The Friction That Freezes Billions

Imagine a water pipe that charges you for every drop you use—not for the water, but for the right to move it. This is the paradox facing stablecoins today. They were created to be digital dollars: stable, global, and efficient. Yet, on most blockchains, to send $10 of USDT, you might need $5 of another, volatile cryptocurrency just to pay the network fee. This isn't a flaw in the stablecoin; it's a fundamental architectural mismatch.

For millions in high-adoption economies—where stablecoins are used for daily remittances, small business payments, and protecting savings from inflation—this friction is a wall. It locks out users who can't navigate the complexity of holding multiple tokens. It turns a tool for financial inclusion into a privilege for the crypto-initiated. The promise of a global, open financial system remains just out of reach, trapped behind a gas fee barrier.

Plasma's Core Innovation: The Gasless On-Ramp

This is where Plasma Network rethinks the problem from the ground up. It isn't just another blockchain trying to do everything. It is a Layer 1 blockchain with a single, profound mission: to be the optimal settlement layer for stablecoin transactions. Its key innovation isn't just lower fees—it's a complete re-engineering of the user experience through transaction fee abstraction.

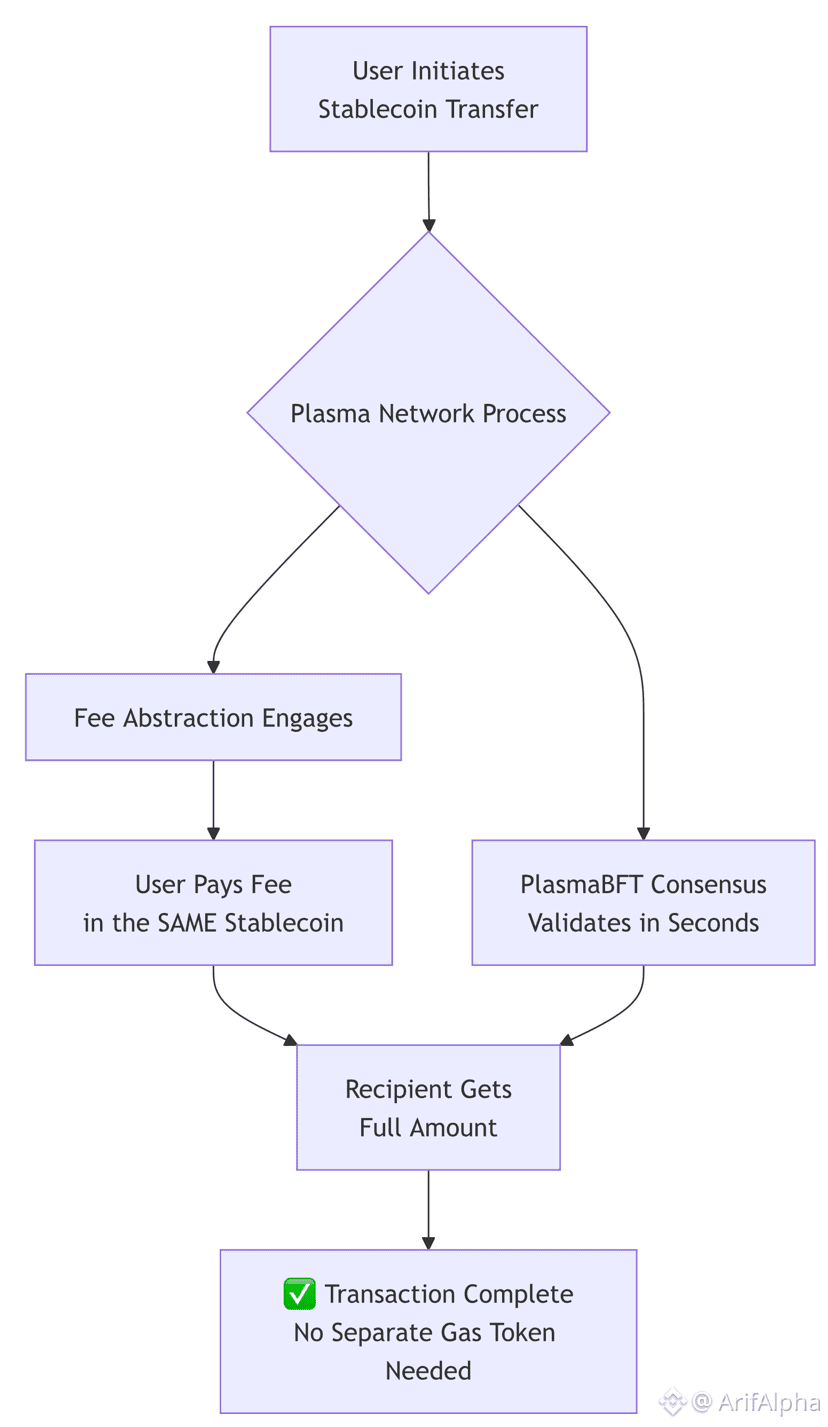

Here’s how it works, visualized as a simple, gasless on-ramp:

In practical terms, this means a merchant in Manila can receive USDT from a customer in Canada. The customer pays only in USDT. The merchant receives the full amount. No ETH, no BNB, no MATIC is ever needed by either party. The technical complexity is absorbed by the network, creating an experience as simple as sending a digital message. This is the "gasless" reality: not literally free, but frictionless, using the very asset you're already transferring.

Building Trust Through Transparency and Simplicity

User education isn't about explaining complex mechanics; it's about building confidence through predictable outcomes. Plasma’s model is inherently easier to teach: "You send USDT, you pay a tiny fee in USDT." There are no hidden second steps. This clarity is a cornerstone of trust, especially for new users whose primary concern is "Will my money arrive intact?"

Integrations with major self-custody wallets like Trust Wallet embed this simplicity directly into familiar tools, putting a powerful financial rail into the pockets of a global user base without requiring them to learn new jargon.

Real-World Scenarios: Where Financial Oxygen Flows

This technology moves from abstract to essential in specific, high-impact scenarios:

The Migrant Worker: Raj sends $200 home to his family in Kerala each month. On a traditional chain, gas fee volatility could unpredictably erase $10-$30 of that value before it even arrives. On Plasma, the cost is minimal and predictable, preserving the full value of his labor.

The Cross-Border Freelancer: Maria in Argentina designs websites for clients in Europe. Clients can pay her in USDT instantly without worrying about sourcing gas tokens. Maria receives her earnings in seconds, bypassing slow, expensive correspondent banking networks that can take days and take a large percentage.

The Small Business Owner: A hardware store in Lagos can now accept stablecoin payments from a wider customer base. The checkout process doesn't require the customer to have a separate crypto for fees, making digital payments a viable alternative to cash.

The Path to High Adoption: Community as Catalyst

For high-adoption economies, the product is only half the battle. The other half is community-driven growth. Plasma’s straightforward value proposition lends itself to organic, grassroots adoption. Communities can form around practical use cases—remittance corridors, merchant adoption groups, savings circles—rather than speculative trading.

This is where engagement transforms. Educational content shifts from "What is a blockchain?" to "How to save 90% on remittances." Community interaction focuses on solving real payment problems, sharing success stories of small businesses going digital, and providing peer-to-peer support. The network grows not because of hype, but because it solves a tangible, daily pain point for its users.

A New Financial Infrastructure Is Being Poured

Plasma represents a significant evolution in blockchain philosophy: from general-purpose "world computers" to specialized financial infrastructure. It acknowledges that for stablecoins to fulfill their destiny as the digital dollars of a new global economy, they need a dedicated highway, not a shared, congested road.

By removing the gas token friction, Plasma isn't just making transactions cheaper; it's making the entire concept of programmable money accessible and intuitive. It's providing the financial oxygen that lets real-world economic activity breathe and grow on-chain. The true measure of success won't be in token price, but in the volume of everyday transactions it enables—the quiet, constant hum of a more inclusive financial system at work.

What’s the one daily financial friction you face that a truly seamless, gasless stablecoin transfer could solve? Share your story below—the most practical use cases often come from the community itself.