Following the Plan Is the Real Win

This conversation might look simple at first glance, but it reflects something most traders struggle with for years: knowing when to stop.

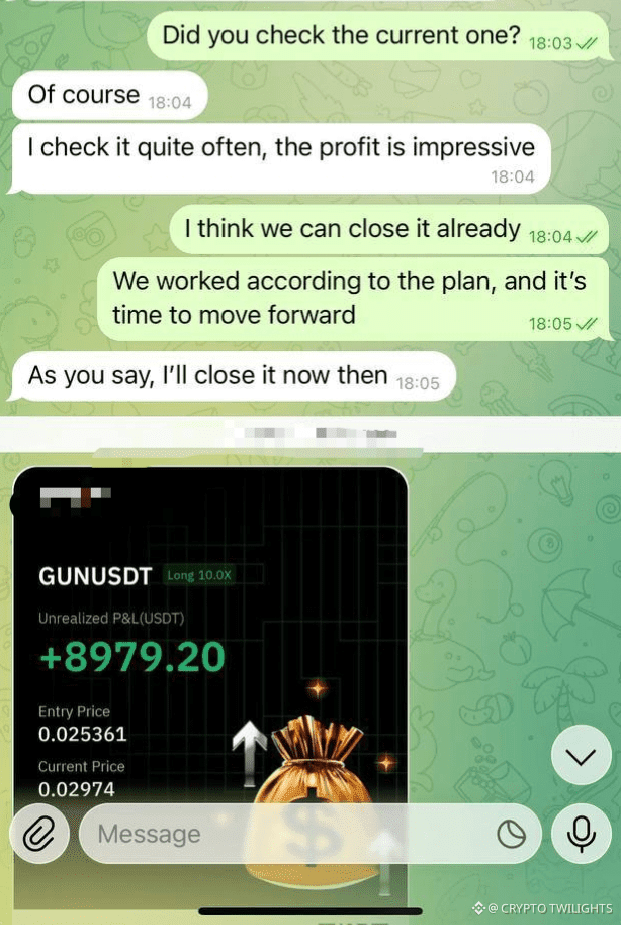

The trade was checked. Not once, but often. The profit was visible, attractive, and tempting. That’s usually the moment where mistakes happen. When numbers look good, the mind starts negotiating. Maybe a little more. What if it keeps going? I’ll close it later.

But instead of negotiating with emotions, the decision came from the plan.

“We worked according to the plan, and it’s time to move forward.”

That single sentence carries more weight than any profit figure. It shows clarity. It shows maturity. It shows respect for a predefined strategy. In trading, the hardest thing isn’t entering a position—it’s exiting one correctly.

Most traders don’t lose because they don’t make money. They lose because they don’t know how to protect money once it’s made.

Closing a trade while it’s still in profit requires discipline. It requires accepting that you’ll never catch the exact top or bottom. It requires letting go of the fantasy of perfection. Professionals don’t aim for perfect trades; they aim for repeatable decisions.

Another important detail here is communication. There’s no confusion, no pressure, no ego. One side checks and reports. The other evaluates and decides. Once the decision is made, it’s executed immediately. No delay. No second-guessing. This is how a structured process works.

Notice how calm everything is. No excitement, no celebration, no dramatic language. That’s not a lack of confidence—it’s control. When trading becomes emotional, consistency disappears. When trading becomes procedural, results follow naturally over time.

Unrealized profit is not profit.

A good-looking position is not a successful trade.

Only a closed trade, executed according to the plan, counts.

Many people get attached to open positions. They start identifying with them. They feel proud, scared, or hopeful because of a number on the screen. That attachment clouds judgment. The moment you say “this trade must do more,” you’ve already stopped trading objectively.

Here, the mindset is different: We did what we planned. Now we move on.

That’s growth.

Moving forward doesn’t mean chasing the next trade immediately. It means resetting mentally. It means staying neutral. It means being ready for the next opportunity without carrying emotional baggage from the previous one.

The market will always offer another setup. Another chance. Another move. What it won’t always offer is the discipline to act correctly. That part has to come from you.

So the real lesson here isn’t the profit amount. It’s the timing. It’s the decision to close without regret. It’s the understanding that long-term success is built on thousands of small, correct actions—not on one impressive result.

Follow the plan.

Respect the process.

Close when it’s time.

And move forward without looking back.

That’s how consistency is built.