Plasma, originally proposed in 2017 by Vitalik Buterin and Joseph Poon, started as an idea to help Ethereum handle more transactions. It aimed to move most activity off the main chain while keeping security through periodic checkpoints. While the idea was mostly theoretical for years, in 2025 Plasma became a real, working blockchain. Today, it is a Layer 1 network designed specifically for stablecoin payments like USDT, solving many problems that general-purpose blockchains face.

The Problem Plasma Solves

Most blockchains are built for general use—DeFi, NFTs, or smart contracts. While versatile, this causes several issues for payments:

Gas Barrier: To send stablecoins, users often need a separate token like ETH or SOL for fees, which adds friction.

Variable Fees: Transaction costs change depending on network traffic, making microtransactions unpredictable.

Finality Delays: Many L2 networks take hours or even days to fully confirm transactions.

Liquidity Fragmentation: Stablecoins are spread across multiple bridges and chains, making large settlements complicated.

Plasma focuses on solving these problems by treating settlement as a core feature of the network.

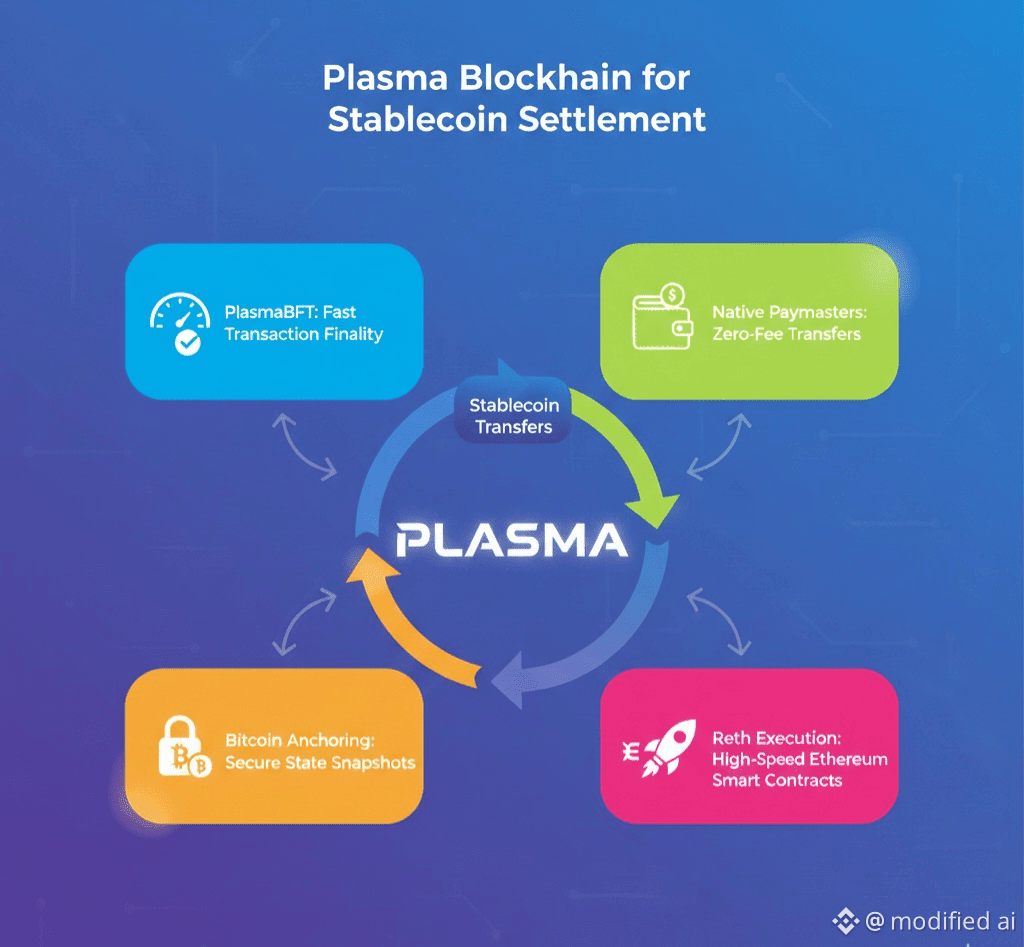

How Plasma Works

Plasma’s technology is designed to make stablecoin payments fast, cheap, and secure.

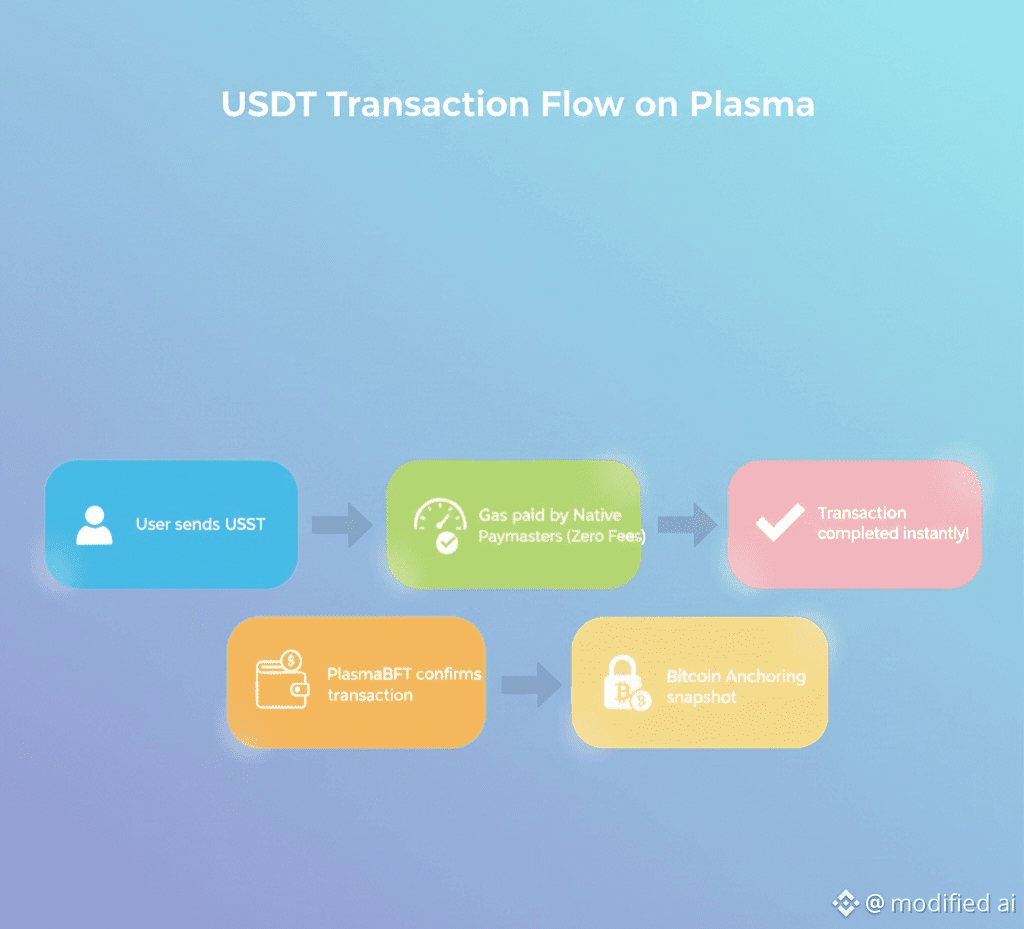

PlasmaBFT confirms transactions in less than a second, giving users almost instant certainty that their money is settled. Native Paymasters let the network or merchants pay transaction fees for users, making sending USDT feel free and easy—just like using a normal banking app. Bitcoin Anchoring regularly copies important data to the Bitcoin blockchain, ensuring everything is safe and cannot be changed. Finally, Reth Execution allows the network to run Ethereum smart contracts very quickly, letting developers use familiar tools while the system handles a lot of transactions at once.

By building these features directly into the blockchain, Plasma avoids the slowdowns and high fees of general-purpose networks, especially during peak traffic.

Recent Developments (2025–2026)

Since launching in September 2025, Plasma has seen strong growth and adoption:

Network Growth: Total Value Locked (TVL) in stablecoins reached over $2 billion.

Partnerships: Plasma integrated with Aave, Ethena, and Tether’s USDT0 bridge, consolidating liquidity.

Staking Launch (Q1 2026): XPL token holders can now stake and delegate tokens to help secure the network and earn rewards.

Plasma One Card: A debit card is planned for direct USDT settlement at merchants, bypassing traditional FX fees.

Community Incentives: A campaign in January 2026 distributed 3.5M XPL tokens to encourage adoption.

Funding: The project raised $373 million in a public sale in July 2025, showing strong institutional interest.

Strengths of Plasma

Specialized Design: Plasma focuses only on stablecoins, keeping the network fast and efficient.

Easy to Use: Gasless transfers make payments feel simple, like a banking app.

Institutional Ready: Partnerships with major liquidity providers strengthen credibility and adoption.

Secure: Bitcoin anchoring adds an extra layer of safety and immutability.

Risks and Challenges

Token Unlocks: Around 25–32% of XPL tokens will become available in mid-2026, which could put downward pressure on prices.

Centralization: To achieve fast finality, Plasma uses a smaller set of validators, raising concerns about censorship or control.

Regulatory Pressure: Focusing on digital dollars makes it more vulnerable to strict KYC and AML rules.

Competition: Tron currently handles most USDT volume (~60%), so Plasma needs to prove it can attract major users.

Conclusion

Plasma (XPL) has evolved from a theoretical idea into a live, high-performance blockchain specialized for stablecoin settlement. Its design solves the biggest problems of general-purpose chains: slow transaction finality, unpredictable fees, and fragmented liquidity. With innovations like PlasmaBFT, Native Paymasters, Bitcoin Anchoring, and Reth Execution, it offers instant, low-cost, and secure transactions.

While token unlocks, centralization, and regulatory scrutiny pose challenges, Plasma’s focus on stablecoins and ease of use makes it a promising “Money 2.0” platform. As of early 2026, it stands out as a high-speed, user-friendly, and institution-ready blockchain for the next generation of global payments.

#TrumpTariffsOnEurope #GoldSilverAtRecordHighs #USJobsData #WriteToEarnUpgrade