Executive Summary

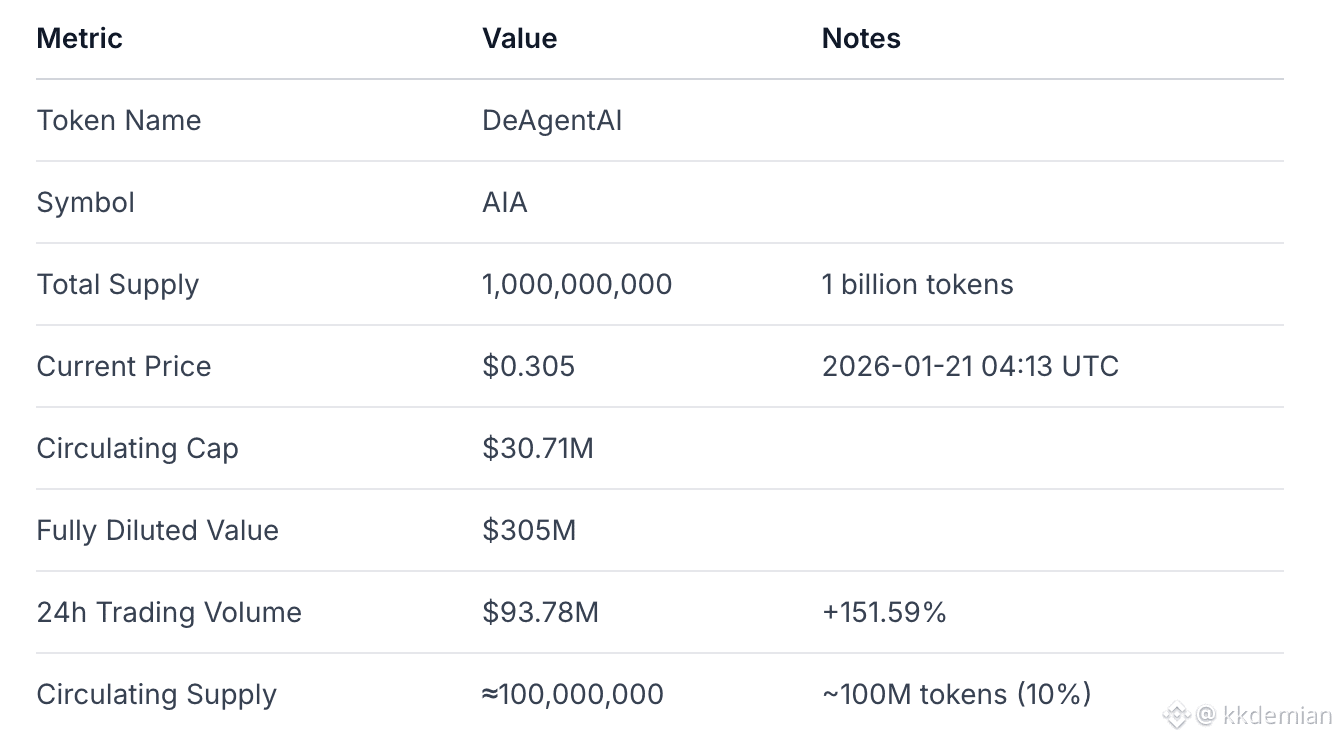

DeAgentAI has built a technically advanced decentralized AI agent coordination framework, but faces significant challenges in token economics sustainability and ecosystem adoption. The protocol addresses three core challenges for AI agents in distributed environments—consensus uncertainty, identity consistency, and state continuity—through its innovative Lobe-Executor-Committer three-layer architecture, demonstrating genuine technical originality. The $AIA

token currently has a market cap of $30.7M, FDV of $305M, and 24-hour trading volume of $93.78M, indicating extremely high market activity. However, the team and investors hold 39% of tokens with concentrated unlock risks, and ecosystem adoption remains in early stages, making this a high-risk, high-potential-reward investment. Institutional investors are advised to adopt a cautious wait-and-see approach until clearer adoption signals and token economics improvements emerge.

1. Project Overview

DeAgentAI is a decentralized AI agent infrastructure protocol designed to address three core challenges for AI agents in Web3 environments: consensus uncertainty, identity consistency, and state continuity. The project has built a framework called the "Autonomous Execution Network" that enables AI agents to operate reliably and persistently on-chain as sovereign entities with self-sovereign identities.

Core Positioning: Unlike traditional AI agent frameworks, DeAgentAI focuses on providing a decentralized decision coordination layer for AI agents rather than simple automation tools. Its core value proposition is ensuring the verifiability and consistency of AI decisions through blockchain technology.

Development Stage: The project is in the early stage of transitioning from testnet to mainnet, with initial applications deployed in the Sui, BSC, and Bitcoin ecosystems, though large-scale adoption has not yet been achieved.

2. Technical Architecture and Framework Design

Core Architecture Components

DeAgentAI's technical architecture is built around three core modules, mimicking different functional regions of the human brain:

Lobe (Decision Center):

Serves as the AI's "prefrontal cortex," responsible for high-level decision making

Reduces variability in probabilistic models through entropy minimization decision mechanisms

Integrates zkTLS/zkML proof generation to ensure authenticity of model calls

Provides verifiable computation guarantees for inference correctness

Memory & Tools System:

Hierarchical storage architecture enables decentralized knowledge accumulation

Short-term memory automatically includes recent N interactions for immediate conversational context

Long-term memory searches complete history through Retrieval-Augmented Generation (RAG) mechanisms

Built-in tools include distributed data queries, web access, and decision plugins

MPC Trusted Execution System:

Achieves trustless execution through Multi-Party Computation (MPC)

Committers form MPC groups to manage cryptographic keys for agent capabilities

Ensures sensitive operations require no single participant to hold complete authority or private keys

Provides enhanced security and decentralized control

Agent-to-Agent (A2A) Protocol

The A2A communication protocol supports complex collaboration, delegation, and emergent system behaviors:

Enables direct inter-agent interaction through underlying distributed systems

Supports patterns including information exchange, task delegation, coordinated actions, and negotiation

Ensures inter-agent communications are verifiable and consistently integrated into each participating agent's state history

Technical Differentiation

Compared to traditional AI agent frameworks, $AIA core differentiation lies in:

Decentralized Verification: Validates AI outputs through blockchain consensus mechanisms rather than relying on centralized authorities

State Persistence: Provides reliable on-chain memory systems ensuring decision continuity

Cross-chain Interoperability: Supports operation across multiple blockchain ecosystems including Sui, BSC, and Bitcoin

3. Token Economics and Economic Design

Token Fundamentals

CoinGecko

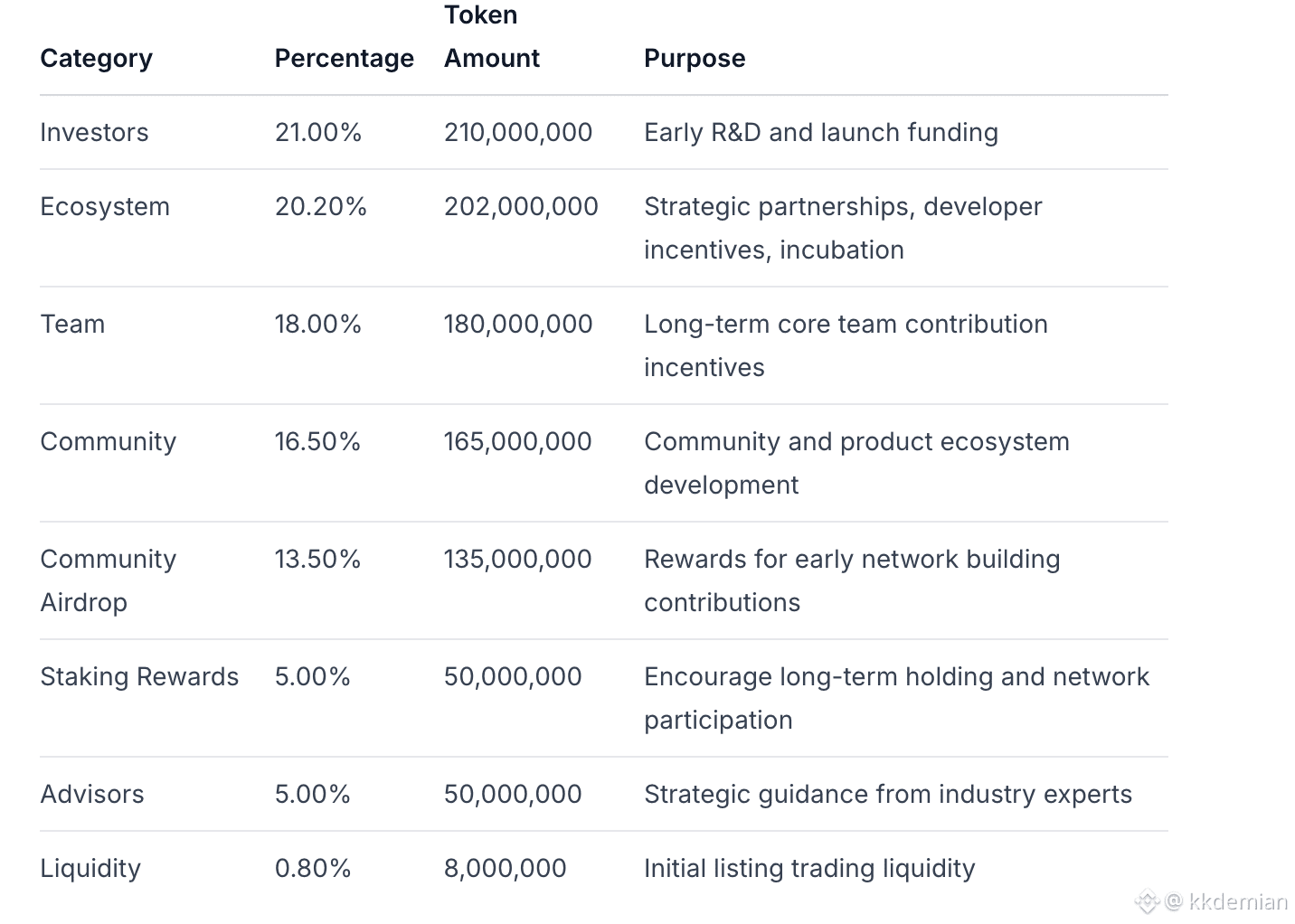

Token Allocation and Economic Model

Token Distribution Structure:

DeAgentAI GitBook

Vesting Schedule:

Investors: 1-year cliff, followed by 3-year linear vesting

Team: 1-year cliff, followed by 3-year linear vesting

Ecosystem: Partial unlock at TGE for initial bootstrapping, core allocation locked long-term with 3-year linear vesting

Community Airdrop: Phased programmatic release over 2 years

Staking Rewards: Phased programmatic release over 1 year

Token Utility and Value Capture

Current Utility:

Network Service Medium of Exchange: Used for AI agent creation, subscriptions, invocations, and unlocking premium features

Staking Rewards: Users stake AIA to help secure the network and ensure data validation reliability

Basic Governance: AIA holders have voting rights on key foundation decisions and network parameters

Value Flywheel Design: DeAgentAI envisions an autonomous AI economy where the AIA token serves as the core economic bandwidth and value medium for the entire ecosystem. Through sophisticated incentive and value capture mechanisms, it deeply aligns the interests of all network participants (creators, users, validators, and AI agent trainers).

4. Agent Ecosystem, Users, and Adoption Signals

Existing Products and Adoption

AlphaX:

DeFi application running simultaneously on Bitcoin and BSC networks

Leverages AI agent infrastructure for autonomous trading strategies and portfolio management

Addresses issues of limited Bitcoin liquidity in DeFi and centralization risks of alternative venues

CorrAI:

Focuses on smart contract automation for the Sui ecosystem

Uses AIA for smart contract execution, eliminating the need for centralized intermediaries in transaction orchestration

Significantly improves transaction throughput and reduces operational costs of traditional manual contract management

Adoption Metrics:

Market Valuation: $30.71M (Rank #512)

Holder Addresses: ~1,101 active holders

Exchange Coverage: 6 exchanges, 8 trading pairs (4 active, 4 delisted)

Developer Ecosystem

Based on the depth and technical detail of the GitBook documentation, DeAgentAI demonstrates strong technical rigor:

Technical documentation comprehensively covers architecture design, token economics, and implementation details

Provides clear developer guides and integration examples

Multi-chain deployment support (Sui, BSC, BTC) demonstrates technical flexibility

Community and Market Sentiment

Recent Market Developments:

January 20, 2026: Binance relisted AIA perpetual contracts, triggering a price surge

January 16, 2026: Gate.io launched AIA/USDT perpetual contract trading

January 12-26, 2026: AIA Power Week in collaboration with AdaptHF, featuring $20,000 in prizes for community content creation

Social Media Sentiment: Twitter discussions show positive market sentiment, primarily centered around the Binance relisting catalyst:

19 high-engagement tweets within 24 hours, with total views exceeding 100,000

Community recognition of the project team's execution capabilities

Excitement around the "comeback narrative" (relisting after being delisted from exchanges)

5. Protocol Economics and Sustainability

Value Creation and Capture Mechanisms

DeAgentAI's economic model is designed around creating an autonomous AI economy, where value is primarily generated and captured through:

Protocol-Level Fees:

Agent creation and invocation fees: Paid in AIA tokens

Premium feature access: Requires staking or paying AIA tokens

Cross-chain operation fees: Fees generated from executing operations in multi-chain environments

Demand Drivers:

As the number of AI agents grows, demand for AIA tokens should theoretically increase

Staking mechanisms encourage long-term holding, reducing circulating supply

Governance rights give token holders the ability to influence protocol development direction

Sustainability Analysis

Strengths:

Multi-tier staking architecture provides flexible participation options

Long-term vesting schedule avoids short-term selling pressure

Protocol's built-in fee mechanisms are expected to create sustained demand

Challenges:

Current ecosystem adoption is low, limiting actual protocol revenue

Token vesting schedule may create long-term dilution pressure

Relies on ecosystem growth to justify current valuation

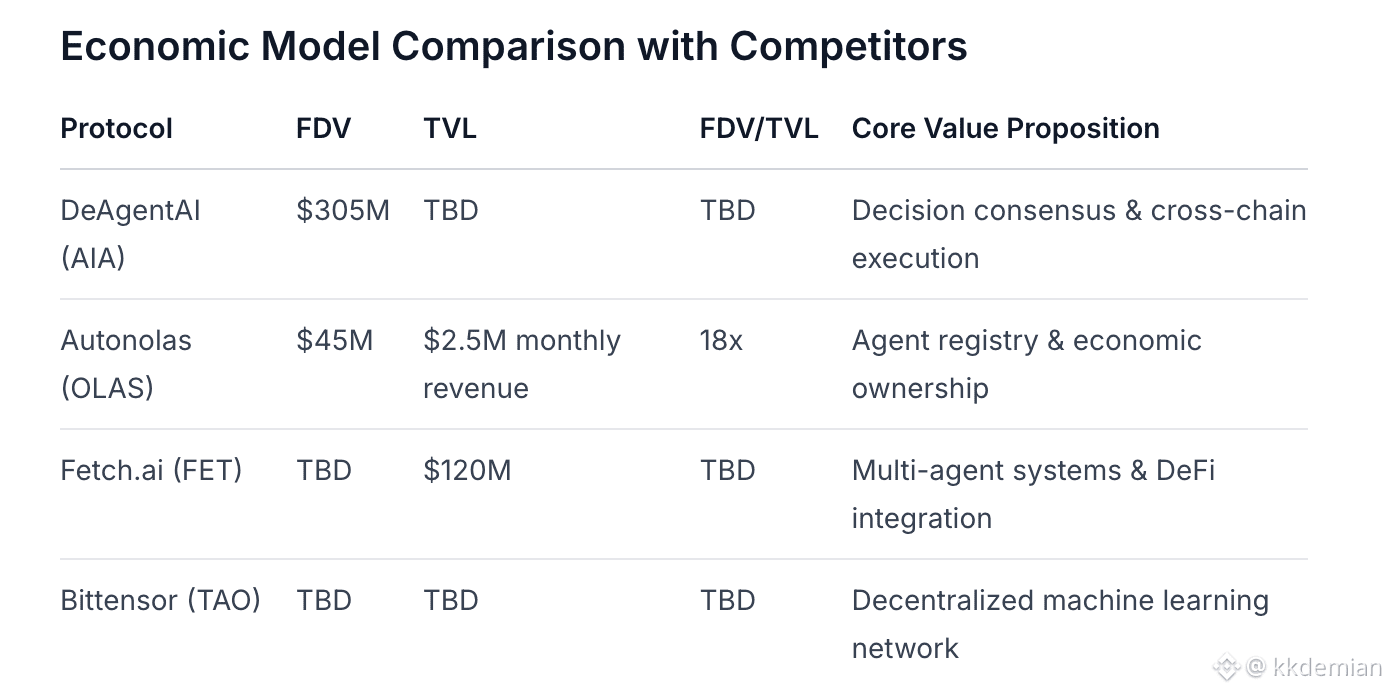

Economic Model Comparison with Competitors

6. Governance, Security, and Risk Analysis

Governance Structure

Current Governance:

Foundation-led governance model with team retaining significant control

AIA token holders have basic governance rights to vote on key decisions

Future plans to transition to a more decentralized DAO model

Governance Mechanisms:

Token-weighted voting system

Protocol parameters adjustable through governance proposals

Critical upgrades require community consensus

Security Architecture

Technical Security:

MPC execution layer eliminates single points of failure

ZK proofs ensure computational correctness

Decentralized verification network prevents manipulation

Economic Security:

Staking mechanisms encourage long-term participation and network security

Token vesting schedule aligns long-term interests

Multi-layer incentive structure reduces short-term behavior

Risk Factors

Technical Risks:

Challenges in verifying correctness of AI decisions

Adversarial agents could potentially compromise the system

Cross-chain coordination complexity may introduce vulnerabilities

Economic Risks:

Token Concentration: Top 10 addresses hold approximately 25%

Vesting Pressure: 39% of tokens will be released over the next 3-4 years

Insufficient Demand: Current ecosystem adoption is low with limited protocol revenue

Strategic Risks:

Large AI labs may commoditize agent frameworks

Open-source competitors may offer similar solutions

Regulatory scrutiny risks for autonomous agents

Competitive Risks:

Direct competition with projects like Autonolas, Fetch.ai, and Bittensor

Need to rapidly establish ecosystem moats and network effects

7. Project Stage and Strategic Trajectory

Development Stage Assessment

DeAgentAI is currently in the early ecosystem building stage, characterized by:

Completed Milestones:

Core protocol architecture design and implementation

Multi-chain deployment (Sui, BSC, BTC)

Initial token issuance and exchange listings

Basic developer documentation and tooling

Key Milestones Pending:

Full mainnet launch and adoption (Q1 2026)

Large-scale CorrAI DeFi tool adoption (Q2-Q3 2026)

AdaptHF integration and technical optimization (Q2 2026)

Ecosystem partner expansion (Throughout 2026)

DAO governance transition (Q4 2026)

Strategic Positioning Analysis

DeAgentAI positions itself as a decision coordination layer specialist in the AI agent space, with differentiated competition against:

vs Autonolas: More focused on decision verification rather than agent registry

vs Fetch.ai: More emphasis on cross-chain execution rather than multi-agent systems

vs Bittensor: More focus on decision consistency rather than machine learning models

Strategic Advantages:

First-mover technology in decision verification

Multi-chain architecture provides flexibility

Strong technical team and documentation

Strategic Challenges:

Need to rapidly establish ecosystem partnerships

Prove demand for real-world business use cases

Stand out in a crowded AI agent space

8. Final Investment Assessment

Dimensional Scoring (1-5 Scale)

Technical Architecture & Originality: 4.5/5

Innovative Lobe-Executor-Committer architecture design

Systematic approach to solving three core AI agent problems

Cross-chain execution capabilities demonstrate technical depth

AI Agent Framework Differentiation: 4.0/5

Unique positioning focused on decision verification

Clear differentiation from competitors

Multi-chain support provides strategic flexibility

Token & Incentive Design: 3.0/5

Economic model design is reasonable but carries concentration risk

Vesting schedule may create long-term selling pressure

Needs stronger value capture mechanisms

Ecosystem Expansion Potential: 3.5/5

Multi-chain deployment provides growth foundation

Existing products demonstrate practical value

Needs more ecosystem partners to prove viability

Competitive Positioning: 3.5/5

Has advantages in the decision verification niche

Faces competitive pressure from multiple directions

Execution speed will determine final market position

Governance & Execution Credibility: 4.0/5

Team demonstrates technical execution capabilities

Binance relisting shows market relationship capabilities

Needs more decentralized governance transition

Overall Score: 3.6/5

Investment Recommendation

Recommended Stance: Cautious Observation, Small Exploratory Position

Rationale: DeAgentAI demonstrates impressive technical depth and potential to solve real problems, particularly in AI agent decision verification and cross-chain execution. The team's technical execution capabilities and market resources (such as Binance relationships) have also been validated.

However, the project faces key challenges:

Token economics carry concentration and vesting pressure risks

Ecosystem adoption remains in very early stages

Competitive environment is intense, requiring rapid moat-building

Investment Strategy:

Short-term: Consider a small position, monitoring market momentum following the Binance relisting

Medium-term: Closely watch Q1 2026 mainnet adoption data and ecosystem partner progress

Long-term: Wait for token economics optimization and clearer adoption signals before increasing allocation

Key Monitoring Metrics:

Number of active mainnet agents and transaction volume

Actual protocol revenue generation capability

Progress on token holder decentralization

Quantity and quality of ecosystem partners

Data as of: 2026-01-21 04:13 UTC Data Sources: CoinGecko, DeAgentAI GitBook, CryptoRank, Twitter analysis, competitive protocol data