There is a particular kind of powerlessness that modern life has perfected. It doesn't arrive with a dramatic crash, but with a quiet, systemic sigh. It's the fee that appears from nowhere, shaving off the top of a carefully calculated grocery budget. It's the international transfer that takes a "business week" to crawl across borders, while a family's need for medicine or tuition is urgent, now. It's the invisible barrier that tells a small business owner in one country that the global marketplace is open in theory, but closed in practice, locked behind a vault door of complexity, cost, and delay. This powerlessness isn't an accident; it is the design of a financial system built for intermediaries, not for individuals. We are taught to see these frictions as natural, as the inevitable "cost of doing business." But what if we began to see them for what they truly are: a silent tax on human potential, a drip-by-drip erosion of agency that tells us the system is not ours to command?

For generations, we have outsourced our financial agency. We hand our paychecks to institutions that charge us to access our own money. We trust third parties to move our value across invisible ledgers, accepting their delays and their cuts as the price of participation. This has trained us into a posture of passive acceptance. We are users, not owners; passengers, not pilots. The revolutionary promise of decentralized technology was meant to shatter this mold, to return agency to the individual. Yet, too often, we've rebuilt the same cages with new materials—complex private keys, volatile gas fees, and user experiences that feel like navigating a submarine with a manual written in code. The gatekeepers changed their uniforms, but the gates remained.

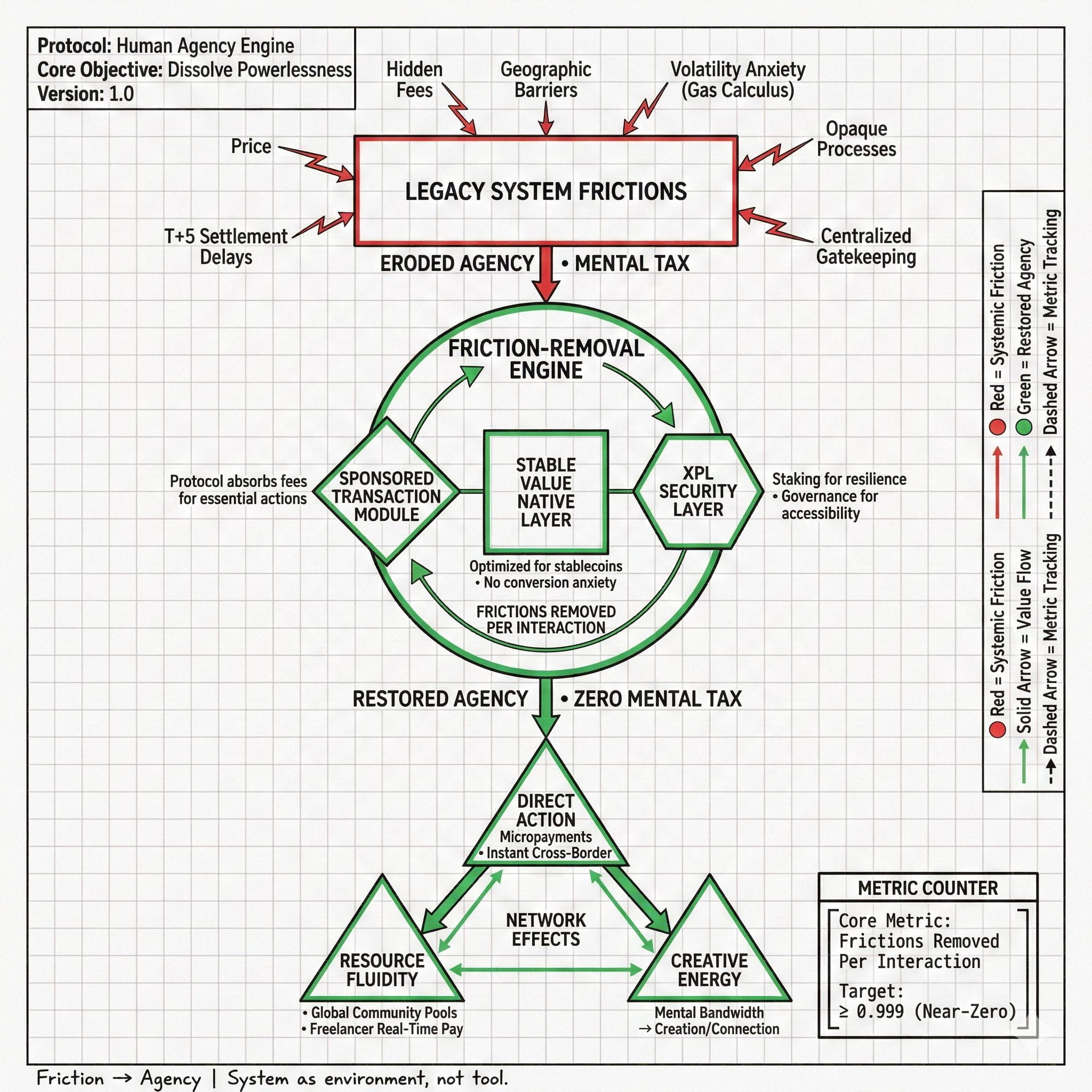

This is the critical juncture. The next evolution isn't about a marginally better wallet or a slightly faster chain. It is about a fundamental reorientation of intent. What if the entire system was engineered from the first line of code not to attract speculative capital, but to dissolve the very experience of powerlessness? What if the core metric of success was not transactions per second, but frictions removed per interaction?

Imagine an architecture designed for the dignity of direct action. A migrant worker finishes a long shift. The act of sending earnings home is not a journey through a labyrinth of forms and fees. It is a simple tap. The value moves, near-instantly and near-freely, arriving in full. The technology doesn't just facilitate the transfer; it actively protects the intent and the full weight of the care behind it. This is possible through a foundational shift: building a chain whose primary, native language is stable value. When the network itself is optimized for the transfer of stablecoins, the user is liberated from the constant, anxiety-inducing calculus of converting volatile assets just to pay a fee. They can transact in the value they already hold and trust. The system conforms to their reality, not the other way around.

This philosophy extends to every point of contact. It means a protocol so committed to accessibility that it can sponsor those zero-fee transactions for essential actions, absorbing the cost so the user doesn't have to. It means a design where paying for a service, contributing to a community fund, or buying a digital asset doesn't require a degree in cryptocurrency. The complexity is engineered into oblivion, leaving only pure utility. The native token of such a network, XPL, finds its highest purpose not in speculation, but in securing and governing this radically accessible environment. It is the stake that ensures the network remains resilient and decentralized, protecting the very simplicity that users rely on. Its value is directly tied to the utility and security it provides to the human-scale transactions happening on top of it.

The outcome is more than convenience. It is the restoration of economic agency. When financial friction approaches zero, behavior changes. Micropayments become practical, unlocking new models for artists, writers, and creators. Community projects can pool resources across continents without a bank account. A freelancer can invoice a client on the other side of the world and be paid before the video call ends. The mental energy once spent navigating the system is freed for creation and connection. The silent tax on potential is repealed.

We are moving beyond building financial tools. We are learning to build financial environments. An environment is not a tool you pick up and put down; it is the space in which you live and operate. A healthy financial environment is one where the infrastructure is so reliable, so intuitive, and so aligned with your needs that it becomes invisible. It simply works, empowering you to act with confidence and directness. It returns the sense of ownership over your economic life.

This is the quiet, profound work of the new digital frontier. It’s not about shouting from the rooftops of trading floors. It’s about listening to the whispered frustrations of everyday economic life and responding with elegant, resilient code. It is about building a layer where the powerlessness engineered by the old world has no place to take root. The future belongs not to the most complex system, but to the most humane one—a system that sees every fee avoided, every delay prevented, and every barrier removed as its most important victory. It is the foundation for a world where financial agency is not a privilege, but a default setting, and where the flow of value finally serves the flow of human life.