98% will miss this and lose everything.

No rage bait, no clickbait listen.

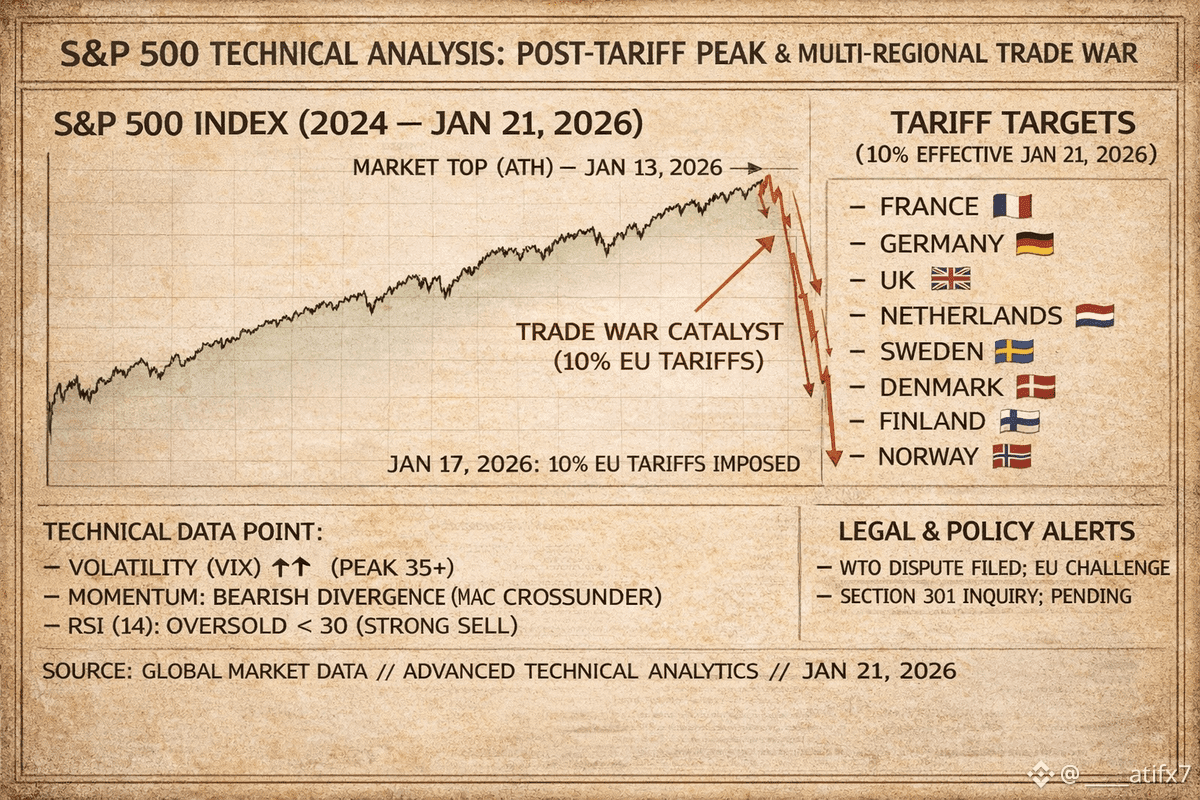

Trump has just announced new TARIFFS at the World Economic Forum.

At the same time, the US Supreme Court is voting on a full cancellation of those tariffs.

If you’re holding crypto, stocks, or any risk assets listen closely:

Tariffs stay = DUMP

Tariffs removed = DUMP

THERE IS NO BULL CASE HERE.

And most people still don’t understand this.

Before we even get to tariffs, look at where the market already is.

→ The Buffett Indicator (Total Market Cap to GDP) just touched ~224%.

That’s the highest level EVER.

Well above the Dot-Com peak (~150%) and higher than the 2021 top.

→ The Shiller P/E is sitting near 40.

This has only happened ONCE in the last 150 years, right before the market collapse in 2000.

This market is priced for perfection.

It can’t survive a hiccup - let alone a trade shock.

Now here’s where it gets dangerous…

1⃣ TODAY: TRUMP AT DAVOS

Trump is speaking at the World Economic Forum in Davos.

Global leaders, CEOs, and markets are listening for one thing: trade policy direction.

Any hint of escalation or defiance will be taken as a green light for volatility.

And the risks are already stacked.

2⃣ THE “GREENLAND” ESCALATION

10% tariffs on European allies (France, Germany, UK, etc.) set to begin Feb 1.

These directly hit multinationals trading at ~22x earnings.

There is ZERO margin for error.

3⃣ THE CONSTITUTIONAL FLASHPOINT

Whispers are growing that the Supreme Court may rule Trump’s IEEPA tariffs ILLEGAL.

Anyone who’s been around long enough knows what that means:

THERE IS NO POSITIVE OUTCOME.

Let’s walk through it.

SCENARIO A: TARIFFS STAND (INFLATION + MARGIN SHOCK)

→ Corporate margins get crushed.

Companies can’t push 10–20% cost increases onto already exhausted consumers.

They absorb it.

→ History reminder: In 2002, Bush’s steel tariffs wiped out 200,000 jobs in steel-using industries - more than the entire steel workforce.

Markets dumped.

→ In 2018, mere tariff threats triggered instant sell-offs (CAC 40 down 1.7% in a single day, Apple off 2.6%).

Bottom line: 2026 earnings expectations are about 15% too optimistic.

SCENARIO B: TARIFFS VOIDED (LEGAL + SOLVENCY SHOCK)

→ The Refund Bomb: If tariffs are ruled illegal, the U.S. government potentially owes billions back to importers.

→ The Smoot-Hawley Echo: In 1930, markets fell 16% before the bill was even signed - purely on anticipation.

→ If courts rule against Trump, the administration won’t just accept it.

Expect Section 232, executive orders, or emergency powers to block refunds.

Markets fear legal chaos and fiscal instability more than they fear taxes.

So pick your poison:

A margin-destroying trade war

OR

A constitutional crisis with insolvency risk

This isn’t a surprise.

This is a known unknown.

I know newer investors don’t want to hear this, but after 20+ years in markets, one truth stands out:

Retail prays for the rally to never end.

Professionals wait patiently for the floor to give way.

Wealth isn’t built at euphoric highs - it’s built when fear takes over.

I’ve studied macro for 10 years and I called almost every major market top, including the October $BTC $ATH .

Follow and turn notifications on. I’ll post the warning BEFORE it hits the headlines.