One Good Trade Is Enough — If You Know When to Stop

There is a moment in every trader’s journey that separates experience from emotion. It’s not when you enter a trade. It’s not even when price moves in your favor.

It’s the moment when profit is already on the screen… and you decide what to do next.

Most people think trading is about finding the perfect entry. In reality, trading is about managing yourself after the entry. That’s where most accounts are made—or destroyed.

---

The Trade Was Right, But That’s Not the Lesson

The setup was clean.

The direction was clear.

The execution was correct.

The trade did exactly what it was supposed to do.

But the real success wasn’t the percentage gain.

The real success was the decision to close.

Many traders fail not because they are wrong, but because they don’t know when to stop being right.

They see profit and immediately start imagining more:

“What if it keeps going?”

“Let me hold a bit longer.”

“This could be the big one.”

That voice has wiped out more profits than bad analysis ever has.

---

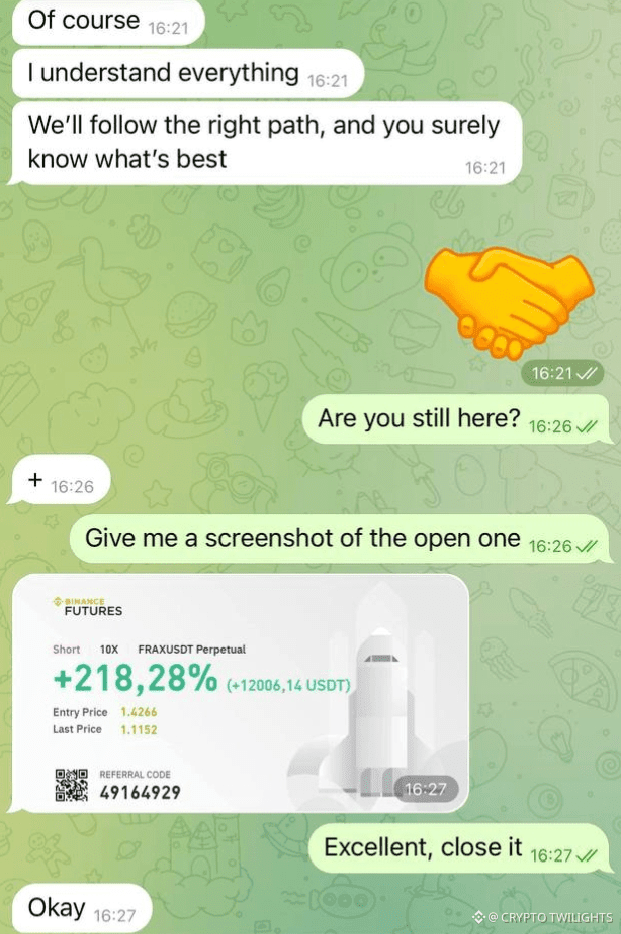

Discipline Speaks Quietly

Notice something important:

There was no excitement.

No rush.

No celebration.

Just a simple instruction:

“Excellent, close it.”

That’s how discipline looks in real trading. Calm. Boring. Controlled.

Professional behavior is often mistaken for lack of confidence. In reality, it’s the highest form of confidence—confidence in your process, not in your emotions.

---

Why Closing on Time Matters More Than Entry

Anyone can catch a good move once in a while.

Very few can consistently protect profits.

Markets don’t reward greed. They exploit it.

When you delay closing a winning trade, you are no longer trading your plan—you are trading hope. And hope has no stop loss.

Closing a trade on time means:

You respected your target

You followed your rules

You stayed emotionally neutral

You lived to trade another day

That’s how longevity is built.

---

Big Numbers Don’t Make Big Traders

A common trap is chasing screenshots instead of sustainability.

One big trade feels good.

But a series of controlled, repeatable trades builds a career.

Professional traders are not obsessed with:

Maximum leverage

Extreme risk

All-or-nothing positions

They are obsessed with:

Capital protection

Consistency

Risk-to-reward discipline

The market will always be there tomorrow. Your capital might not be if you don’t respect it today.

---

Silence After Execution Is a Skill

Look at what happened after the trade was shown.

No arguments.

No second-guessing.

No emotional debate.

Just execution → confirmation → closure.

That silence is powerful.

Most losses happen after profit appears—when traders start interfering with their own system.

If you feel the urge to constantly check, adjust, or overthink a running trade, that’s a sign your system isn’t the problem—your discipline is.

---

Trading Is a Mental Game First

Charts don’t break accounts.

People do.

Impatience, greed, fear, and ego are far more dangerous than any market volatility.

The ability to say “enough” is what keeps traders in the game long-term.

Closing a winning trade is not weakness.

It’s mastery.

---

Respect the Process, Not the Outcome

Focus less on:

How much you made

How big the move was

How impressive it looks

Focus more on:

Did you follow your plan?

Did you manage risk properly?

Did you exit according to rules?

If the answer is yes, then the trade was successful—regardless of the number.

---

Final Thought

The market rewards patience, discipline, and restraint far more than aggression.

Anyone can open a trade.

Not everyone can close it at the right time.

If you can master that one decision—

you’re already ahead of most traders.

Stay calm.

Stay disciplined.

Let the process do the work.