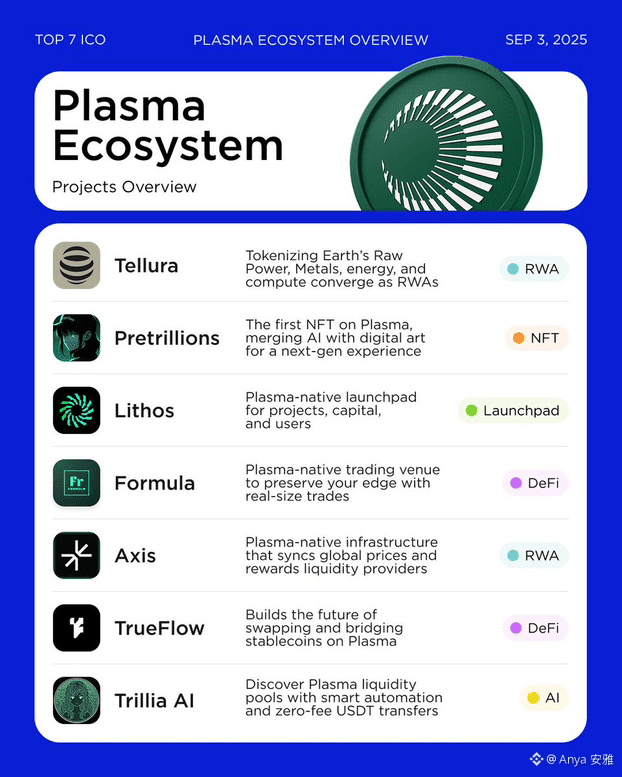

Have you ever wondered why Plasma keeps expanding its footprint even when its price action looks quiet on the charts? Since the Plasma (XPL) mainnet beta launched in September 2025, the network has consistently shown ecosystem growth through measurable on-chain activity, including more than $2 billion in stablecoin liquidity flowing into the chain. This growth highlights Plasma’s role as a settlement-focused Layer-1 rather than a speculative trading asset, placing usage metrics at the center of its relevance.

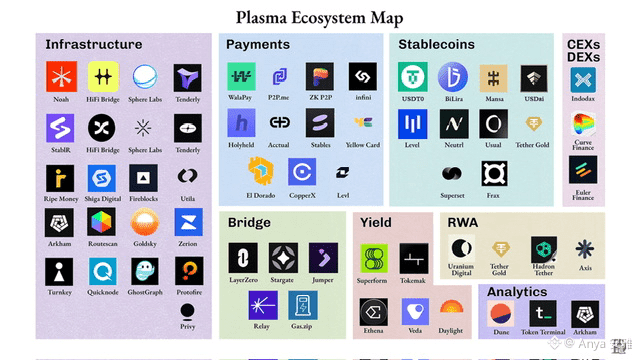

Plasma’s ecosystem development has been driven by infrastructure adoption rather than short-term hype. Integrations with major exchanges, wallet providers, and oracle services enabled native stablecoin transfers with predictable fees and fast finality. On-chain data shows that transaction volume and liquidity concentration increased alongside these integrations, signaling real network usage rather than transient capital inflows.

Market behavior around XPL reflects this distinction. After listing on major platforms such as Binance and OKX, XPL briefly traded above $1.40 before adjusting as circulating supply expanded. By early 2026, the token traded near the $0.14–$0.16 range, a pattern commonly observed in infrastructure-focused networks where adoption develops independently of speculative price momentum.

Bitcoin’s influence provides important context. With BTC trading around $95,000–$97,000, market liquidity concentrated around large-cap assets, compressing volatility across altcoins. During these periods, speculative assets often underperform, while networks tied to real transaction demand maintain consistent activity. Plasma’s stablecoin settlement volumes remained observable even as broader altcoin prices consolidated.

Comparative sector data reinforces this point. Meme coins followed rapid volume spikes and sharp retracements, DeFi tokens tracked total value locked rotations, and Layer-2 tokens mirrored Ethereum gas demand. Plasma’s activity instead aligned with stablecoin velocity and transfer frequency, placing it in a different performance category shaped by payment demand rather than execution competition.

The broader ecosystem context further supports Plasma’s positioning. Global stablecoin supply surpassed $300 billion by late 2025, increasing demand for reliable settlement infrastructure. Plasma’s architecture directly serves this growth by enabling tokenised stable value to move efficiently without dependence on Ethereum calldata costs, which often fluctuate during congestion.

Parallel developments across the crypto market highlight a shift toward specialization. Dusk Network’s recent updates, centered on compliant, privacy-preserving tokenised asset infrastructure, demonstrate how networks are focusing on distinct layers of the stack. While Dusk targets regulated asset issuance, Plasma concentrates on settlement throughput, reinforcing a multi-layered ecosystem rather than a single-solution race.

Ecosystem growth on Plasma is also reflected in network composition. Liquidity providers, exchanges offering low-fee stablecoin transfers, and wallet integrations contribute to sustained usage even when trading volumes cool. These elements create a feedback loop where utility drives adoption, independent of short-term price movement.

From a market-structure perspective, this explains why Plasma’s ecosystem metrics often diverge from its chart performance. Infrastructure networks historically show delayed price response relative to usage growth, especially during Bitcoin-dominant cycles when capital rotation favors established assets over emerging platforms.

What the data consistently shows is that Plasma’s relevance is anchored in ecosystem expansion, not daily price candles. In a market shaped by Bitcoin dominance, growing stablecoin adoption, and increasing specialization, Plasma’s steady network growth offers a clearer signal of long-term positioning than short-term price fluctuations ever could.