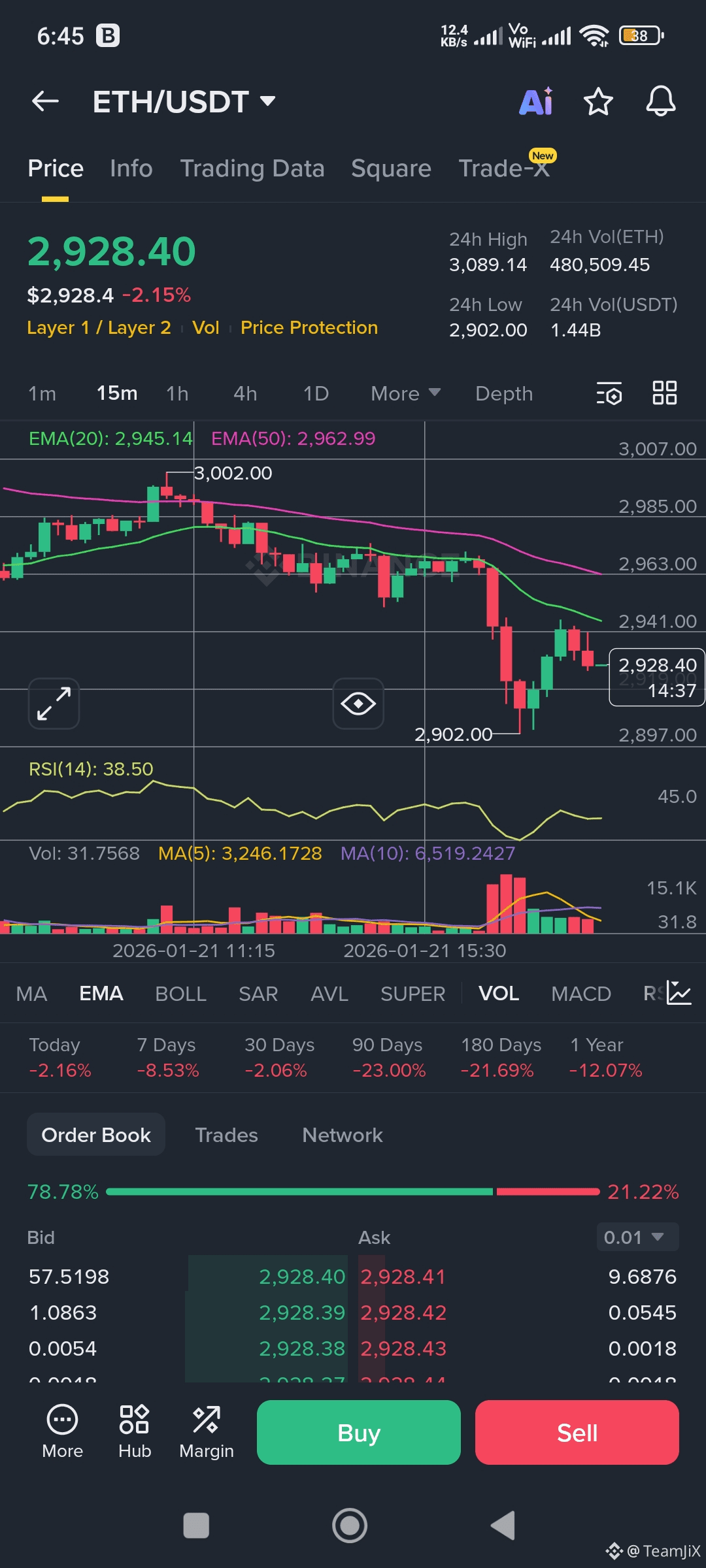

$ETH Ethereum market detailed analysis:

Conclusion: Today our view has shifted from bearish to bullish; we won't overly bearish until it breaks below 2900. We will begin to tentatively enter long positions, initially looking at a range of 2900-3000.

Market situation: From the data, it appears that the main force has not significantly increased its short positions again, which should be largely related to the reduction in the number of retail investors holding long positions. There is not enough opposing volume to give the main force a chance to open a large number of short positions. The decrease in the number of retail long positions directly affects the contract trends. The second point is that the spot price has already reached 2900 (near the strong support at 2890); at this position, retail investors have a strong willingness to take delivery, and it is estimated to be quite difficult for the contracts to drop directly given the significant reduction in long positions compared to yesterday.

Recommended trading method: Before breaking below 2900, use a stop loss at 2899 to tentatively test long positions; the closer it gets to the stop loss position, the higher the risk-reward ratio.

Note: The key point in the market is 2900. If it breaks below this, all previous analyses will become invalid, and we will also stop loss and exit our long positions. One should only utilize key positions for speculative plays, and do not assume that 2900 is a guaranteed bottom to heavily invest; it can only be said that this is the most worthwhile place to speculate, so a regular position should suffice.

#WhoIsNextFedChair #TrumpTariffsOnEurope