As of today , gold (XAU/USD) is absolutely crushing it in this macro environment, trading around $4,820–$4,890 per ounce (recent highs touching fresh all-time records near $4,887–$4,889). The yellow metal is up roughly +75–77% over the past year and showing strong bullish momentum YTD 2026 with continued safe-haven buying fueled by geopolitical noise (US-EU tensions over Greenland, global uncertainty), persistent inflation fears, central bank demand, and a weakening dollar outlook.

Bitcoin, meanwhile, is stuck in a painful short-term risk-off correction, hovering in the $88,000–$90,000 zone after erasing early 2026 gains and trading roughly flat to down YTD. BTC is down significantly against gold in recent months — the Bitcoin/Gold ratio has collapsed from peaks around 20–21x down toward 18–19x (some prints as low as 18.28x), signaling gold's clear outperformance since late 2025.

Key dynamics right now:

Correlation between BTC and gold remains extremely low (~0.01–0.4 on 30-day/12-month rolling basis) — basically decoupled. When risk appetite fades (like now), gold rallies as the classic hedge while Bitcoin bleeds with equities/tech/growth assets.

2025 recap: Gold +65–77%, Bitcoin flat to -6–11% — a complete role reversal from previous cycles where BTC was the explosive "digital gold."

2026 so far: Gold continues its tear higher; BTC faces downside risks toward $80K if macro pressure persists (tariffs, Fed uncertainty, ETF outflows).

Narrative shift: Many analysts now see gold as the superior "fear trade" asset in the current regime, while Bitcoin needs a major catalyst (regulatory clarity, new institutional wave) to reclaim dominance.

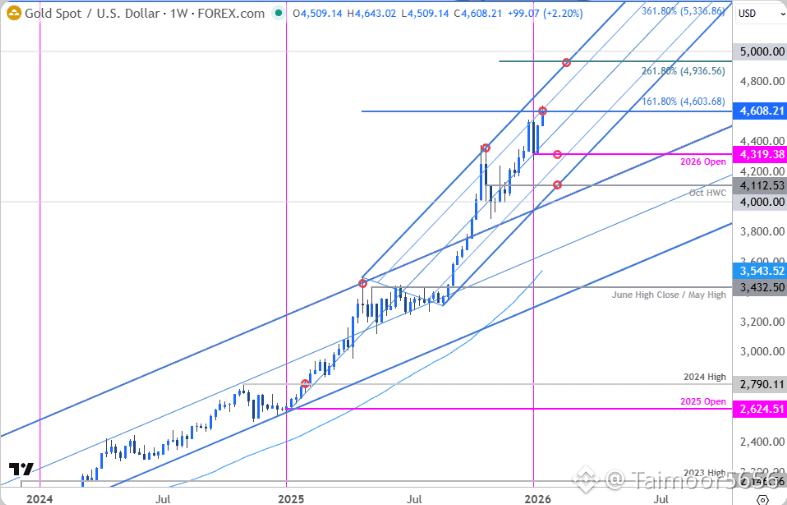

Visuals — Here are some relevant candlestick charts showing the recent action and divergence:

Here are candlestick charts highlighting gold's strong bullish run (XAU/USD recent months with upward momentum):

Bottom lines:

Gold is the undisputed king in this risk-off phase — printing new highs while crypto (led by BTC) consolidates/defends. If macro fear stays elevated, expect the divergence to widen further into 2026. Watch $4,900+ on gold and $85K support on BTC for the next big move. Stay hedged! 🚀🪙

#WhoIsNextFedChair #GoldSilverAtRecordHighs