Profits Are Temporary, Discipline Is Permanent

One of the most satisfying moments in trading is not watching numbers go up—it’s realizing that you’re no longer emotionally trapped by the market. When profits grow, yes, it feels good. But when clarity grows, that feeling is on another level entirely.

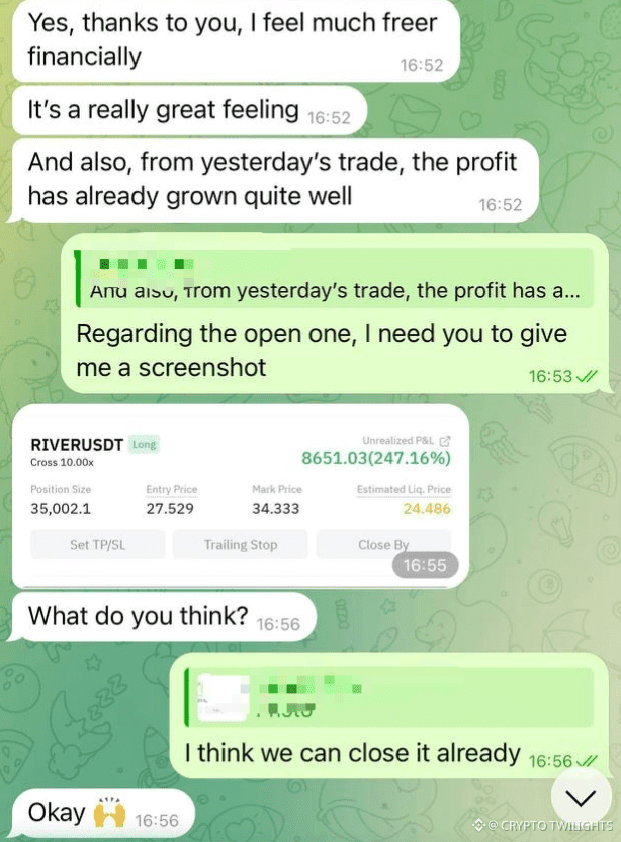

In the image above, the numbers tell a story of a strong move and healthy unrealized profit. But the real story isn’t the percentage or the dollar value. The real story is decision-making under control.

Many traders lose not because the market is against them, but because they stay in positions longer than they should. Greed whispers, “Just a little more.” Fear replies, “What if it goes back?” And in between those two emotions, discipline quietly disappears.

That’s why the most powerful sentence in that entire conversation is simple:

“I think we can close it already.”

That sentence shows maturity.

Understanding When Enough Is Enough

The market will always offer another opportunity. Always.

But your capital, your mindset, and your confidence are limited resources.

When a trade has already delivered strong returns:

The goal is no longer maximizing profit

The goal becomes protecting what has already been earned

Unrealized profit is not yours until the trade is closed. Many traders forget this and mentally spend profits that don’t yet exist. Discipline means respecting the difference between potential and realized gains.

Financial Freedom Starts in the Mind

Feeling “freer financially” doesn’t come from one big trade. It comes from consistency. From repeating the same correct behaviors:

Entering with a plan

Managing risk

Taking profits without regret

Accepting that no trade captures the full move

This mindset removes pressure. When pressure is gone, execution improves. When execution improves, results follow naturally.

The Trap of Overconfidence

High leverage and fast-moving profits can create a dangerous illusion:

“I’ve figured it out.”

That’s usually when traders break rules.

A disciplined trader sees a large profit and asks:

Is this aligned with my plan?

Has my risk already been satisfied?

Am I staying because of logic or emotion?

Closing a profitable trade is not weakness. It’s strength. It’s the ability to walk away when the market has already paid you.

Why Closing Early Is Often the Smartest Move

Markets don’t move in straight lines. After sharp expansions, pullbacks are normal. Waiting for “just one more candle” often turns winners into breakeven trades—or worse, losses.

Professional thinking says:

> “I don’t need the top. I need consistency.”

Locking in profits:

Reduces emotional fatigue

Builds confidence

Protects capital

Keeps your trading account stable

And stability is what allows growth over time.

The Bigger Picture

Trading success is not about screenshots or percentages. It’s about:

Sleeping well at night

Trusting your process

Knowing you acted rationally

Anyone can win a big trade. Very few can close it at the right time.

The moment you can calmly say, “This is enough, let’s close,” you’ve already stepped into a higher level of trading.

Final Thought

The market rewards patience, but it punishes attachment.

Take what the market gives.

Respect your plan.

Protect your profits.

Because in the long run, discipline compounds faster than any trade ever will.