📊 What Is Crowd Positioning?

Crowd positioning refers to where the majority of traders are currently placed in the market — whether they’re mostly long, mostly short, or heavily leveraged in one direction.

Markets constantly track this behavior.

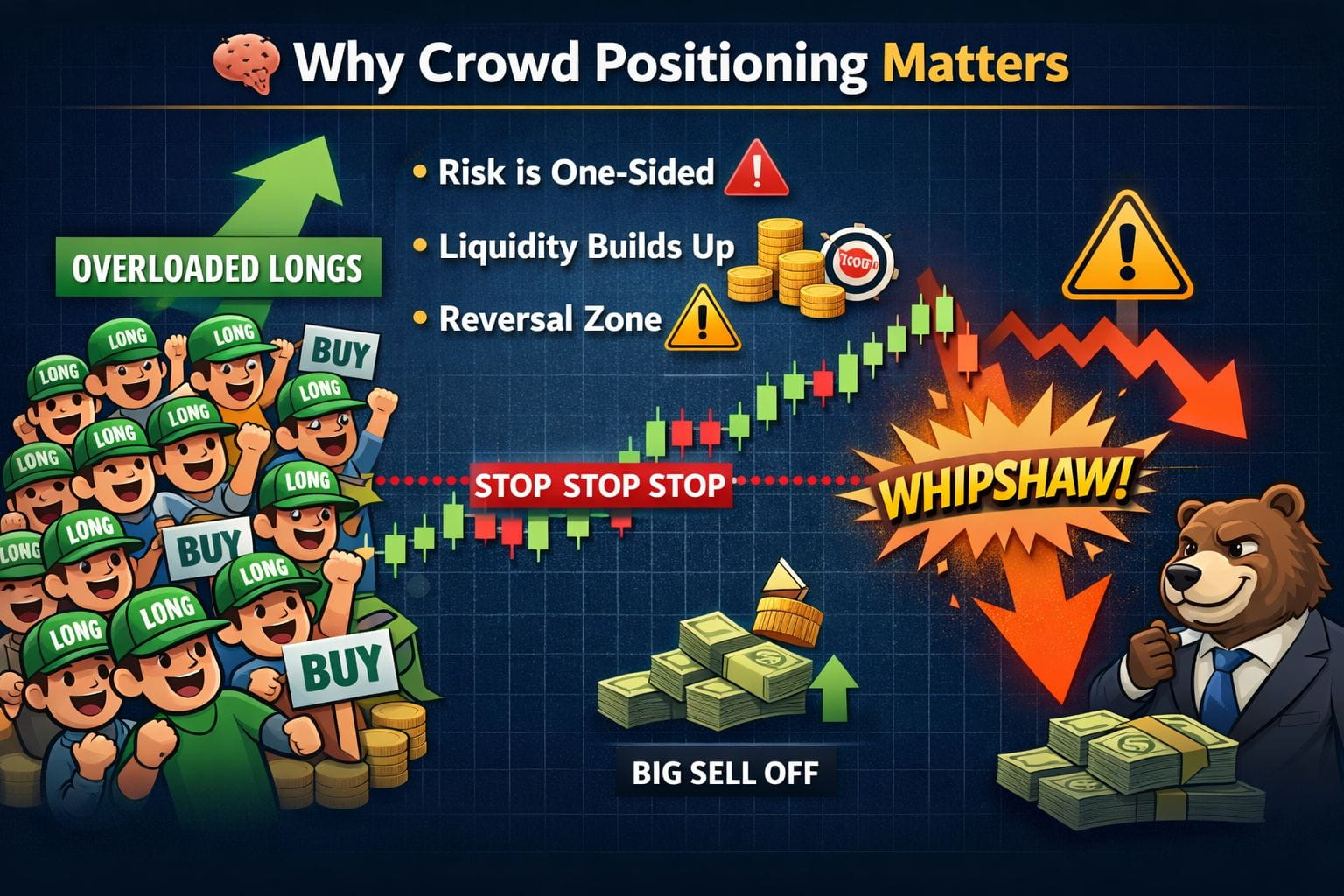

🧠 Why Crowd Positioning Matters

When too many traders agree on one direction:

Risk becomes one-sided

Liquidity builds up around stops

The market becomes vulnerable to sharp reversals

Price often moves against the crowd, not with it.

🔍 How Crowd Positioning Forms

Crowd positioning usually becomes extreme around:

Strong trends that attract late entries

Popular support & resistance levels

Breakouts fueled by FOMO

High funding rates and open interest

The more obvious the trade looks, the more crowded it becomes.

🎯 How Smart Traders Use It

Instead of following the crowd, smart traders:

✔ Monitor long vs short ratios

✔ Watch funding rates and open interest

✔ Wait for confirmation before fading extremes

They trade imbalances, not opinions.

📌 Key Takeaway

Crowd positioning shows who’s trapped and where risk is concentrated.

Price moves to rebalance that risk.

If everyone is on one side of the trade —

ask yourself: who’s left to buy or sell?

#WriteToEarnUpgrade #StrategyBTCPurchase #BTC100kNext? #position