credentials off-chain, but the chain can still verify them through cryptography. Pair it with Dusk’s Phoenix protocol (for confidential transfers), and you get a setup where high-value assets—fine art, vintage cars, you name it—can be tokenized through SPVs. Only compliant users get access, and you never have to trust a middleman. You own the proof, so all those old inefficiencies disappear.

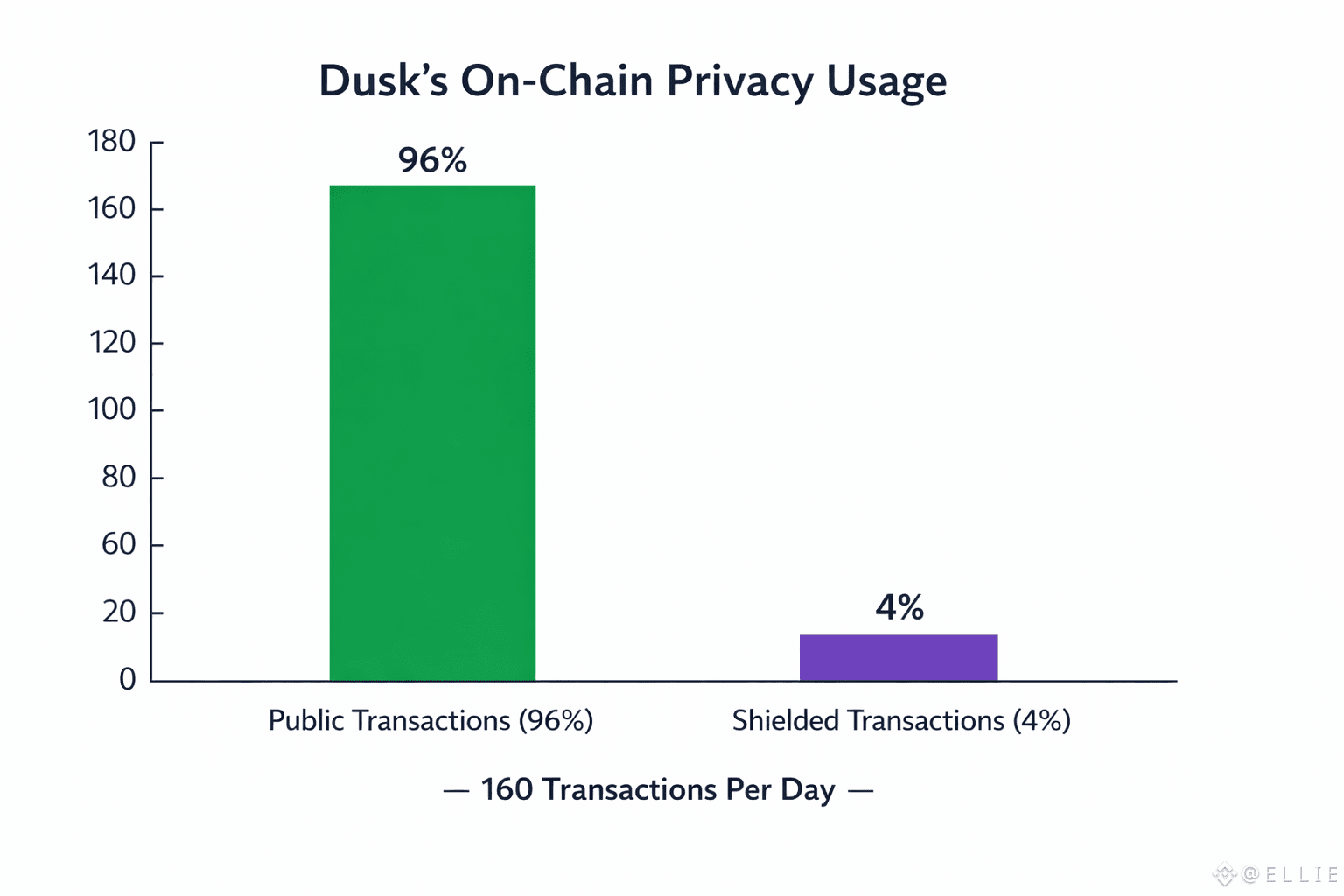

How does it actually work? Citadel uses Poseidon hashes in a Merkle Tree (called whitelistTree) to keep identities private. When you need to interact—say, trade a tokenized green bond—you send a zero-knowledge proof that your identity is valid, but never reveal which one is yours. Regulators get what they need: audits via special viewing keys, all in line with GDPR and AML. And there’s proof it works—since mainnet launch, shielded transactions (about 4% of 160 daily) are often tied to compliance-heavy flows. So Citadel’s not just theory; it’s running in the wild.

For sustainable finance, Citadel is a game-changer. Issuers can tokenize green bonds and use ZKPs to prove they meet environmental standards—like carbon offsets—without making sensitive details public. That’s huge for big institutions that handle massive amounts of sensitive data. Dusk’s stack is built for this: DuskDS handles settlement, Citadel plugs into DuskEVM for Solidity contracts, and DUSK tokens (measured in LUX units) power it all. With 37% of the 490 million DUSK supply staked by hundreds of provisioners, the network’s security is rock-solid.

Citadel fits right into Dusk’s bigger vision: privacy by default, with selective disclosure. Other blockchains tack on privacy as an afterthought. Dusk makes it core. And while others chase hype, Dusk just keeps building. Partners like Quantoz use Citadel for MiCA-compliant EURQ stablecoins, and Cordialsys for compliant custody. One Citadel KYC unlocks a whole ecosystem—bond settlements, private equity trades, instant finality through Succinct Attestation consensus.

As tokenization takes off—think €300 million in NPEX assets moving on-chain—Citadel puts Dusk right at the center of the self-custody movement institutions are demanding. It’s not about hiding. It’s about deciding what to share, when, and with whom. In a world full of centralized gatekeepers, Dusk’s Citadel hands control back to users. It’s not some distant promise. It’s already here, quietly building the trust layer for the next wave of on-chain finance.