A while back, I had to move USDT across chains to cover a position during a rough market session. Nothing clever. No yield, no trade, just moving funds so something else wouldn’t break. Ethereum was busy that day. Fees jumped, confirmations lagged, and by the time the transfer cleared, the damage was already done. I remember thinking this shouldn’t feel like speculation. It should feel like plumbing.

That experience isn’t rare. It points to a basic issue with how most blockchains are designed. Everything shares the same space. Payments, NFT drops, memecoin rushes, airdrops, bots. When activity spikes, the network doesn’t distinguish between someone gambling on momentum and someone trying to move money they actually depend on. Fees rise across the board. Settlement slows. Stablecoins end up behaving anything but stable.

The problem isn’t volatility itself. Volatility belongs in markets. The problem is letting it spill into settlement. Once that happens, the network stops behaving like financial infrastructure and starts acting like a crowded trading floor.

I tend to think of it in physical terms. Freight traffic and sports cars don’t mix well on the same road. Trucks need predictability. If every lane turns into a racetrack, deliveries get delayed and costs rise. Payments work the same way. They need isolation more than flexibility.

That idea is what sits underneath Plasma. It isn’t trying to be a general playground for every onchain use case. It is narrow on purpose. Stablecoin settlement comes first. Everything else is secondary.

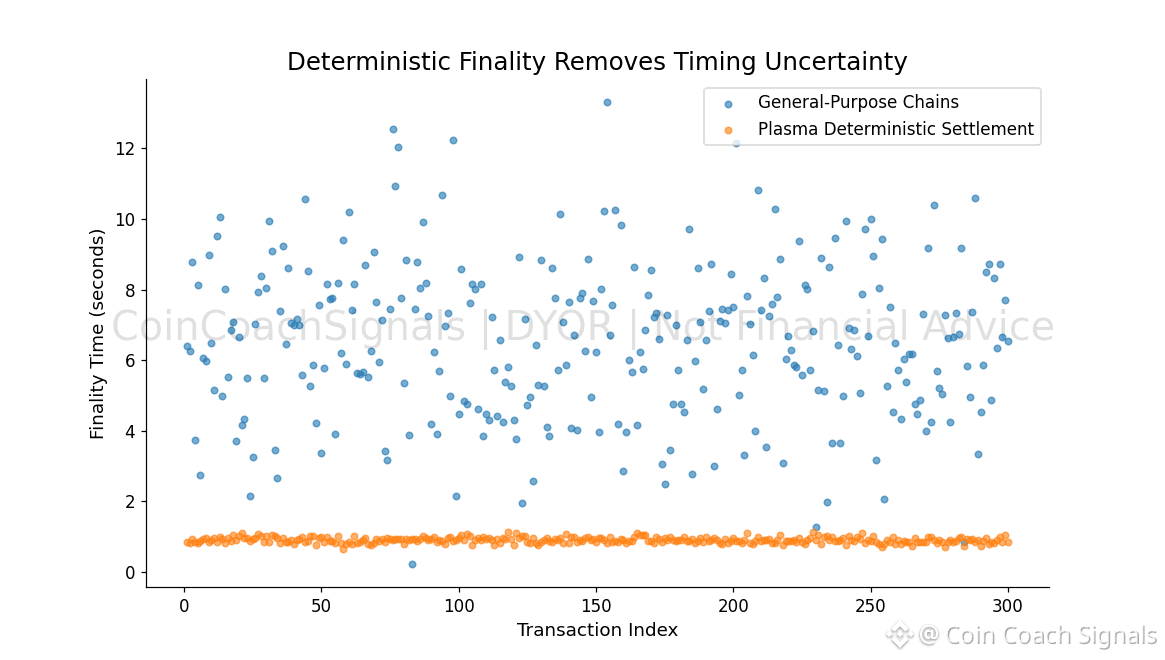

Plasma is built so transfers resolve as completed events, not probabilities. Finality is fast and deterministic, even when conditions aren’t ideal. Stablecoin transfers are gasless for users, which matters more than it sounds once payments become routine. You don’t need to hold or manage a volatile token just to move value. The cost is handled at the protocol level instead of being pushed onto the person sending money at the worst possible moment.

It keeps full EVM compatibility, which is practical rather than flashy. Existing applications can deploy without rewriting logic, but they run in an environment where settlement is the priority, not an afterthought squeezed between speculative bursts.

Security choices follow the same mindset. Plasma anchors itself to Bitcoin, favoring assumptions that have survived real stress over new ideas that still need to prove themselves. For payments, durability tends to matter more than novelty.

The XPL token reflects that restraint. It covers non-stablecoin fees, validator staking, and governance. It isn’t framed as a growth story on its own. It exists to keep the system functioning, not to generate excitement.

Market behavior has been rough at times. Early enthusiasm faded quickly, and price action has been volatile. That’s typical for infrastructure that doesn’t lend itself to hype. The longer question is simpler. If stablecoins keep being used as everyday money, the chains that treat settlement as a first-class responsibility rather than shared blockspace may end up being the ones people rely on quietly.

There are real risks. Tron already dominates stablecoin volume. Regulatory shifts could change issuer behavior. If adoption slows, validator incentives will be tested. None of that is abstract.

But payment systems aren’t judged by launches or narratives. They’re judged by whether they work on bad days, when nothing else does. Plasma is betting that separating payments from speculative congestion is not a nice optimization, but a requirement. Whether that bet holds up will only become clear over time, not during the next attention cycle.

@Plasma #Plasma $XPL