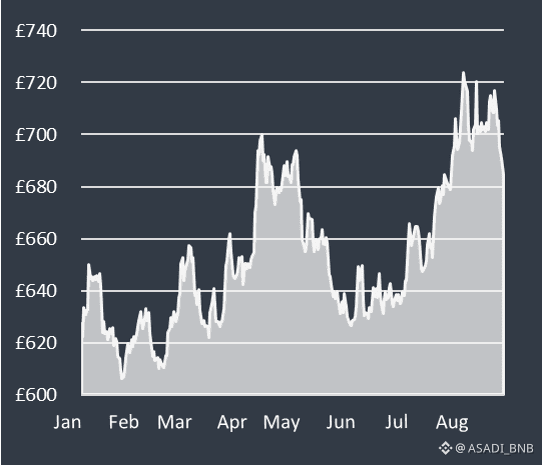

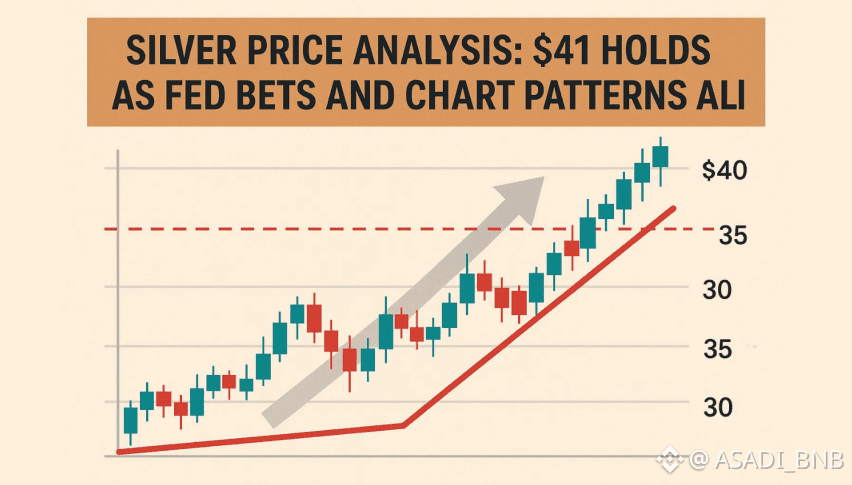

Silver edged higher to around $95 per ounce

on Wednesday, following a record intraday

peak of $95.87 on Tuesday, fueled by a

combination of safe-haven demand and

persistent physical shortages.📉😱

US President Donald #TRUMP is on his way to Davos, Switzerland, and is expected to use the World Economic Forum to intensify his push to acquire Greenland, despite strong opposition from Europe. 😱🌟

On Tuesday, Trump reaffirmed his ambition to control the Arctic island, refusing to rule out the use of force. 😨✅

Danish Prime Minister Mette Frederiksen rejected the US President's demands, asserting she would not cede Greenland, while the European Union is considering possible retaliatory measures. 🌟🔥

Back in the silver market, demand shows no signs of easing while supply continues to lag.

The market has now experienced four consecutive years of global deficits, with shortages deepening rather than abating. 🤑

Silver futures and options contracts are used

by mining companies, fabricators of finished

products, and users of silver-content industrial materials to manage their price risk. 😱📉🚨

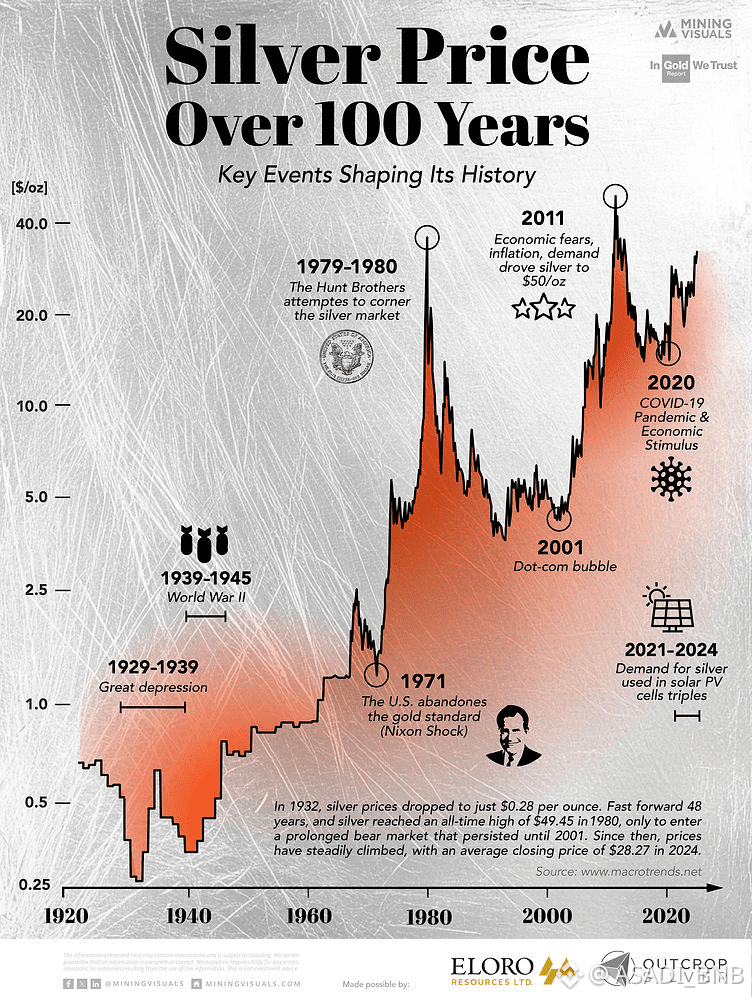

As a precious metal, silver also plays a role in investment portfolios. The largest industrial users of silver are the photographic, jewelry, and electronic industries. The biggest producers of silver are: Mexico, Peru and China followed by Australia, Chile, Bolivia, United States, Poland and Russia.🔥🔥💥