Plasma caught my attention not because it promises something abstract or futuristic, but because it focuses on a problem that already exists at massive scale: moving stable value quickly, cheaply, and reliably across borders. Stablecoins are no longer an experiment. They are already being used daily by millions of people, especially in regions where traditional banking is slow, expensive, or unreliable. Plasma feels like a chain that starts from this reality instead of trying to invent a new one.

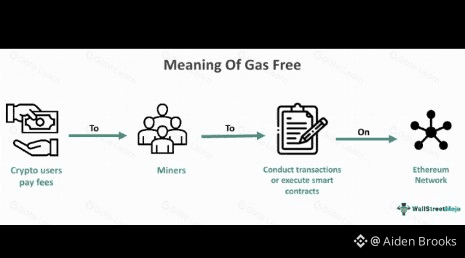

What stands out immediately is how intentionally Plasma is designed around stablecoins rather than treating them as just another asset type. Gasless USDT transfers and stablecoin-first gas are not gimmicks; they directly remove two of the biggest friction points in real-world usage. Anyone who has ever tried to explain gas fees to a non-crypto user knows how quickly that conversation kills adoption. Plasma’s approach flips the model. Instead of asking users to hold a volatile native token just to move value, it lets them transact directly with stablecoins. That single design choice makes the network far more approachable for everyday users and businesses alike.

From a technical standpoint, Plasma’s full EVM compatibility through Reth is a smart move. It lowers the barrier for developers who are already building on Ethereum while offering them a faster, settlement-focused environment. Sub-second finality via PlasmaBFT is especially important in payments and financial use cases. Waiting minutes for confirmation might be acceptable in DeFi, but it’s unacceptable at a checkout counter or in institutional settlement. Plasma seems to understand that payments infrastructure must feel instant, even if complex systems are working behind the scenes.

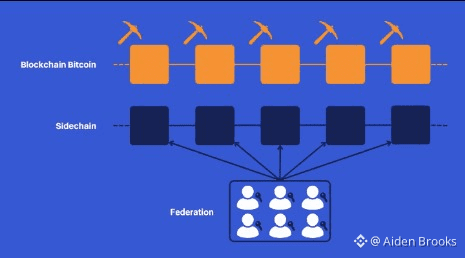

When you compare Plasma to other Layer 1s, the difference in focus becomes clear. Many chains try to be general-purpose platforms competing for everything at once: DeFi, NFTs, gaming, social, and more. Plasma narrows its scope and becomes sharper because of it. Its closest peers are payment-focused blockchains and stablecoin settlement layers, yet few combine EVM compatibility, gas abstraction, and Bitcoin-anchored security in one coherent design. Anchoring security to Bitcoin adds an extra layer of neutrality and censorship resistance that institutions care deeply about, especially as regulatory scrutiny increases globally.

I’ve seen firsthand how stablecoins are used in high-adoption markets. For many people, they are not speculative instruments; they are digital dollars used for remittances, payroll, and savings. Plasma’s target audience reflects this reality, spanning both retail users in emerging economies and institutions operating in payments and finance. This dual focus is difficult to execute, but if done right, it creates powerful network effects. Retail usage drives volume, while institutional integration brings liquidity, compliance, and long-term stability.

Looking ahead, Plasma’s potential market integrations are compelling. Payment processors, fintech apps, remittance services, and even traditional financial institutions could use Plasma as a settlement layer without forcing users to think about blockchain mechanics. Imagine cross-border payments that settle in seconds using USDT, with fees that are predictable and transparent. Imagine businesses paying suppliers or employees globally without relying on slow correspondent banking networks. These are not distant scenarios; they are practical use cases that Plasma is structurally built to support.

What I appreciate most is that Plasma doesn’t feel like it’s chasing hype. It feels like infrastructure quietly positioning itself where demand already exists. As stablecoins continue to grow and regulators clarify frameworks around them, networks that prioritize neutrality, speed, and usability will matter more than ever. Plasma seems to be building for that future with patience and precision.

The real question is simple but powerful: if stablecoins are already reshaping global finance, which blockchains will become their natural home? Plasma is clearly making its case, not with noise, but with design choices that align with how people actually move money today.