Why is VANRY activity rising even while the broader crypto market feels crowded with noise and short-term volatility? VANRY (Vanar Chain) has been showing a measurable increase in ecosystem engagement that aligns with verifiable network developments rather than speculative attention. Recent updates around Vanar Chain’s Layer-1 infrastructure continue to emphasize performance for AI-driven and gaming-focused applications, two sectors that demand consistent throughput and low latency. Publicly visible ecosystem releases point to ongoing platform refinement and tooling expansion, which has translated into sustained on-chain interactions tied directly to usage rather than promotional cycles. Anya notes that this type of activity growth often appears before it is fully reflected in market narratives.

At the network level, VANRY’s role as the native utility token remains central to transaction execution, application interaction, and ecosystem participation across the Vanar Chain environment. Observable on-chain data indicates steady transaction flows connected to platform use cases, suggesting that token movement is increasingly linked to functional demand. This pattern differs from purely speculative tokens where spikes in activity are often short-lived and disconnected from application usage. The consistency of these interactions provides a factual basis for understanding why activity metrics have trended upward despite external market distractions.

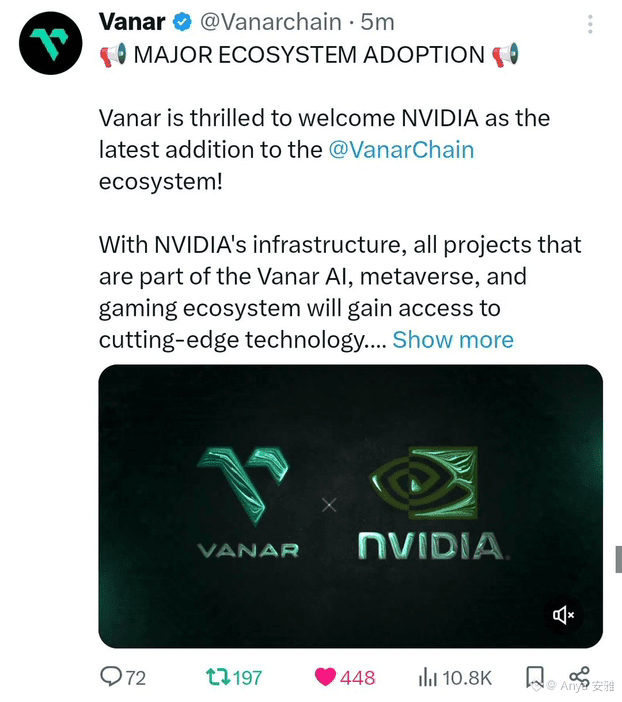

Technology-focused updates have also contributed to this momentum. Vanar Chain has continued expanding its infrastructure stack designed to support AI workloads, digital environments, and interactive content, areas that require persistent on-chain engagement. Platform-level enhancements and integrations have lowered friction for developers and users, which naturally increases transaction frequency. These developments are verifiable through ecosystem announcements and reflected in the type of on-chain activity recorded, reinforcing the connection between technical progress and network usage.

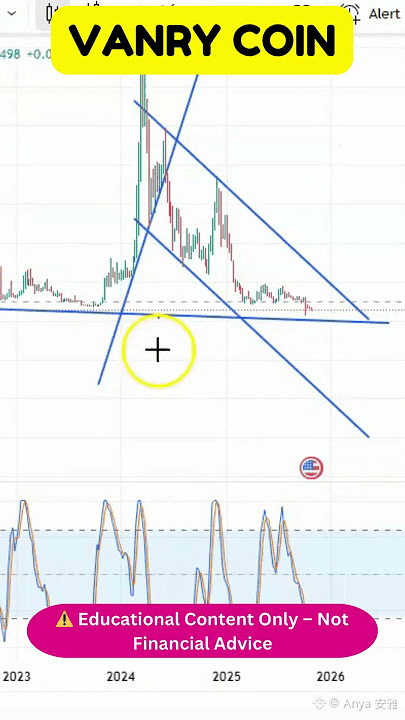

Market behavior adds another layer to this explanation. VANRY’s price action and trading volume have largely followed broader mid-cap utility token patterns, showing sensitivity to overall market liquidity rather than isolated spikes. Exchange data points to consistent availability across major trading venues, supporting stable liquidity conditions even during periods of reduced risk appetite. Anya observes that this stability allows on-chain activity to continue independently of short-term price fluctuations, a characteristic often associated with infrastructure-focused projects.

The influence of Bitcoin (BTC) remains a defining factor in VANRY’s trading environment. During periods when BTC dominance increases, capital typically consolidates into large-cap assets, temporarily dampening volume across AI, gaming, and infrastructure tokens. VANRY has followed this broader market behavior, with relative compression in trading activity during BTC-led volatility phases. However, when BTC price action stabilizes, market data shows normalization across mid-cap tokens, allowing ecosystem-driven activity to become more visible.

Comparative performance across sectors further clarifies the trend. AI and gaming utility tokens have generally shown more resilient on-chain engagement than narrative-driven or meme-based assets during recent market cycles. VANRY’s activity profile aligns with this segment, where usage metrics remain active even when price movement is muted. This contrast highlights how functional demand can persist regardless of short-term shifts in trader sentiment.

Liquidity movement also plays a role in explaining rising activity. While speculative capital often rotates quickly between assets, infrastructure projects with active ecosystems tend to retain baseline liquidity tied to usage. VANRY’s exchange presence and transactional role within its network support this dynamic, enabling continuous token circulation linked to applications rather than purely speculative trades. These conditions are observable through steady volume patterns rather than abrupt surges.

Ecosystem participation programs and platform integrations have further contributed to measurable engagement. Verified community initiatives and application-level interactions increase the number of wallet addresses and transactions interacting with the network. Such growth signals are commonly reflected in on-chain data long before they influence broader market perception, reinforcing why activity trends can diverge from headline sentiment.

From a macro perspective, the current crypto environment has favored projects demonstrating tangible utility over those relying solely on narrative momentum. Infrastructure and application-focused networks have continued to build quietly, accumulating usage metrics while market attention shifts between sectors. VANRY’s recent activity increase fits within this observable market pattern, where functional ecosystems maintain engagement despite external volatility.

Taken together, the real reason VANRY activity is increasing despite market noise lies in verifiable factors: ongoing technical development, consistent token utility, stable exchange access, and sector-wide dynamics shaped by Bitcoin-led market cycles. Anya sees through objective data that VANRY’s network engagement reflects underlying ecosystem growth rather than short-term speculation, offering a clear, fact-driven explanation for the rising activity visible on-chain today.