The "Psychological Shield" has cracked. Bitcoin has officially slipped below the $90,000 mark, sending a wave of caution across the market. As large-scale distribution intensifies, traders are asking: Is this the dip to buy, or the start of a deeper correction? 🩸

🚨 Whale Inflows & LTH Selling

🚨 Whale Inflows & LTH Selling

The data suggests that the big players are the ones driving this move. On-chain indicators are flashing "caution" as two major groups shift their weight:

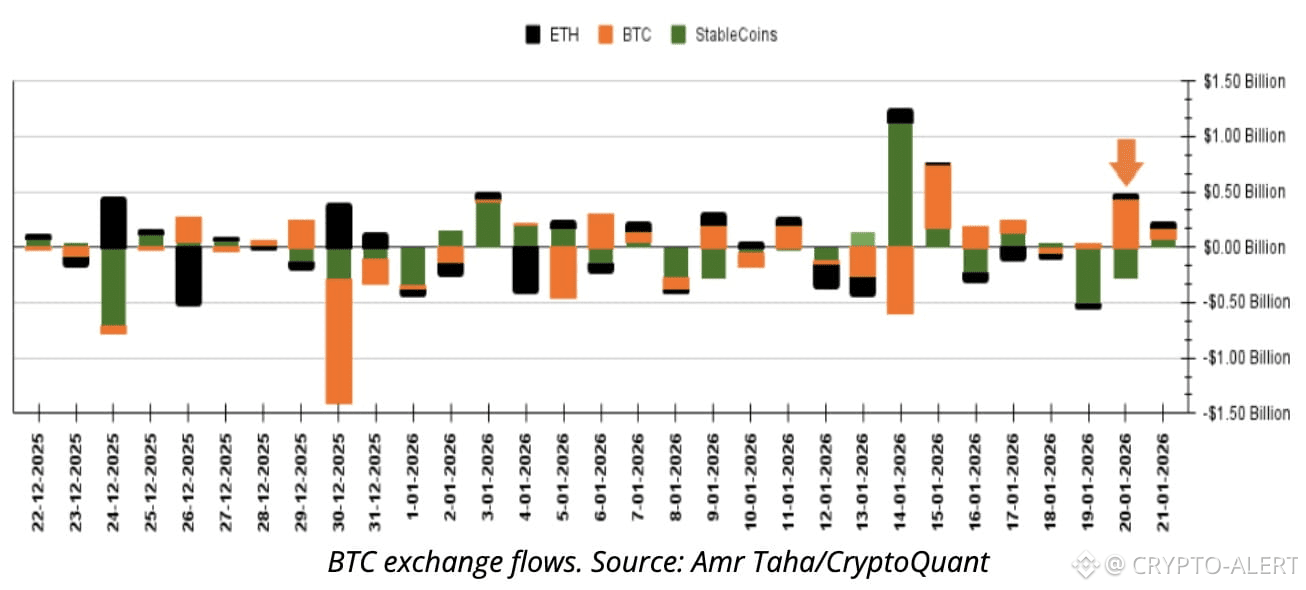

The Whale Move: On Jan 20, over $400 Million worth of $BTC was deposited into spot exchanges. Historically, these massive inflows signal a preparation to sell or an increase in market-side liquidity. 🐋💨

The Whale Move: On Jan 20, over $400 Million worth of $BTC was deposited into spot exchanges. Historically, these massive inflows signal a preparation to sell or an increase in market-side liquidity. 🐋💨

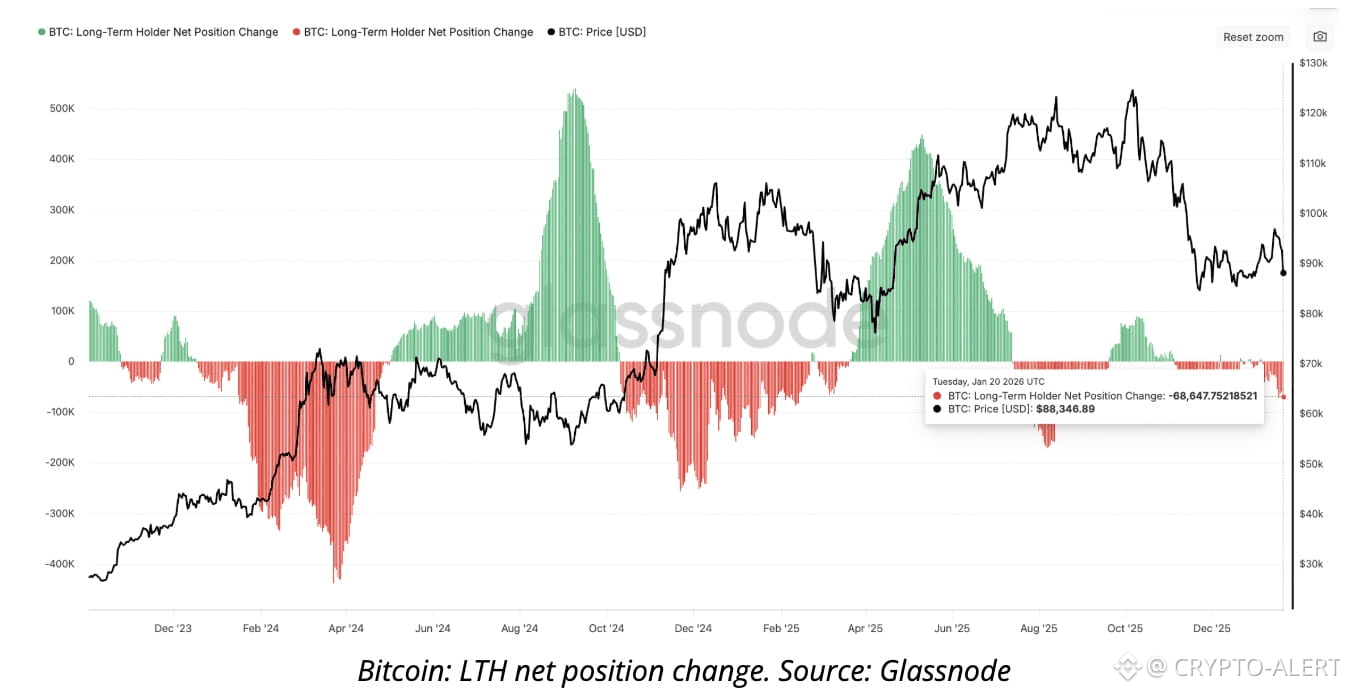

Long-Term Holders (LTH): The "Diamond Hands" are finally taking some chips off the table. Approximately 68,650 BTC has been distributed by LTHs over the past 30 days as they lock in profits from the recent rally toward $97,000.

🗺️ The Technical Roadmap

🗺️ The Technical Roadmap

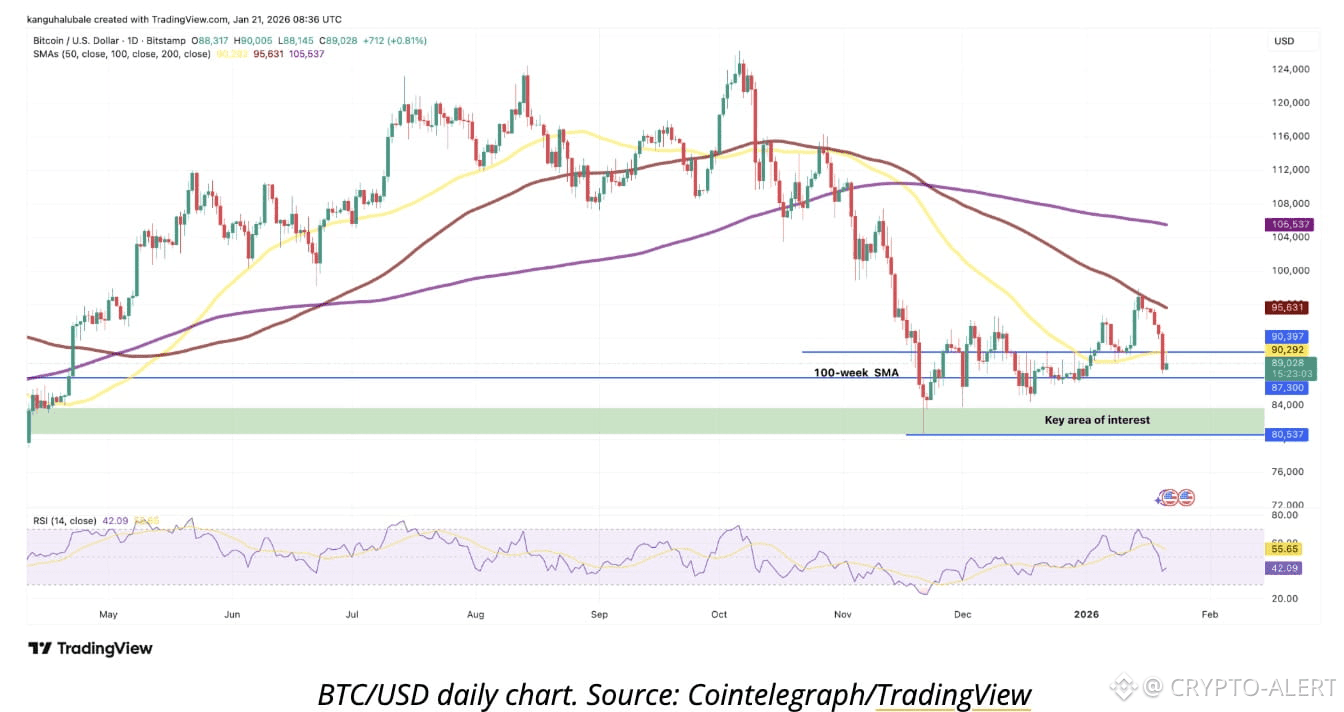

With the price hovering near $89,000, the bulls are looking for a place to stand their ground. Here are the levels the market is watching:

$87,300: The 100-week Simple Moving Average (SMA).

$84,000 – $86,000: The primary demand zone and psychological floor. 🛡️

$80,500: The local low from November—a critical line in the sand.

🧠 Analyst Insight: Bounce vs. Reversal

🧠 Analyst Insight: Bounce vs. Reversal

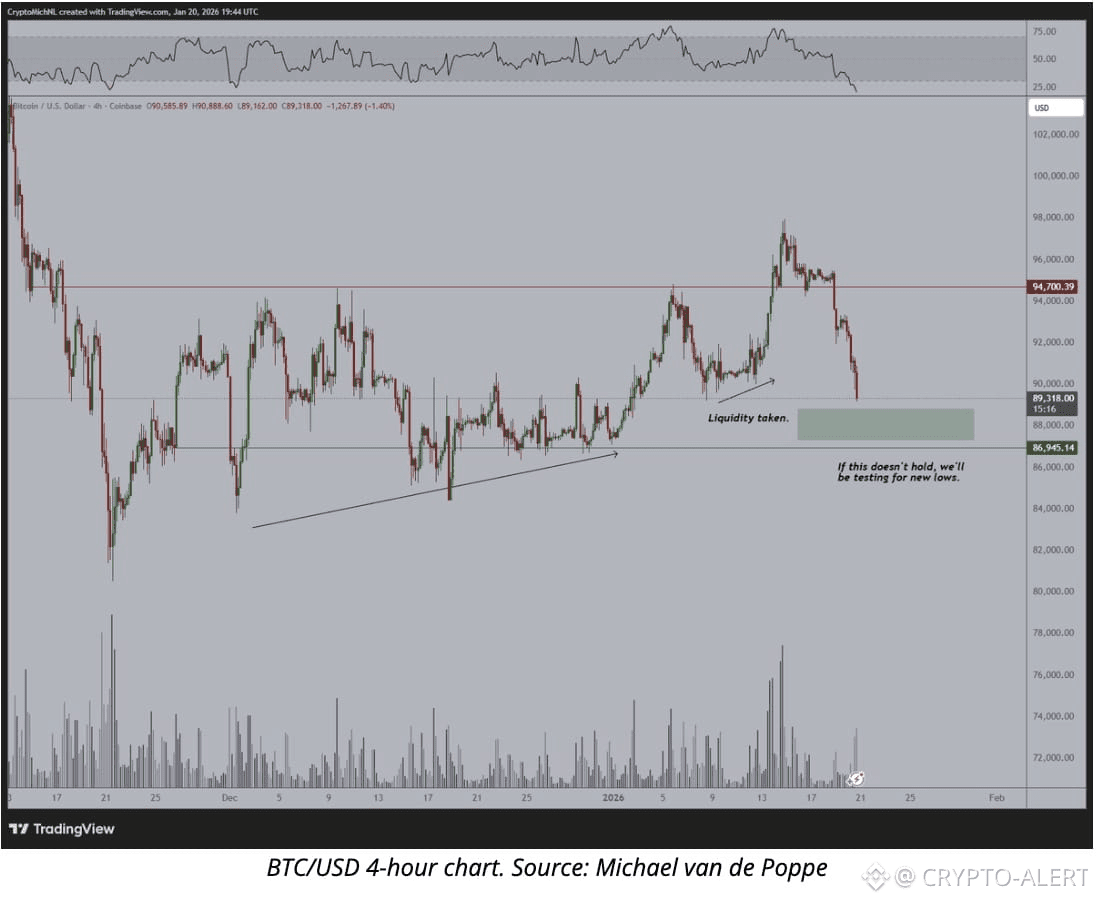

Michael van de Poppe and other top analysts suggest that while we might see a relief bounce soon (due to oversold RSI levels), we haven't seen a confirmed trend reversal just yet. Macro uncertainty and geopolitical tensions continue to act as a headwind for risk assets.

Bottom Line: Reclaiming $90,000 is the first step to restoring market confidence. Until exchange inflows slow down, expect high volatility. 🎢

💬 What’s your strategy?

Are you stacking sats at $89K, or are you waiting for the $85K retest to go all-in?

Let’s hear your predictions in the comments! 👇