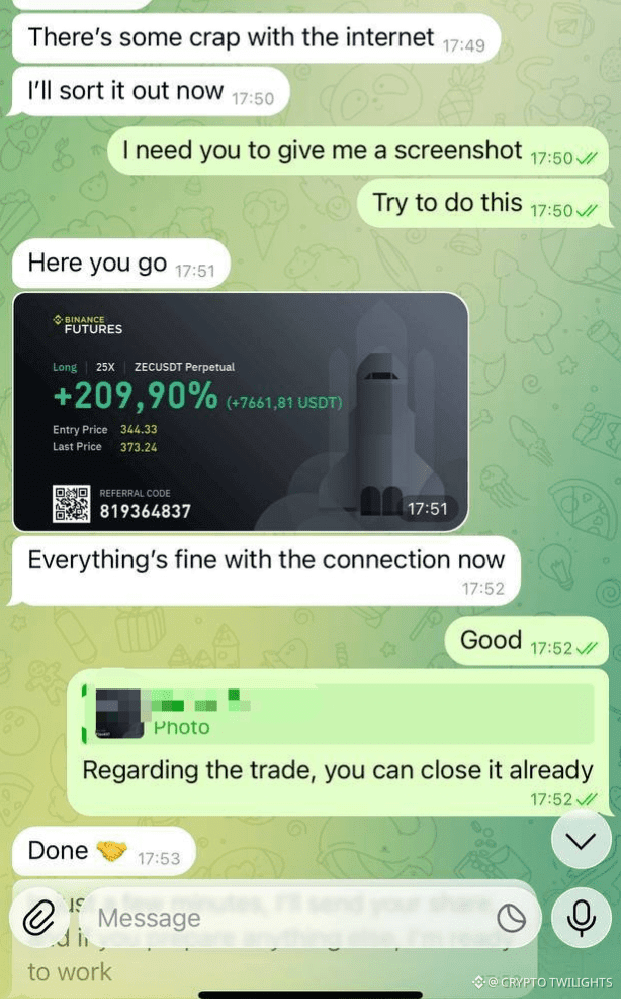

A Simple Screenshot, A Powerful Lesson

Sometimes a single screenshot says more than a thousand charts. Not because of the numbers on it, but because of the behavior behind those numbers.

Look closely at moments like these. A trade is running well. The connection had issues, stress was present, communication was short and direct. Yet the focus stayed where it mattered. Fix the problem. Get the confirmation. Follow the plan. Close the trade. Done.

This is how trading should look in real life—not dramatic, not emotional, not noisy.

Many people think trading is about predicting the market or catching the biggest move. In reality, trading is about execution under normal conditions and pressure under abnormal ones. Internet issues, delays, fear of missing out, excitement after seeing green numbers—these things test a trader far more than the chart itself.

Notice something important here:

There was no panic. No rush to boast. No overreaction. Just a clear request for proof, confirmation of stability, and a calm instruction to close the trade. That’s discipline.

A lot of traders lose not because their analysis is wrong, but because their process breaks down when emotions enter. They hesitate when they should act, or they act when they should wait. They hold winning trades too long hoping for more, and cut losing trades too late hoping for recovery. Both mistakes come from the same place: lack of control.

Professional behavior is boring by design.

It’s boring to wait.

It’s boring to follow rules.

It’s boring to close a trade when the target is hit instead of dreaming about “what if it goes more.”

But boring is profitable.

Another lesson hidden here is trust, but verify. Asking for a screenshot isn’t about doubt; it’s about clarity. In trading, assumptions are expensive. You don’t assume execution happened—you confirm it. You don’t assume conditions are fine—you check them. This habit alone separates consistent traders from gamblers.

Also, notice the mindset around the result. The trade was closed, acknowledgment given, and the moment passed. No attachment. No emotional high. The market doesn’t care about our feelings, and experienced traders don’t demand validation from the market either.

One good trade doesn’t make you successful.

One bad trade doesn’t make you a failure.

What defines you is how repeatable your actions are.

Can you follow the same steps again tomorrow?

Can you stay calm when things don’t go smoothly?

Can you take profit without regret?

Can you accept closure without greed?

These are the real questions every trader should ask themselves.

If you’re still chasing excitement in trading, you’re not trading—you’re entertaining risk. The goal is not to feel something. The goal is to execute well, again and again, until results become a byproduct of discipline.

So next time you see a screenshot like this, don’t focus only on the percentage or the profit. Focus on the behavior behind it. That’s where the real edge lives.

Stay patient.

Stay structured.

Stay professional.

The market rewards those who respect the process, not those who chase the outcome.