Tokenization is taking off. The NYSE is rolling out 24/7 platforms, and everyone’s talking about it. But here’s the real debate: How do you keep financial privacy compliant without smothering innovation? Dusk Network isn’t just part of that conversation—they’re steering it. Since starting up in Amsterdam in 2018, Dusk hasn’t just built clever tech. They’ve become the people institutions actually listen to when it comes to bringing real-world assets on-chain, securely and at scale. Seven years of navigating market storms pays off. Their insights aren’t just theory—they’re battle-tested.

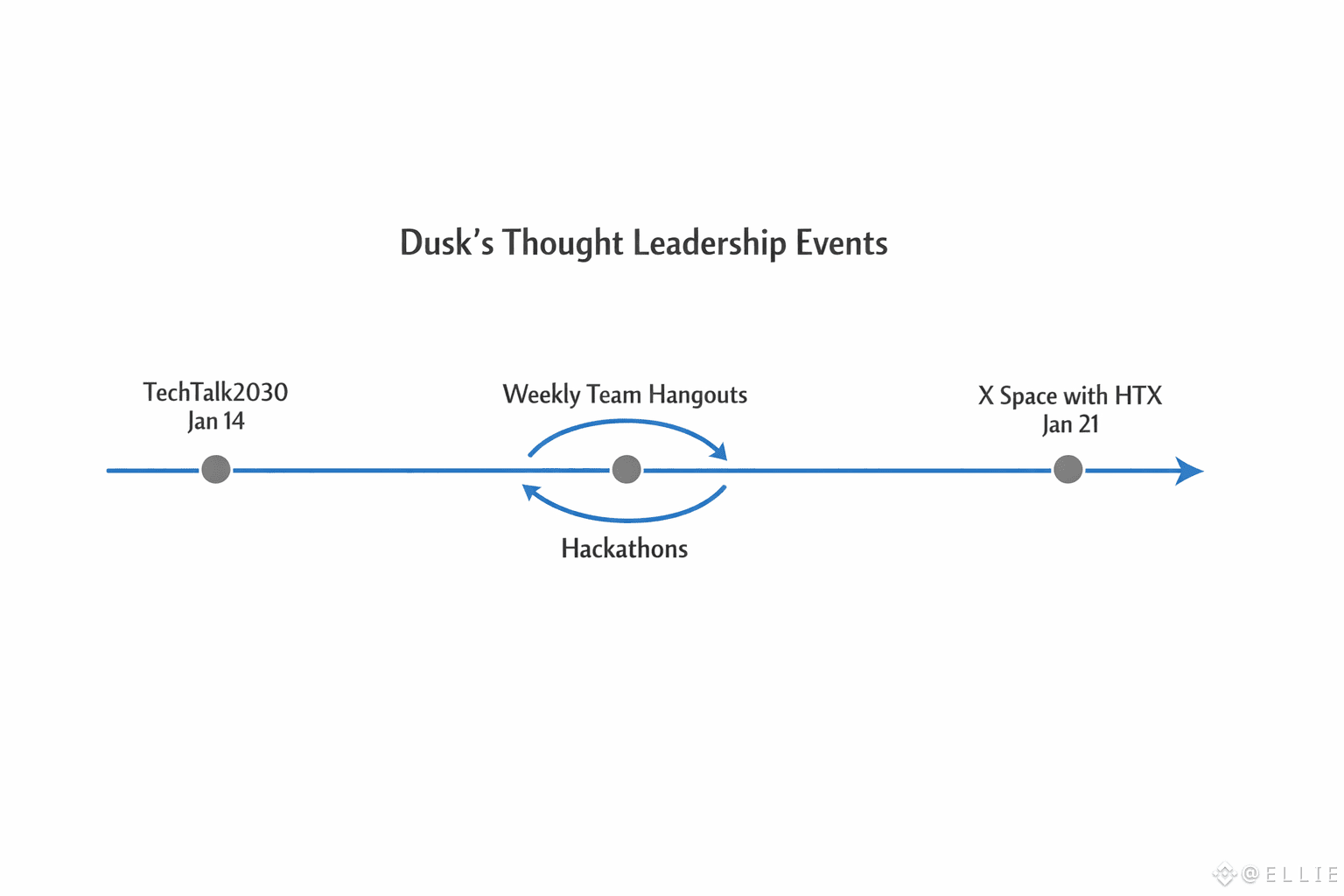

Look at their recent appearance at TechTalk2030 on January 14. CTO Hein Dauven didn’t just show up to sit on a panel. He got into the real details of FinTech infrastructure with the likes of Andreas Schweizer. This was no puff piece. They dug into how Dusk’s modular blockchain actually handles regulated flows, and how quantum-resistant designs can keep things secure for years to come without jacking up costs. Dusk’s approach keeps things modular: DuskDS handles the core settlement and consensus, guaranteeing finality, while upper layers take care of execution—privacy included. Developers get to upgrade and iterate without forking the chain, dodging the headaches that have tripped up other L1s.

Dusk’s leadership isn’t just top-down panels and PR. They’re hands-on, right in the thick of their community. Every week, CEO Emanuele Francioni and the team jump onto Discord and YouTube, breaking down everything from security audits to grant programs. No scripts, no fluff—just real talk and AMAs where builders can ask tough questions and get straight answers. They’re constantly busting myths—like the idea that on-chain finance is just “finance, but worse.” Instead, they show how it can mean instant settlements and less risk. With hackathons funding new RWA prototypes, Dusk is nurturing real innovation, from eco-bonds that verify impact privately to SPVs for luxury assets, all staying compliant.

And they’re not slowing down. On January 21 at 11:00 UTC, they’re teaming up with HTX for an X Space, bringing in folks like Autholykos and Hein Dauven to talk about the future of on-chain markets and compliant privacy. Dusk keeps building alliances with exchanges—Bitfinex, one of their key investors, says a lot about the confidence big players have in them. Backers like Cosimo X, RR2 Capital, and Blockwall Management are here for the mission, not the hype. They want to unlock economic inclusion and move away from institution-only assets toward user-first models, where anyone can access tokenized markets without handing over custody.

The heart of Dusk’s thought leadership? Redefining privacy. It’s not about hiding; it’s about giving people selective, practical tools for finance. Their Hedger engine, now in Alpha, blends homomorphic encryption with ZKPs, so balances stay encrypted but auditable—proofs run in under two seconds, making it workable for everyday apps. This fits into their bigger vision: a single source of truth using global bulletin boards to pull liquidity together. And it’s not just talk. Dusk is seeing steady on-chain growth—about 160 daily transactions, with a mix of public and shielded operations—showing they can actually deliver.

What sets Dusk apart is how they mix deep expertise with real-world accessibility. They survived bear markets by focusing on what matters, and now they’re leading the charge—hosting panels, backing developers, and partnering with licensed entities to tokenize trillions, all by the book. If you’re following where finance is headed, pay attention to Dusk. They’re not just in the game—they’re rewriting the rules, building a privacy-first ecosystem that’s open, tough, and ready to scale.