💣 The Uncomfortable Truth: KOLs, Exchanges & Incentive-Driven Trading

Let’s talk about something most people avoid saying out loud.

A large part of today’s “crypto trading  content” is no longer about market edge - it’s about incentives.

content” is no longer about market edge - it’s about incentives.

Many KOLs aggressively call Long/Short positions across Binance and other exchanges, every day, every token, every volatility spike.

The quality of the setup doesn’t matter.

The direction doesn’t matter.

Activity matters.

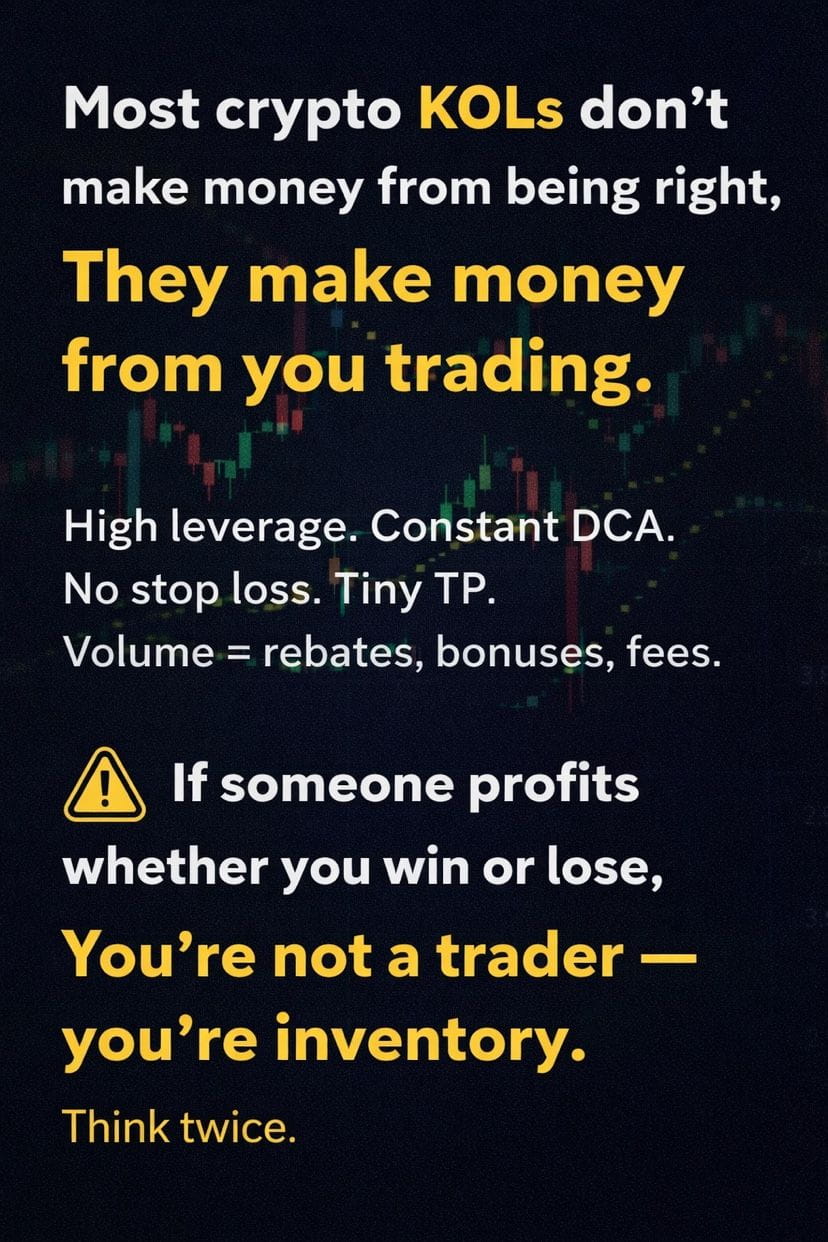

Why? Because the business model is simple:

High leverage

Frequent entries

Constant DCA

Small take-profits

Undefined stop losses

This structure maximizes one thing only: trading volume.

And volume means:

Fee rebates

Affiliate commissions

Performance bonuses

Project incentives

Exchange rewards

Whether followers win or lose is secondary.Let’s be honest:

If a KOL earns from your execution, not from their edge, your loss is still profitable — just not for you.

This explains a lot of behaviors we see repeatedly:

Longing into clear breakdowns

Averaging down in strong trends

Calling “another entry” after heavy drawdowns

Never showing full loss histories

Blocking professionals who ask about risk metrics

This is not incompetence. This is aligned incentives.

A trader focused on survival:

Protects capital

Defines invalidation

Trades less, not more

Accepts being wrong

A KOL focused on incentives:

Needs you active

Needs you emotional

Needs you overtrading

Needs you believing “the next entry fixes it”

That’s why transparency disappears when questions start.

Ask for win rate → silence

Ask for drawdown → block

Ask for R:R → deflection

Because real numbers break the illusion.

Here’s the harsh reality:

Most signal-based KOL models are not designed to make followers profitable.

They are designed to monetize followers’ behavior.

If someone benefits more from how often you trade than how well you trade,they are not your mentor.

They are your counterparty.

Think carefully.

Protect your capital.

And stop confusing incentive-driven content with real trading skill.