Knowing When to Lock Profit Is a Skill, Not Luck

Every trader dreams of moments when the market moves exactly as expected. Price respects the direction, momentum builds, and the numbers on the screen grow larger with every tick. But those moments are also the most dangerous ones—because that’s when emotions quietly take control.

The real test is not whether a trade goes into profit.

The real test is what you do after it does.

---

When Profit Appears, Psychology Takes Over

At first, everything is calm. The trade is planned, risk is defined, and execution is clean. But once unrealized profit starts increasing, the mind shifts.

Thoughts begin to creep in:

“This move is strong, maybe it will go further.”

“What if I close now and miss more profit?”

“Let me just wait a little longer.”

This is where discipline is either proven—or exposed.

Professional trading isn’t about squeezing every last dollar from a move. It’s about locking what the market has already given you.

---

The Power of a Simple Question

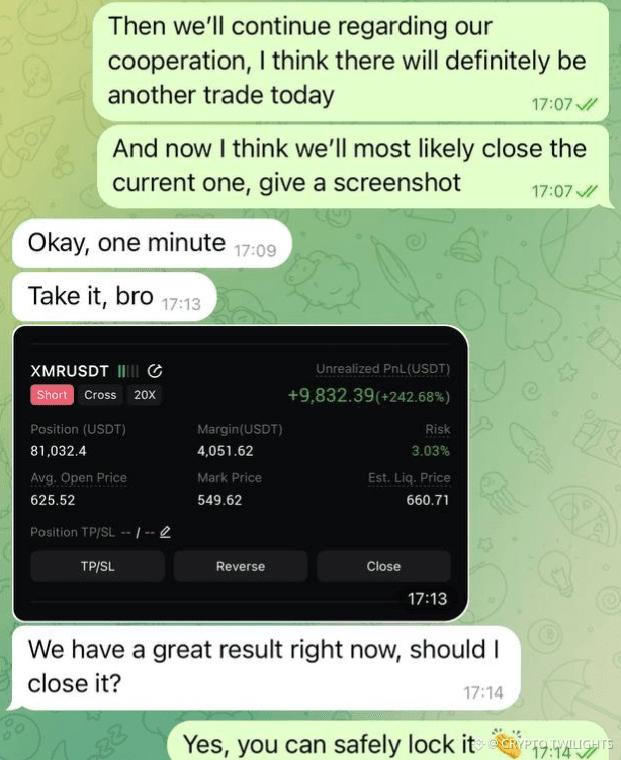

“We have a great result right now, should I close it?”

That one question shows maturity. It shows awareness that profit is not permanent until it’s realized. Markets don’t owe anyone continuation. What is green now can turn red in seconds.

Asking whether to close is not hesitation.

It’s respect for risk.

And the answer was clear:

Yes. Lock it.

---

Locking Profit Is Not Fear — It’s Control

Many traders confuse discipline with fear. They think closing early means they lacked confidence. In reality, it means they had control.

Control over:

Greed

Overconfidence

The urge to gamble

Locking profit is a decision made from logic, not emotion.

The goal is not to predict the future.

The goal is to manage the present.

---

Unrealized Profit Is Just a Number

Until a position is closed, profit is only potential. It exists on the screen, not in the account. The market can take it back at any time—without warning, without apology.

That’s why experienced traders treat unrealized gains carefully. They understand that protecting capital and securing returns matter more than chasing perfection.

One closed, disciplined trade is always better than a perfect trade that was never realized.

---

Consistency Beats Big Wins

Big numbers look impressive, but they don’t define a trader’s success. What defines success is consistency—repeating the same disciplined behavior again and again.

Closing a trade at a planned or logical point:

Builds confidence

Strengthens discipline

Reduces emotional stress

Protects long-term growth

This is how traders survive market cycles.

Calm Decisions Create Long-Term Results

Notice the tone of the decision. There was no excitement, no rush, no ego involved. Just a calm acknowledgment of a good result and a rational choice to secure it.

That calmness is not accidental. It comes from experience, rules, and trust in the process.

The market rewards those who stay neutral more than those who chase adrenaline.

Final Thought

Trading is not about proving how right you are.

It’s about managing risk, respecting profit, and making clear decisions under pressure.

When the market gives you a strong result, the smartest move is often the simplest one:

Lock it. Protect it. Move on.

Because in trading, survival and consistency will always matter more than trying to catch the last move.