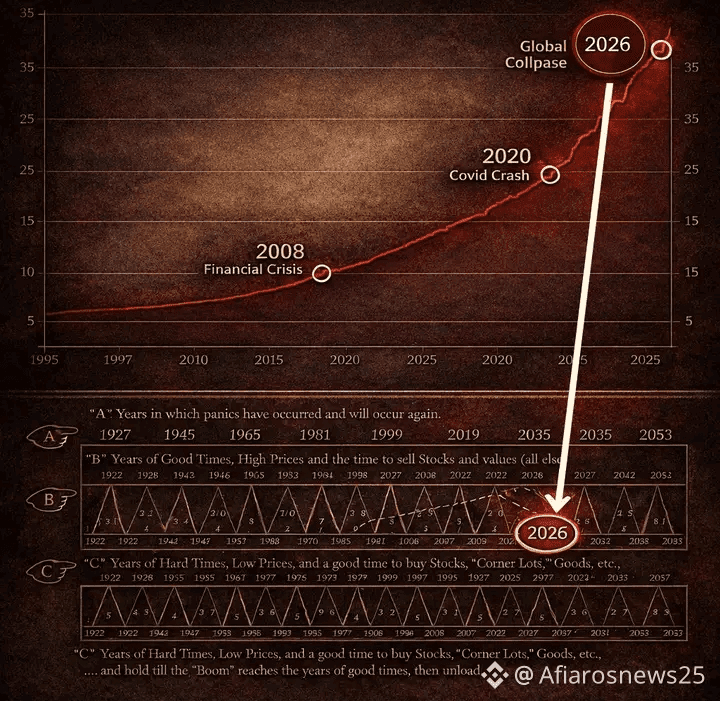

🚨 ALERT: A MAJOR MARKET BREAKDOWN IS APPROACHING

IS APPROACHING

The latest macro data from the Federal Reserve confirms what very few are willing to admit:

The global financial system is under growing stress, and the risks are accelerating.

This is not noise.

This is not a normal market pullback.

And this is not bullish.

WHAT JUST HAPPENED (AND WHY IT MATTERS)

The Fed’s balance sheet has quietly expanded by ~$105 billion.

Here’s the breakdown:

• Standing Repo Facility: +$74.6B

• Mortgage-Backed Securities (MBS): +$43.1B

• U.S. Treasuries: only +$31.5B

This is critical.

This is not growth-driven QE.

This is emergency liquidity being injected because funding conditions tightened and banks needed immediate cash.

When the Fed is absorbing more MBS than Treasuries, it sends a clear signal:

→ Collateral quality is deteriorating

→ Stress is rising inside the funding markets

That only happens during periods of systemic pressure.

THE BIGGER PROBLEM MOST PEOPLE ARE IGNORING

U.S. national debt is no longer just “high.”

It is structurally unstable.

• Total debt: $34+ trillion

• Debt growth: faster than GDP

• Interest expense: becoming one of the largest federal budget items

The U.S. is now issuing new debt just to service old debt.

That is the textbook definition of a debt spiral.

At this point, Treasuries are not truly “risk-free.”

They are a confidence instrument.

And that confidence is starting to crack.

• Foreign demand is weakening

• Domestic buyers are highly price-sensitive

• The Fed quietly becomes the buyer of last resort

Whether they admit it or not.

This is why funding stress matters more than stock prices right now.

You cannot:

→ Sustain record debt when funding tightens

→ Run trillion-dollar deficits while collateral quality worsens

→ Pretend this is a normal cycle

THIS IS A GLOBAL ISSUE, NOT JUST A U.S. ONE

China is facing the same structural problem at the same time.

The PBoC injected over 1.02 trillion yuan in a single week through reverse repos.

Different country.

Same issue.

Too much debt.

Too little trust.

The global system is built on rolling liabilities that fewer participants actually want to hold.

When both the U.S. and China are forced to inject liquidity simultaneously, this is not stimulus.

It is a warning sign that the global financial plumbing is starting to clog.

WHY MARKETS KEEP MISREADING THIS PHASE

Markets always make the same mistake here.

Liquidity injections are interpreted as bullish.

They’re not.

This is not about supporting asset prices.

This is about keeping funding alive.

And when funding breaks, everything else becomes a trap.

The sequence never changes:

• Bonds move first

• Funding markets show stress

• Equities ignore it

• Crypto absorbs the most violent damage

THE SIGNAL YOU SHOULD BE WATCHING

Gold: All-time highs

Silver: All-time highs

This is not a growth trade.

This is not inflation optimism.

This is capital rejecting sovereign debt.

Money is moving out of paper promises and into hard collateral.

That does not happen in healthy systems.

We have seen this exact setup before:

→ 2000 before the dot-com collapse

→ 2008 before the global financial crisis

→ 2020 before the repo market seizure

Each time, recession followed shortly after.

THE FED IS CORNERED

If they print aggressively:

→ Precious metals surge

→ Control is visibly lost

If they don’t:

→ Funding markets freeze

→ Debt servicing becomes impossible

Risk assets can ignore this reality for a while.

They always do.

But never forever.

This is not a typical cycle.

This is a balance-sheet, collateral, and sovereign debt crisis forming quietly in real time.

By the time it becomes obvious, most participants will already be positioned wrong.

📌 Position carefully heading into 2026.

I’ve tracked major market tops and bottoms for over a decade.

When I make my next move, I’ll share it publicly.

If you’re not paying attention now, you may wish you had later.