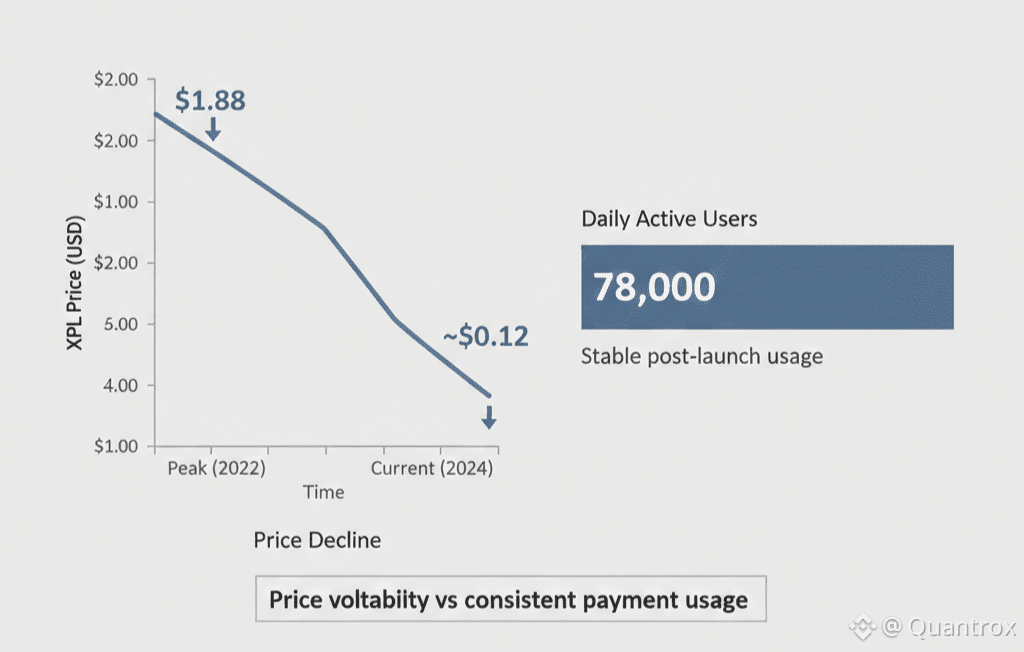

I've been tracking blockchain adoption metrics long enough to know that daily active users reveal more than token price. Most chains obsess over TVL and market cap while ignoring whether anyone actually uses the thing, but Plasma's story is different. When Plasma launched in September 2025, the $14 billion TVL looked impressive. Three months later with $XPL at $0.1228, what matters more is that 78,000 people still show up daily for actual transactions.

But something kept nagging at me about those usage patterns. Not the volume statistics marketing teams highlight. The actual transaction behavior.

Right now $XPL sits at $0.1228, up 0.33% today with volume around 118.98M. RSI at 38.5 which shows oversold conditions without panic. Price movement is recovering slightly after yesterday's drop. What's more interesting is that 78,000 daily active addresses are still interacting with Plasma despite an 88% crash from the $1.88 peak, and the retention pattern suggests these aren't airdrop farmers hoping for quick returns. Someone's actually using this for payments.

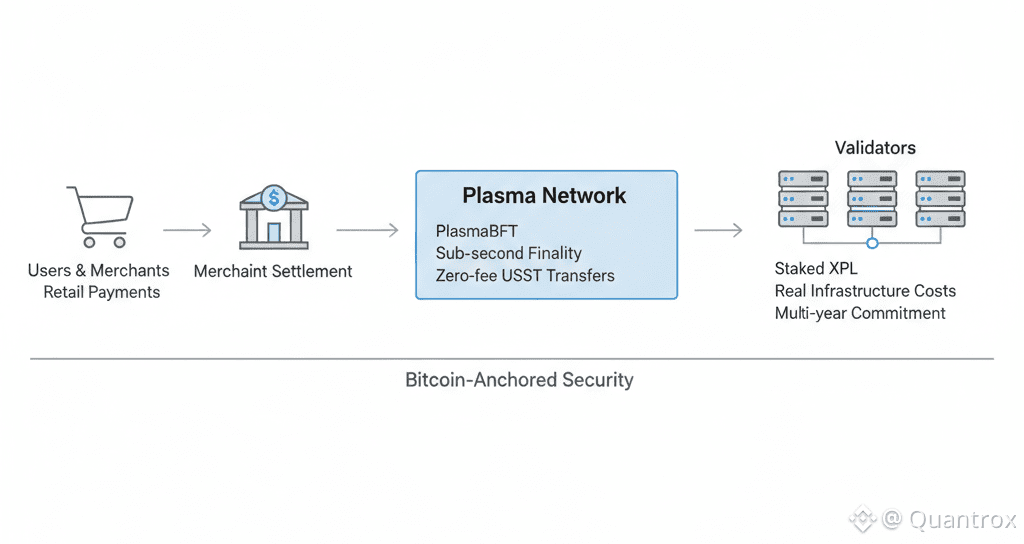

The protocol itself uses PlasmaBFT for consensus. Sub-second finality that brings settlement down to under a second instead of probabilistic confirmation. That speed matters because it's the only way stablecoin payment economics work without forcing users to wait anxiously. The team built Plasma with backing from Peter Thiel's Founders Fund and Paolo Ardoino from Tether, focusing specifically on zero-fee USDT transfers. Cross-border payments, merchant settlement, remittances. Things general-purpose blockchains fundamentally can't optimize for when they're trying to be everything.

Validators have to stake XPL tokens to participate. That's their skin in the game. They earn staking rewards at 5% inflation declining to 3%. They get a portion of transaction fees. Standard delegated proof of stake structure, nothing revolutionary there. But here's what caught my attention.

The user retention isn't random. It's deliberate in ways that suggest people found actual utility despite brutal price action. You've got 78,000 daily actives three months post-launch. Down from 137,000 peak but holding steady rather than collapsing. Different usage patterns. Mix of retail payments and what looks like merchant activity. That retention through an 88% crash costs users nothing directly but requires them choosing Plasma over established alternatives. People are picking harder mental switching costs because they actually care about zero fees or Bitcoin-anchored security.

Maybe I'm reading too much into user behavior. Could just be people stuck in positions hoping for recovery. But when you're using a payment network, every transaction has opportunity cost implications. Choosing Plasma means not using Tron or Ethereum, dealing with less liquidity, accepting newer infrastructure. You don't do that unless you're committed to the actual value proposition, not just the token speculation.

Plasma processed over $6 billion in stablecoin supply during launch week before crash. Real capital from real users testing whether the zero-fee mechanism worked. That was September through October 2025. Not sustained scale but enough to prove Plasma could handle actual payment flows with independent users who weren't on the team.

Volume of 118.98M today doesn't tell you much about payment usage. Trading happens for lots of reasons. What you'd want to know is how many merchants are settling on Plasma consistently, whether remittance corridors are building, whether the economic model sustains itself without depending purely on token appreciation. Those metrics are harder to track than daily active addresses.

The circulating supply sits at 1.8 billion XPL out of 10 billion max. So about 18% is out there with the rest locked or unvested. That's fairly standard for projects this early. As more unlocks over time, you get selling pressure unless demand from actual usage grows proportionally. The bet Plasma validators are making is that payment volume scales faster than token supply.

Here's what makes that bet interesting though. Plasma validators aren't just passive yield farmers staking tokens for rewards. They're running real infrastructure with real costs. Servers, bandwidth, maintenance. If XPL price crashes further from current $0.1228, they can't just exit positions immediately. They're committed to physical infrastructure until they wind it down, which takes time and has costs.

That commitment creates interesting dynamics. Validators who stayed with Plasma through the 88% crash aren't looking for quick flips. They're betting on multi-year adoption curves where stablecoin payment usage grows enough to justify infrastructure investment through brutal conditions. You can see this in what's still running. Not minimal specs hoping to scrape by. Proper infrastructure persisting despite economics that don't close yet.

Opening validator participation in Q1 2026 will test this further. Right now it's a controlled launch set. Soon the protocol needs to attract external operators based on how much XPL staking economics make sense. Validators will compete by maintaining reliability despite token price. That competition should improve network quality, though it also means validators need conviction to join when price is down 88% and transaction fees generate minimal revenue.

The economic mechanism has validators earning both staking rewards and transaction fees. Trying to make infrastructure viable while fees are negligible creates interesting tensions. When XPL appreciates like today's 0.33% gain to $0.1228, validator revenue in dollar terms improves slightly. When it drops, revenue decreases even though infrastructure costs stayed fixed.

This is where established payment networks still have enormous advantages. Predictable revenue, proven adoption, institutional trust when things break. Plasma validators are competing against that with a model that's objectively riskier and less mature. They're betting that enough payment flows care about zero fees, censorship resistance through Bitcoin anchoring, and not depending on single intermediaries to justify the tradeoffs.

My gut says most stablecoin volume will stay on Tron and Ethereum. The convenience and established liquidity are hard to beat. But the subset that does care, maybe that's enough for Plasma. If you're moving USDT across borders frequently enough that even small fees compound, if you're building in markets where payment censorship is real, if you need settlement anchored to Bitcoin's security, then Plasma starts making sense.

The 78,000 daily users three months after launch suggest at least some people are making that bet seriously. Whether it pays off depends on whether Plasma One and other products convert those early users into sustained payment volume before the July 2026 unlock of 1 billion XPL floods supply. Early but the user retention through brutal price conditions looks more serious than most payment chains that became ghost towns after similar corrections.

Time will tell if betting on purpose-built stablecoin infrastructure works. For now the users keep showing up and Plasma keeps processing payments despite 0.2 TPS utilization that reveals massive excess capacity. That's more than you can say for most "payment chains" that are really just general L1s with stablecoin marketing tacked on.