A couple of years ago, I was looking into a tokenized securities setup and trying to answer a simple question: how do you move assets onchain without putting every sensitive detail on display. The deeper I went, the clearer the tension became. Most blockchains either expose everything by default or hide so much that regulators immediately lose confidence. That friction stuck with me. It made me wonder whether institutional capital could ever move onchain comfortably, without constant workarounds or second-guessing.

The problem itself is not complicated. Traditional finance depends on privacy to function. Firms protect trading strategies, positions, and counterparties for good reasons. At the same time, regulators require auditability, traceability, and rule enforcement. Public blockchains collapse these needs into a single surface by broadcasting everything. The result is a system that is transparent but brittle. Settlement slows down, compliance becomes expensive, and trust erodes because no one wants their internal state permanently exposed just to participate.

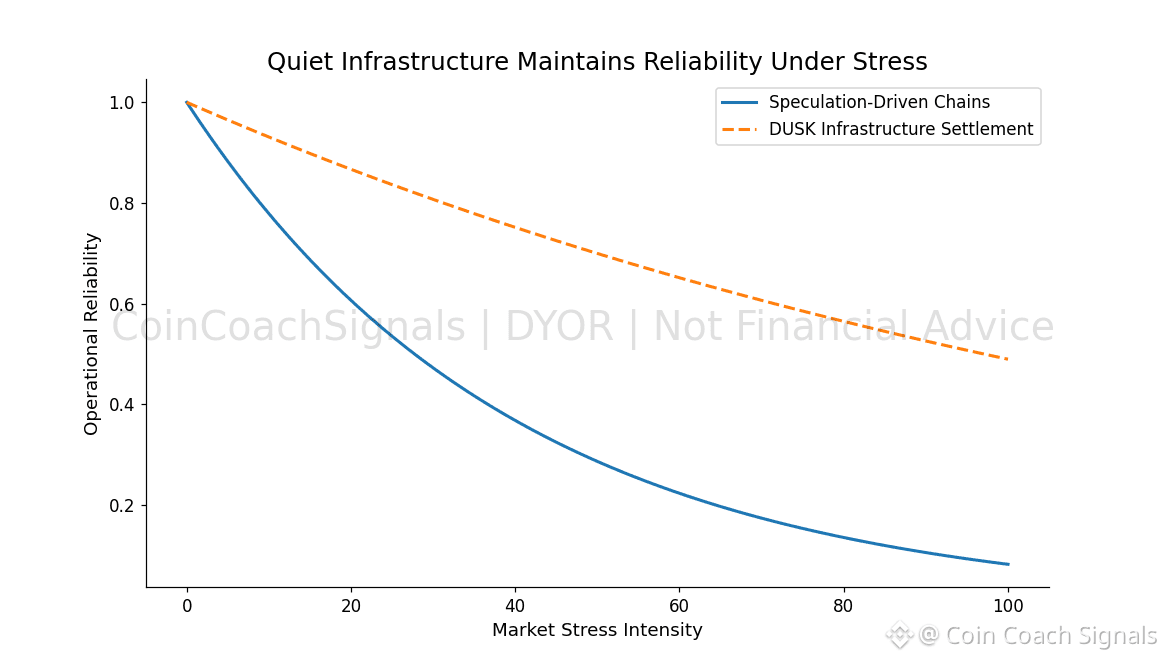

I usually think of it like underground plumbing in a city. Pipes need to move water reliably, out of sight, day after day. Inspectors still need access points to verify flow or spot problems, but they do not rip up the entire street every time they run a check. When plumbing fails, everything above ground suffers. Onchain settlement works the same way. If the base layer cannot handle privacy and verification cleanly, higher-level markets freeze under pressure.

This is the problem space Dusk Network is designed for. It is a layer-one chain built around confidential execution. Transactions and smart contracts can operate on hidden data, while cryptographic proofs confirm that rules were followed. That allows things like tokenized bonds or equity-style instruments to settle without broadcasting balances, counterparties, or internal logic to the public.

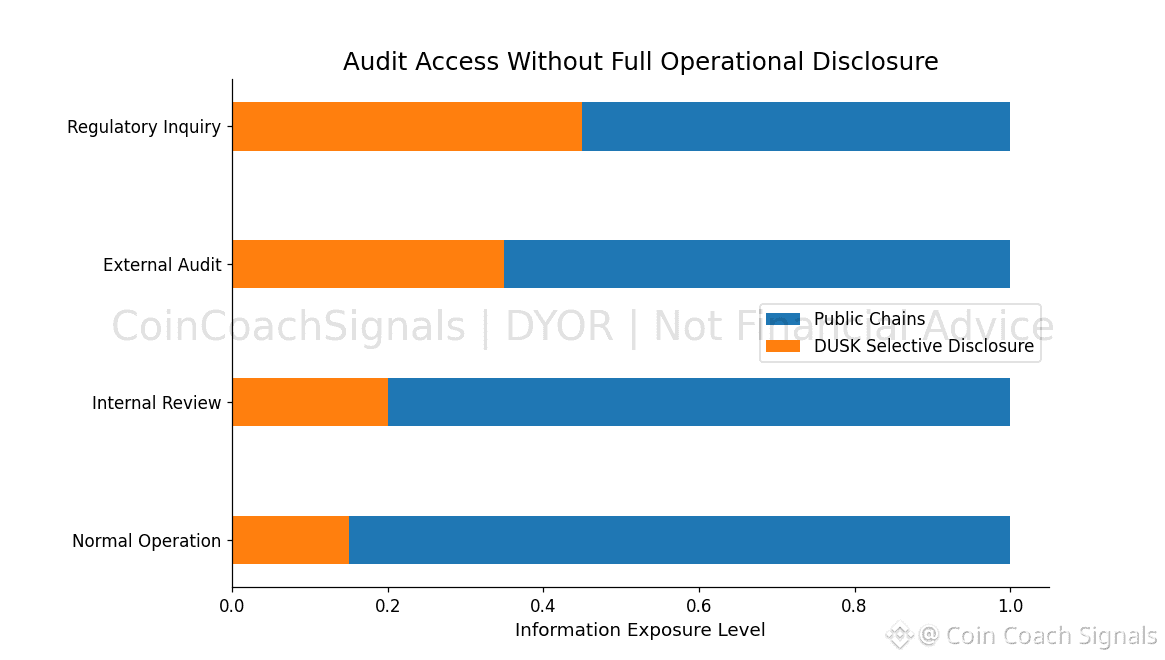

Two parts of the design are especially relevant. One is its Segregated Byzantine Agreement consensus, which separates roles in validation so the network can reach agreement efficiently without relying on energy-heavy mechanisms. The other is its bulletin board structure, which acts as a shared reference layer. It gives auditors and counterparties a consistent source of truth for verification without forcing sensitive data into the open. Together, these choices aim to make audits possible without turning normal operation into constant disclosure.

The DUSK token itself is deliberately plain. It pays transaction fees, is staked by in practice, validators to secure the network, and is used for governance decisions around protocol changes. It is not positioned as a growth narrative. It is simply the economic glue that keeps the system functioning in a decentralized way.

In market terms, the project remains relatively small. Market capitalization sits a little above one hundred million dollars, with a circulating supply just under five hundred million tokens. Trading volume is steady in practice, but modest, reflecting a niche audience rather than speculative frenzy.

Short-term trading tends to follow familiar patterns. Privacy narratives heat up, prices jump. Broader market weakness sets in, and they fall back. I have seen moves of twenty or thirty percent driven more by sentiment than by fundamentals. Long-term, the case is different. If institutions actually begin using the chain for real settlement flows, the value would come from sustained usage, not bursts of attention. That kind of adoption takes years, not weeks.

There are real risks. Competition is intense, whether from privacy-first chains like Monero or asset-focused platforms such as Centrifuge. Regulatory shifts could also change the landscape quickly. If frameworks like the EU’s DLT Pilot Regime tighten or stall, projects built for compliant finance could find themselves blocked despite working technology. And even with solid design, there is no guarantee large financial institutions will migrate meaningful activity onchain anytime soon.

Infrastructure earns its place slowly. It proves itself by not breaking, by behaving predictably, and by staying boring under scrutiny. Whether this approach attracts lasting institutional use is still an open question. But watching how it performs over time may say more about the future of onchain finance than any short-term market move ever will.

@Dusk #Dusk $DUSK