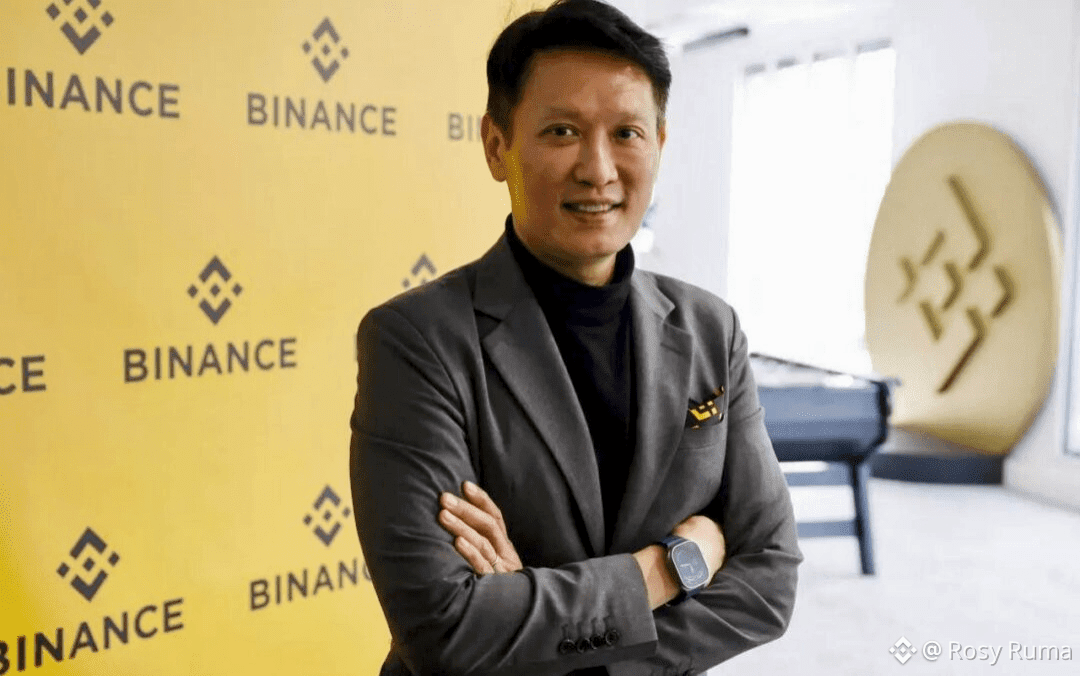

India has silently emerged as the world’s largest grassroots crypto adopter, according to Binance co-CEO Richard Teng, who shared his views during Davos 2026. While global attention often focuses on the US and Europe, India’s impact on crypto growth is unfolding steadily beneath the surface.

📊 India Ranks No.1 in Crypto Adoption

Citing Chainalysis data, Teng confirmed that India tops the global crypto adoption index at the grassroots level. The driving force is the country’s young, tech-savvy population, which continues to embrace digital assets despite regulatory uncertainty.

⚖️ Growth Despite Regulatory Grey Zones

Although India allows digital assets and CBDCs, it still lacks clear crypto trading regulations. Yet, adoption continues to rise. Teng noted that skepticism around crypto often fades once policymakers and institutions understand blockchain technology more deeply.

He believes education and awareness could play a key role in shaping India’s future crypto policy, just as it has transformed opinions among global financial leaders.

🌍 Why India Matters to Binance

Binance has crossed 300 million users globally and aims to reach one billion users—a goal Teng says is impossible without India. He also highlighted India’s CBDC pilot as a strategic step that could help regulators better understand blockchain’s real-world value.

📈 Global Momentum Remains Strong

Despite recent market corrections, Teng emphasized that crypto’s market structure remains resilient. Institutional participation is rising, stablecoins are gaining traction, and corporations are increasingly using crypto for 24/7 global fund transfers.

🏛️ Regulatory Clarity Is the New Advantage

Teng praised the US for passing the GENIUS Act and Clarity Act, calling regulatory clarity a competitive edge. Europe’s MiCA framework is another sign that governments are moving toward structured crypto oversight.

🚀 2026: A Turning Point for Finance

According to Teng, 2026 could mark the convergence of traditional finance, blockchain, and tokenized assets. Stablecoins, real-world asset tokenization, and on-chain trading models are reshaping how value moves globally.

🔍 The Big Picture

India may be quiet—but it is powerful. With unmatched grassroots adoption, rising developer talent, and increasing global relevance, India is positioning itself as a key pillar of crypto’s next growth phase.