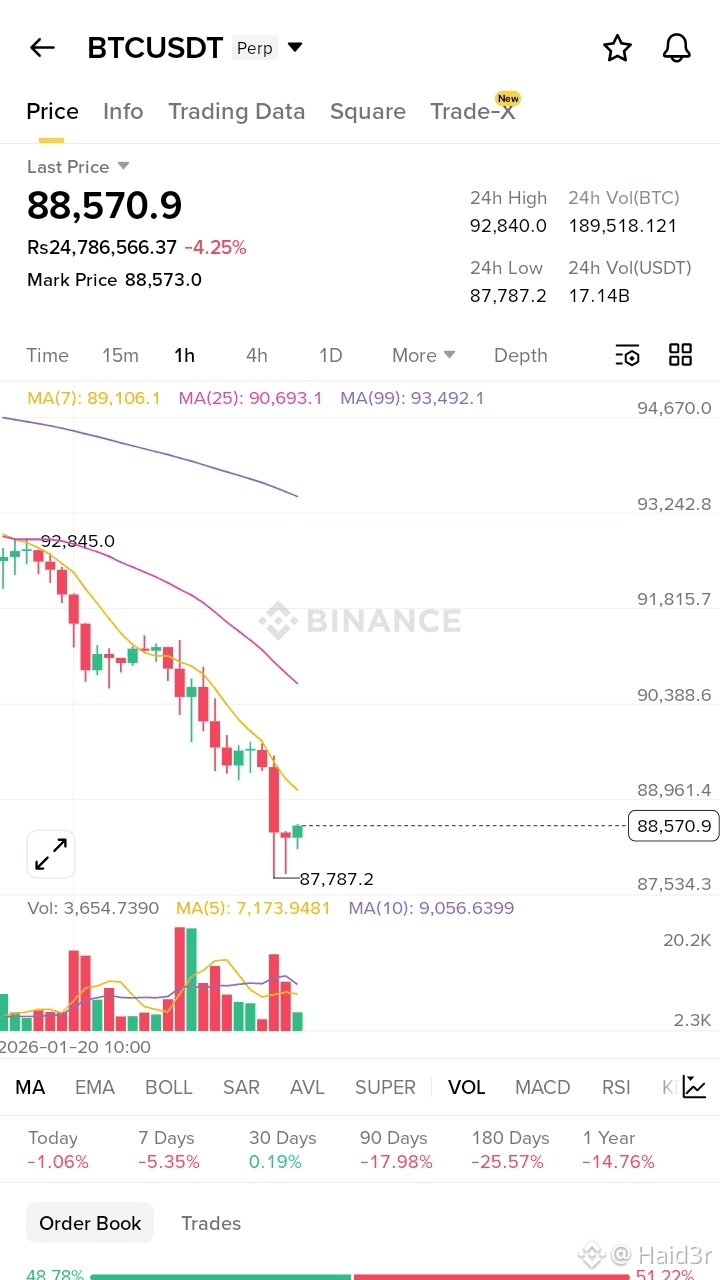

Why Did BTC Drop?

1.Tariff Risk (Main Factor)

Trump’s tariff actions involving Greenland-related countries triggered European retaliation. If this escalates further, it’s more serious than the U.S.–China trade war.

Why?

U.S. imports from the EU (~$538B) are more than double those from China

EU exports hit consumer-facing sectors (autos, luxury goods, pharma, manufacturing)

This directly raises U.S. inflation expectations, hurting risk assets

Europe is also discussing stronger counter-coercion tools, which could shift this from trade friction into geopolitical risk, sharply reducing market risk appetite.

2.CLARITY Act Delay (Secondary Factor)

The CLARITY Act has been suspended due to internal industry disagreement.

The draft limits stablecoin yield models, hurting growth expectations for USDC and similar assets.

The market priced in fast regulatory clarity — instead it got delay + uncertainty, leading to valuation compression.#USJobsData #CPIWatch

What Determines Tomorrow’s Direction?

Tariff Escalation

Expanded targets?

Faster jump from 10% → 25%?

Extreme statements (e.g., “200% tariffs”)?

If yes, downside continuation is likely.

Europe’s Response

Avoid escalation → rebound possible

Immediate counter-tariffs (~€93B list) → risk-off continues.

U.S. Supreme Court Signals

This is the key sentiment switch.Clear limits or fast procedural action → market relief

Silence or approval of tariff authority → risk assets reprice lower

My View

There is no certainty: up, down, or sideways are all valid paths.

What matters is which variables move next.

Escalation continues → decline not over

Any softening or legal clarity → rebound can come fast

No new shocks → high chance of consolidation

$BTC continues to show strong correlation with U.S. equities, acting as an amplifier of U.S. stock market sentiment.