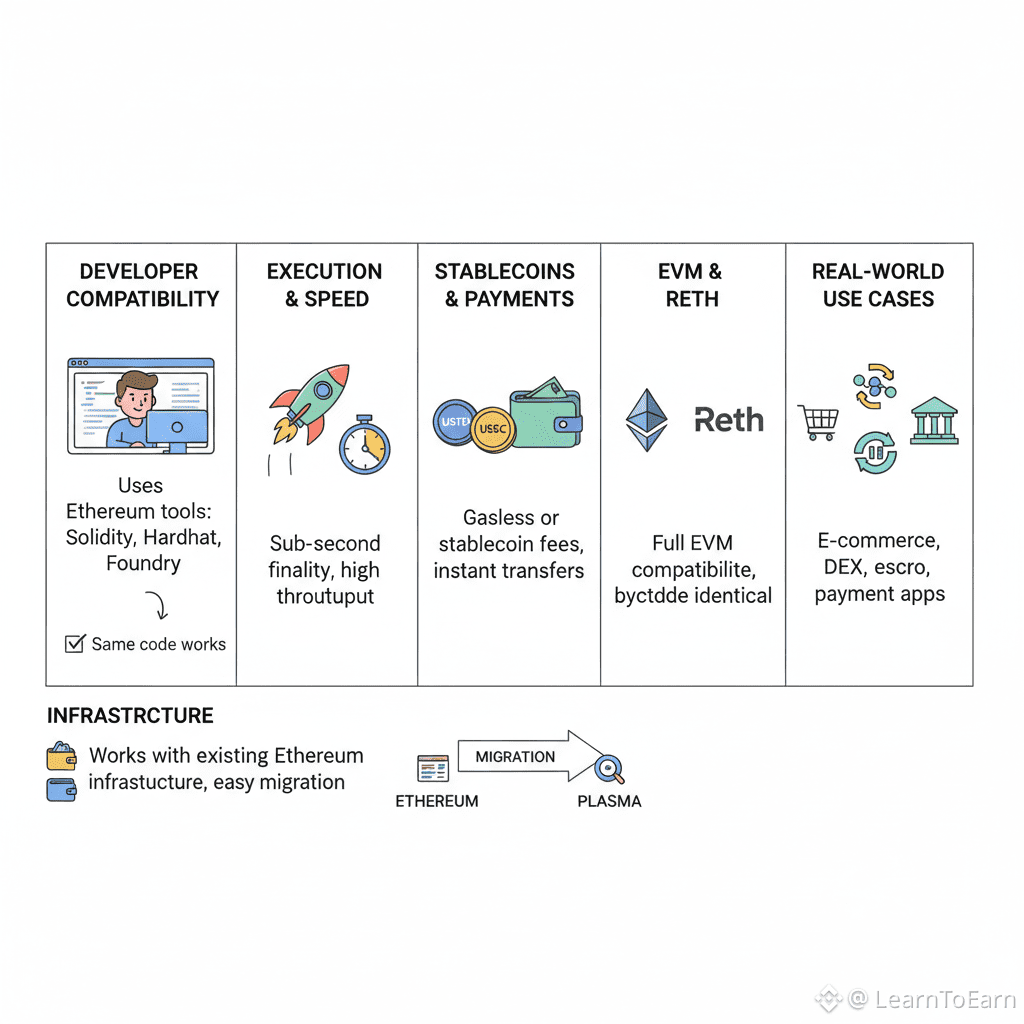

Plasma’s decision to pursue full, unmodified EVM compatibility is best understood as a strategic response to one of blockchain’s most persistent problems: how to innovate without isolating yourself from developers. Every new Layer 1 network promises faster execution, cheaper transactions, or specialized functionality, yet many fail because they launch into an ecosystem vacuum. They resemble empty highways—technically impressive, but with no vehicles to justify their existence. Plasma confronts this dilemma directly by anchoring its execution layer to the Ethereum Virtual Machine, ensuring that technical progress does not come at the cost of adoption. By building on Reth, a high-performance Rust implementation of Ethereum, Plasma does more than optimize throughput; it inherits the largest and most battle-tested developer ecosystem in Web3 and removes the primary friction that slows new chains down.

When Plasma speaks about full EVM compatibility, it is making a strict technical claim rather than a loose marketing promise. Smart contracts compiled for Ethereum behave the same way on Plasma, down to bytecode execution and state transitions, as long as the same inputs are provided. The same opcodes execute, the same gas accounting logic applies, and the same JSON-RPC interfaces respond to wallets and development tools. This consistency is achieved through Reth, which is not a redesigned virtual machine but a faithful, optimized implementation of Ethereum’s execution layer. Developers writing Solidity contracts for Plasma use the same compiler, the same frameworks such as Hardhat or Foundry, and the same deployment workflows they already rely on. While Plasma introduces its own consensus mechanism and economic model, the experience of building and the behavior of deployed contracts remain indistinguishable from Ethereum itself.

This architectural choice becomes a powerful adoption engine because it collapses the learning curve for developers. Ethereum has accumulated tens of thousands of active developers over the years, and Plasma allows them to deploy applications without retraining or retooling. Existing codebases can be reused with minimal changes, often requiring nothing more than a configuration update. A decentralized exchange, a lending protocol, or a payment contract that already runs on Ethereum can be deployed on Plasma in hours rather than months. This drastically lowers the opportunity cost of experimentation and makes Plasma an attractive extension of any multi-chain strategy rather than a risky bet on unfamiliar infrastructure.

Beyond developer convenience, EVM compatibility allows Plasma to inherit Ethereum’s liquidity and composability. Stablecoins such as USDT and USDC already follow ERC-20 standards, which means they integrate natively into Plasma’s environment. Developers can also rely on the vast library of audited smart contract components that power Ethereum’s DeFi ecosystem, from OpenZeppelin’s security-hardened contracts to automated market maker logic inspired by Uniswap or Curve. This composability allows Plasma’s ecosystem to mature rapidly, achieving depth and reliability that would otherwise take years of iterative development and auditing.

The benefits extend to infrastructure as well. New blockchains often struggle with a cold start problem, launching without wallets, explorers, indexers, or node providers. Plasma avoids this entirely by conforming to Ethereum’s standards. Popular wallets like MetaMask and Rabby work immediately, development suites connect without modification, and data providers that already support Ethereum RPC endpoints can index Plasma from day one. This mature tooling environment accelerates debugging, monitoring, and deployment, allowing innovation to compound rather than stall on basic infrastructure gaps.

What makes Plasma distinct is that this familiarity exists within a highly specialized environment. Plasma is not simply “Ethereum, but faster.” It uses the EVM as a processor while surrounding it with systems designed specifically for stablecoin settlement. Transaction ordering and finality are handled by PlasmaBFT, a Byzantine Fault Tolerant consensus mechanism that delivers deterministic finality in under a second. From a developer’s perspective, contract execution feels the same, but the results are settled almost instantly, enabling payment use cases that are impractical on Ethereum mainnet. The economic model further reinforces this specialization by allowing gas fees to be sponsored or paid directly in stablecoins, creating a user experience that feels closer to traditional digital payments than to crypto transactions. At the security level, Plasma periodically anchors its state to Bitcoin, adding an external layer of neutrality and censorship resistance without requiring any changes to smart contract code.

This combination of familiarity and performance becomes especially clear when applied to real-world use cases. Consider an e-commerce platform that wants to accept USDT with escrow protection. On Plasma, the platform can deploy a standard Solidity escrow contract drawn from existing Ethereum libraries. Customers pay from their usual wallets, transactions finalize in under a second, and fees can be sponsored to create a gasless experience. The escrow logic behaves exactly as it would on Ethereum, but settlement is instant and predictable. Similarly, a stablecoin-focused decentralized exchange can deploy proven AMM designs with minimal configuration changes. Faster finality improves arbitrage efficiency and pricing, while standard ERC-20 liquidity tokens remain fully composable across the Plasma ecosystem.

This approach does involve trade-offs. By committing to full EVM compatibility, Plasma inherits some of Ethereum’s limitations, including execution models that were designed for generality rather than maximum speed. Certain opcodes and patterns remain inefficient, and the system must support features that are not strictly necessary for payments. Plasma also shares Ethereum’s security considerations, meaning developers and protocol designers must remain vigilant against known classes of smart contract vulnerabilities while simultaneously auditing Plasma’s unique consensus and fee mechanisms. These costs, however, are accepted as the price of ecosystem access and developer trust.

In the end, Plasma’s strategy reflects a deeply pragmatic view of blockchain adoption. The fastest way to build a useful network is not to invent entirely new paradigms, but to remove friction for those who already know how to build. Full EVM compatibility ensures that Plasma’s high-performance, payment-optimized infrastructure is immediately usable, populated with applications, liquidity, and familiar tools from day one. Developers arrive for the comfort of known interfaces, stay for sub-second finality and stablecoin-native economics, and build systems that attract users at scale. By pairing radical improvements under the hood with conservative, familiar surfaces on top, Plasma positions itself not as an experimental alternative, but as a practical and adoptable settlement layer for the next phase of global digital finance.

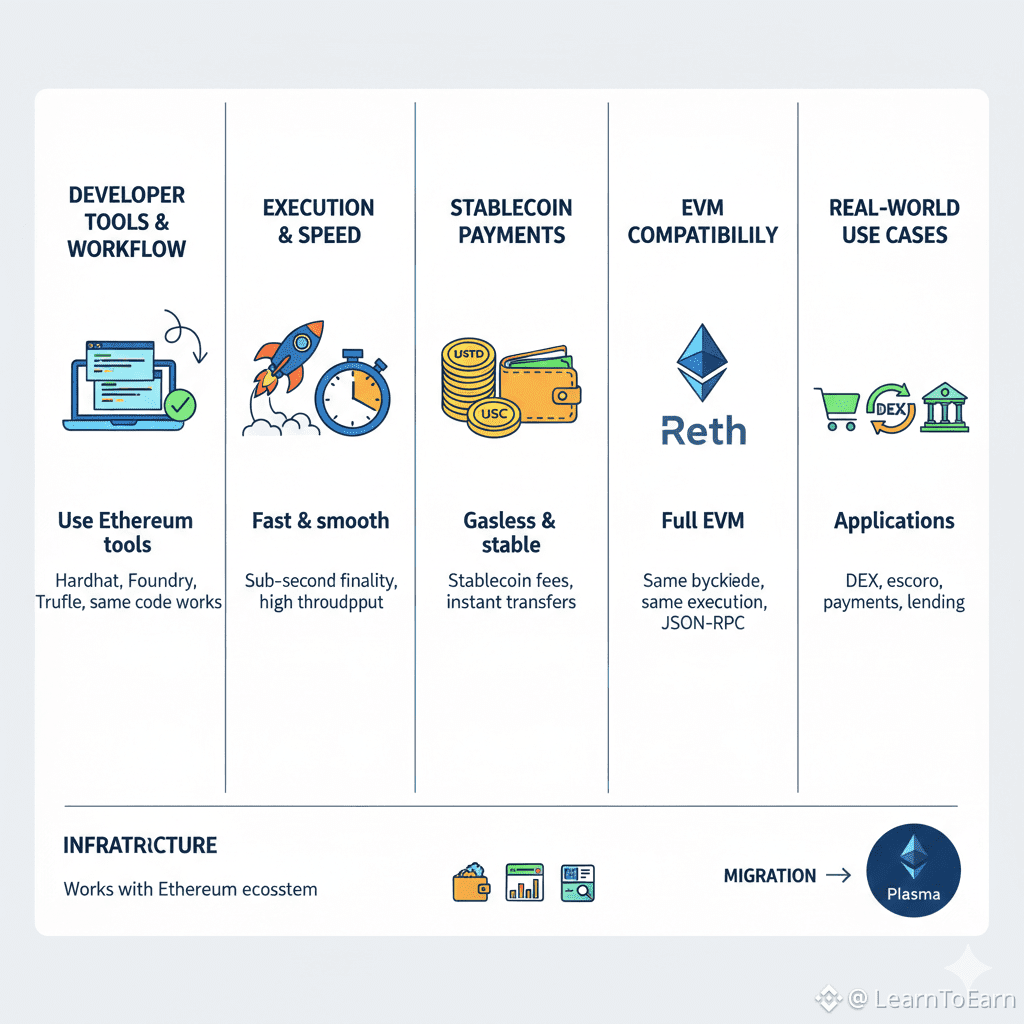

Plasma’s approach to developer adoption is rooted in a clear understanding of where most Layer 1 blockchains fail: not in raw performance, but in the friction they impose on builders. A network can offer sub-second finality, high throughput, and novel economic models, yet still struggle to gain traction if developers must abandon familiar tools and workflows. Plasma resolves this paradox by committing to full, unmodified Ethereum Virtual Machine compatibility through its Reth-based execution layer. This decision turns Plasma into a natural extension of the Ethereum world rather than a parallel ecosystem, allowing developers to arrive with their existing tools, habits, and codebases fully intact.

At the technical level, this seamless experience is only possible because Plasma mirrors Ethereum with precision. Smart contracts compiled for Ethereum produce the same bytecode and execute with identical semantics on Plasma. The same opcodes run, the same gas rules apply, and the resulting state is structured in the same way as Ethereum’s. Under the hood, Reth faithfully implements the Ethereum protocol, ensuring that execution behavior is not “Ethereum-like,” but Ethereum-identical. Equally important is Plasma’s strict adherence to Ethereum’s JSON-RPC interface. Every request that a wallet, framework, or monitoring tool makes—whether it is querying a balance, sending a raw transaction, or tracing execution—is answered in the exact format those tools expect. Because the protocol speaks Ethereum fluently at both the execution and API layers, existing tooling connects without friction or special adapters.

This foundation unlocks the entire Ethereum development environment the moment a developer points their configuration to a Plasma RPC endpoint. Wallets such as MetaMask, Rabby, and any WalletConnect-compatible client work immediately, requiring nothing more than standard network parameters. Private keys, signatures, and transaction flows behave exactly as they do on Ethereum. Even though Plasma introduces innovations like gasless stablecoin transfers and stablecoin-denominated fees, these differences are abstracted away from the wallet through protocol-level mechanisms. To the user, sending USDT on Plasma feels like a normal transaction—only faster and simpler.

Development and testing workflows carry over just as smoothly. Frameworks like Hardhat, Foundry, and Truffle function without modification, enabling developers to write, compile, and test Solidity or Vyper contracts using the same commands and plugins they already rely on. Local development nodes can emulate the Plasma environment, and existing test suites—whether written in JavaScript with Mocha and Chai or directly in Solidity using Foundry—run unchanged. Logic that has already been validated on Ethereum behaves the same way on Plasma, giving teams confidence before deploying to production.

Deployment and operational tooling follow the same pattern of continuity. Scripts written with ethers.js, web3.js, or viem only need a new RPC endpoint to target Plasma. Even complex deployment pipelines involving proxy upgrades, multi-contract initialization, or governance setup proceed without interruption. Continuous integration and delivery systems that automate Ethereum deployments can be duplicated for Plasma with minimal effort, allowing teams to manage releases with the same discipline and safeguards they already use on mainnet.

Once applications are live, monitoring and data tooling remain just as familiar. Debugging platforms connect directly to Plasma’s RPC endpoints, providing transaction simulations, execution traces, and alerts identical to those used on Ethereum. Indexing solutions ingest Plasma’s blocks and logs in standard Ethereum formats, enabling frontends to query application state using the same GraphQL schemas and queries. Block explorers, whether Plasma-native or adapted from existing Ethereum explorers, present transactions, events, and internal calls in layouts developers already understand.

The strategic impact of this compatibility extends far beyond convenience. By eliminating tooling friction, Plasma dramatically shortens the time it takes to bring applications to market. Teams that have already built on Ethereum can deploy optimized versions of their products on Plasma in days rather than months, focusing on configuration rather than reinvention. Security risks are also reduced, as developers continue to rely on audited libraries, established patterns, and mature analysis tools. Instead of worrying about untested toolchains, they can concentrate on Plasma’s unique features, such as its consensus model and stablecoin-first economics.

This approach also broadens Plasma’s reach into the global developer talent pool. Solidity developers and Ethereum engineers can become productive almost immediately, without learning new languages or paradigms. In a market where skilled blockchain developers are scarce, this accessibility is a decisive advantage. Capital and liquidity benefit from the same standardization, as cross-chain bridges and messaging protocols already know how to interact with EVM-based networks, making it easier to route stablecoins and assets into Plasma from across the Ethereum ecosystem.

The effect of this design choice becomes especially clear when viewed through a practical example. A team launching a stablecoin-focused decentralized exchange can fork an existing, audited AMM design, run its existing tests against a Plasma environment, deploy using familiar scripts, integrate a frontend with standard wallet libraries, and monitor performance with established debugging tools—all within a single week. At no point do they need to rewrite core logic or adopt unfamiliar infrastructure. The only real difference is that the final product benefits from Plasma’s sub-second finality and user-friendly fee model.

Ultimately, Plasma’s commitment to out-of-the-box Ethereum tooling reflects a deep understanding of what truly drives ecosystem growth. Developer attention and time are limited resources, and Plasma refuses to waste them on unnecessary friction. By meeting builders where they already are—inside their existing wallets, frameworks, and repositories—it turns familiarity into a competitive advantage. This seamless bridge does more than make Plasma easy to use; it makes it immediately useful. In doing so, Plasma positions itself not as an experimental departure from Ethereum, but as a pragmatic evolution of it, purpose-built for fast, reliable, and scalable stablecoin settlement at a global level.

Plasma approaches one of the hardest problems in the multi-chain world with a simple but powerful idea: migration should feel like an upgrade, not a rewrite. Across the blockchain industry, developers repeatedly face the same dilemma. New chains promise faster execution, cheaper transactions, or purpose-built performance, yet moving an existing decentralized application from Ethereum usually comes with painful trade-offs. Codebases must be refactored, tooling replaced, audits repeated, and users retrained. The cost and risk of this process often outweigh the benefits, leaving innovation stuck on congested infrastructure. Plasma, designed as a high-performance stablecoin settlement layer, resolves this dilemma by making migration economically and technically rational through full, bytecode-level EVM compatibility.

The foundation of this seamless migration lies in Plasma’s execution environment. By using a Reth-based EVM that mirrors Ethereum precisely, Plasma achieves true binary compatibility. A smart contract compiled for Ethereum produces the same bytecode and executes with the same semantics on Plasma. There is no need for alternative compilers, adapters, or wrapper contracts. Storage layout, one of the most fragile aspects of any migration, is preserved exactly because Plasma follows Ethereum’s keccak256-based storage rules. This means upgradable proxy contracts, complex state mappings, and long-lived user balances can be migrated safely without risking corrupted state or broken upgrade paths. Even advanced contract behavior relying on precompiled contracts or intricate opcode patterns behaves identically, ensuring mathematical and logical equivalence across chains.

Because the execution layer is identical, the developer workflow changes only at the configuration level. Migration is not a rebuild but a redeployment. Teams continue to use the same development commands, the same test suites, and the same deployment scripts they already trust. Instead of rewriting logic, they simply point their tooling to a new RPC endpoint. Local testing, integration testing, and fork-based simulations behave as expected, providing confidence that application behavior remains unchanged. Infrastructure components follow the same pattern. Wallets connect through standard network configuration, indexers redeploy by targeting Plasma endpoints, and analytics platforms can interpret Plasma data using existing Ethereum schemas. Oracles and monitoring systems integrate using the same interfaces, turning what would normally be a tooling overhaul into a straightforward environment switch.

For users, the migration is designed to be nearly invisible. They interact with migrated applications using the same wallets, the same addresses, and the same private keys. There is no new key management burden and no unfamiliar interaction patterns. Yet, without any changes to the application’s smart contracts, users immediately benefit from Plasma’s native advantages. Transactions finalize in under a second, removing the psychological friction of waiting for confirmations. Stablecoin transfers can be gasless, sponsored at the protocol level, transforming everyday interactions into something that feels closer to traditional digital payments. Existing assets retain continuity through bridging, allowing users to move familiar stablecoins from Ethereum into Plasma without abandoning the broader ecosystem.

The strategic logic behind migrating to Plasma becomes especially clear for applications centered on payments and stablecoins. Decentralized exchanges focused on stable pairs gain faster arbitrage and lower slippage due to rapid finality. Payment platforms can finally support point-of-sale use cases and subscriptions without exposing users to volatile gas fees. Lending and money market protocols benefit from deterministic settlement, improving capital efficiency and liquidation accuracy. Bridges and liquidity hubs find in Plasma a natural settlement destination where assets can exit quickly and cheaply. In each case, the application logic remains the same, but the performance profile improves dramatically.

This performance improvement translates directly into business value. Finality measured in seconds rather than minutes reshapes user expectations. Predictable, stablecoin-denominated fees remove cost uncertainty. Higher throughput allows applications to scale during periods of volatility instead of throttling usage. Just as importantly, Plasma enables access to markets that are effectively unreachable on slower, more expensive chains. Retail payments, remittances, institutional treasury flows, and users in high-inflation economies all require speed, cost predictability, and settlement certainty. Plasma’s design aligns precisely with these needs.

A practical migration follows a clear and efficient path. Teams begin by reviewing their existing codebase to identify assumptions tied to Ethereum’s environment, such as hardcoded addresses or timing expectations. They then configure Plasma RPC endpoints and deploy contracts using the same scripts they already maintain. Verification proceeds through familiar explorer interfaces, and frontends are updated by switching network parameters and contract addresses. Optional enhancements, such as enabling gasless interactions through Plasma’s paymaster system, can be layered on without touching core logic. Liquidity is bridged, users are informed, and monitoring resumes using the same dashboards and alerting tools already in place. What might once have been a multi-month engineering effort becomes a matter of days.

Of course, migration is not entirely without challenges. Liquidity must be bootstrapped on the new chain, oracles must be available, and communities must be aligned through governance. Yet these are operational and strategic considerations rather than technical roadblocks. They can be addressed with incentives, partnerships, and phased deployment strategies that allow Ethereum to remain a liquidity anchor while Plasma serves as a high-performance execution layer.

In this light, Plasma reframes migration as a strategic upgrade rather than a disruptive fork. Applications are not leaving Ethereum behind; they are extending themselves into a specialized environment optimized for speed, stability, and payments. Ethereum remains the center of gravity for liquidity and security, while Plasma becomes the place where financial applications run at the pace required by global commerce. By eliminating the traditional porting paradox, Plasma opens a clear pathway for existing dApps to evolve without sacrificing continuity. It positions itself not as a rival draining value from Ethereum, but as a complementary layer that amplifies Ethereum’s utility by giving its most demanding applications room to operate at full speed.@Plasma #plasma $XPL