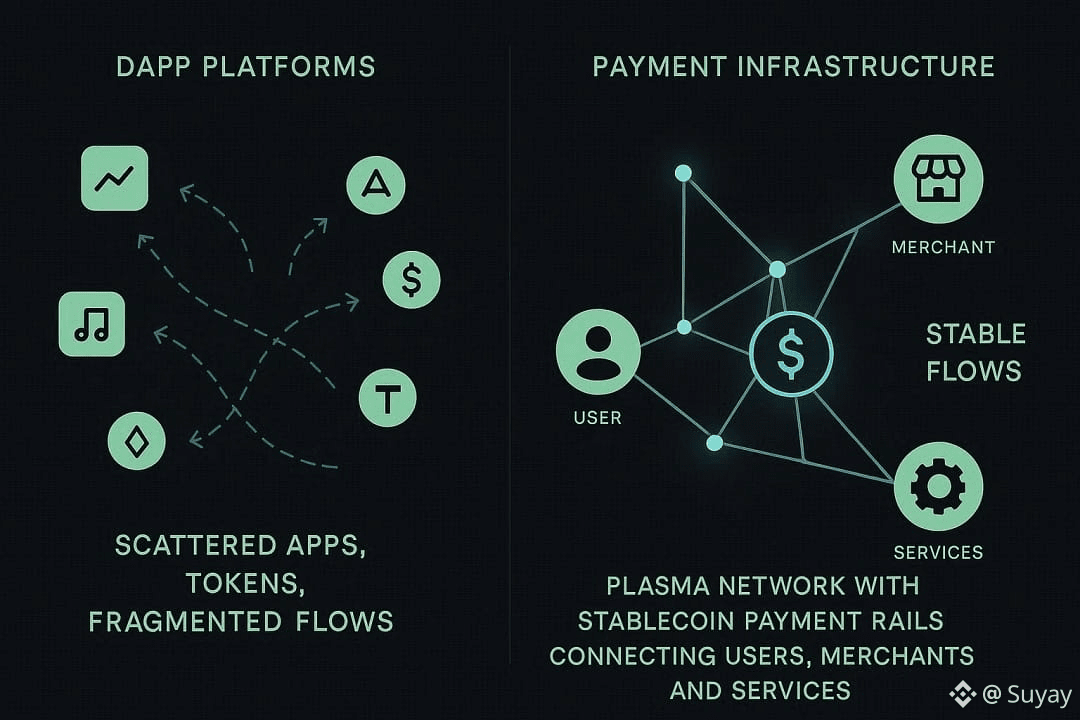

Most blockchains describe adoption in terms of dApps: what can be built, what can be launched, what can be experimented with. Plasma starts from a different question: what kind of financial behavior can a network reliably support?

Instead of positioning itself as another general-purpose platform, Plasma frames its role around payments. Not as a single use case, but as a systemic function. The network is designed to move stable value efficiently, predictably, and continuously — closer to financial infrastructure than to an application marketplace.

This difference defines how Plasma thinks about users, developers, and real-world relevance.

Payments are not apps

Applications come and go. Payment systems endure. They are not judged by novelty, but by reliability, cost structure, and behavioral fit. Plasma’s positioning reflects this reality.

Rather than optimizing for maximum composability, Plasma is built around the mechanics of moving money: stablecoins, transfers, recurring payments, merchant flows, and financial operations that repeat thousands of times a day.

This shifts the core question from “What can be deployed?” to “What kind of financial activity becomes natural?”

When a blockchain is structured around payments, everyday behavior becomes the benchmark. Small transfers, high frequency usage, consumer-facing flows, and business settlement are not edge cases. They are the baseline.

Designing for real economic behavior

Real-world payments are repetitive, margin-sensitive, and invisible when they work well. Plasma’s positioning acknowledges that financial adoption does not look like on-chain experimentation. It looks like systems quietly doing their job.

This is why Plasma emphasizes stable value movement, native financial primitives, and payment-oriented tooling. The network is not trying to attract users through app novelty, but through economic usability.

The measure of success is not how many protocols exist, but how naturally value can circulate between people, services, and businesses.

Use cases driven by flows, not features

Plasma’s real-world orientation becomes clear when looking at its intended use cases. They are not defined by product categories, but by transaction patterns.

Consumer payments, merchant settlement, cross-border transfers, on-chain balances, recurring payments, and programmable financial flows all share one requirement: money must move smoothly, without cognitive or economic friction.

Plasma positions itself to support these flows natively. Instead of each application rebuilding payment logic, the network embeds it at the system level.

This allows developers to focus less on how to move money, and more on what financial experiences they want to design.

From blockchain user to financial participant

In dApp-centered ecosystems, users are often framed as explorers of protocols. In payment-centered systems, users are economic participants.

Plasma’s positioning reflects this shift. The network is built for people and businesses who care less about block space and more about outcomes: sending, receiving, holding, and deploying stable value.

This changes how adoption is imagined. Growth is not measured only in active wallets, but in recurring financial behavior. Not visits, but flows.

And flows demand infrastructure, not platforms.

Why this positioning matters

The long-term relevance of a blockchain is determined less by how many apps it hosts and more by what kind of economic role it plays.

By placing payments at the center, Plasma defines itself as a monetary layer rather than a deployment layer. It is not competing to be where experiments happen. It is positioning itself to be where financial activity settles.

That strategic choice influences everything: architecture, consensus, tooling, and ecosystem direction.

It also sets expectations. Plasma is not promising novelty. It is committing to utility.

Conclusion

Plasma’s real-world positioning is simple, but demanding: build a blockchain that behaves like a payment network.

By organizing the system around stable value flows instead of application variety, Plasma moves away from the logic of dApps and toward the logic of financial infrastructure.

And in the real world, infrastructure is what quietly shapes behavior at scale.